International Marketing – Exploring New Products and New Markets

Any company which aspires to expand into new overseas markets faces a significant challenge in selecting the appropriate international marketing strategy to do so. An organisations strategic and managerial depth is severely tested. The challenge lies in understanding the new market, and designing and fabricating a suitable marketing mix for the dynamics of the market.

The challenge lies in being able to analyze the market for existing players, market size, and future of the industry. Expanding into a new country takes significant investment from the company in terms of organizing logistics, administration and controls, storage facilities, promotions and management costs. Hence, the right strategy to enter and exploit the market could mean a significant financial implication for the organization in the medium and long term.

Vic’s Premium Quality Meat is a family business established in a small way which has grown into a global business. Meat business in Australia was saturated, with little differentiation in products, which is when Vic’s decided to differentiate the product to create a price premium in the market. The company has to expand into overseas markets to be able to survive in the meat business. The company has decided to expand into China with its premium meat products because of China’s potential of huge demand. The market for Australian meat in China has grown by over 1500% from the mid-1990s (Bernoth, 2007). Hence, succeeding in this market is going to be very important to the company.

Perhaps the most important part of the international marketing strategy in entering a new market with a new product is the function of the marketer and the role he plays in making the venture a success. Product knowledge and a socio-cultural and economic awareness are necessary for marketing to succeed.

Organizational Strategies and Bearing on International Marketing Strategy

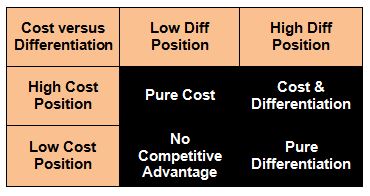

Porter categorized strategies into cost leadership, differentiation and focus (Porter, 1980). While the first two are generic strategies, focus is an increased attention on the business if either strategy is adopted (Dess & Davis, 1982), and hence a necessary strategic recourse in this case. Hence, between the generic strategies of cost differentiation and differentiation, a company’s entry strategy can be understood as four distinct positions taken by the company in the market (White, 1986). See Appendix 1. These four positions are as follows:

Pure Cost Position

This is a strategic position where cost differences between competitors are low, and there is little or no differentiation between products available in the market. Vic’s entered the market when the market was positioned like this, and successfully created a market for a product line which was priced higher. Hence, this international marketing strategy could mean that the company has to regress on its corporate strategy. Also, a low cost position is not viable in a market like China, which has the lowest cost structures for production anywhere in the world. Hence, Vic’s cannot use this strategy to enter China.

Pure Differentiation Position

This is a strategic position where product differentiation is high, because of which the implications of costing is low. This strategy is suitable for companies which target a niche segment of the market and hence aim to be highly profitable, at the same time be assured of business. This is the strategy Australian meat importers in China are following at present. This could be a suitable international marketing strategy for entering the market for Vic’s, as the primary strength of the company is the superiority of its products compared to local produce. Its assured customers are expats and the affluent and middle class Chinese who want safe and exclusive meat for consumption.

Differentiation and Cost Leadership Position

This is a strategic position in which the company is unique in its offerings and also prices competitively. This is suitable strategy for companies who find that the products and services they offer are unique, but the local and other substitutes that are available could compete with them. This strategy could be suitable for Vic’s in China because of the fact that there are several Australian companies who are into the meat importing business already and there is the threat of local produce which is much cheaper than imported meat.

No Competitive Advantage Position

This is an international marketing situation which is similar to a commodity market, where there are several products in the market and they are all equal in price, quality and uniqueness (Zahra et al, 2000). This situation does not apply to Vic’s business or its entry into China

The Apt Strategy

Out of the four strategic alternatives discussed above, Pure Differentiation and a combination Cost and Differentiation strategies could be the most suitable for Vic’s. Let us now explore these two strategies to find the most suitable. In both these strategies differentiation is common. Vic’s has to differentiate its products from the local produce and the existing Australian meat producers and importers to gain competitive advantage.

Vic’s has to gain cost leadership in the market with respect to the other Australian meat companies because it does not have the first mover advantage in this market. Hence, to gain competitive advantage Vic’s must be innovative and careful with its pricing strategy during the entry stage.

Vic’s has to adopt a combination of cost leadership and differentiation strategy to enter the Chinese meat market.

Coming to focus, the company needs to focus on gaining market knowledge in China, the dynamics, regulatory and the competitive forces. China has an embargo on meat imports from America, and this is aiding Australian companies in China (Australian Trade Commission, 2010). This situation could change in the future, and Vic’s has to be prepared for increased competition from other countries. Australian players in China are primarily focused on the metropolitan cities, and the new focus areas could be tier II cities, which are growing at a massive rate. This will take some serious understanding of the logistics and supply chain operations within China.

A company with a pure cost leadership position has relatively simple management bandwidth required in marketing and other functions. Its production and sales are synchronized. It produces goods at the cheapest cost and marketers sell them for as low as they can afford to. This requires a very simple management structure, low autonomy and frequent low complexity of reporting (Porter, 1980).

However, when a company goes in for product differentiation strategy, the coordination required between the various departments is high (Porter, 1980). The company has to have a senior management team to be functioning in China, as the business complexity is high. This entails a higher cost outlay for the expansion project and suitable individuals to be available for recruitment at a very senior level. Organizing its command structure and organizing its operations is the next significant complexity for Vic’s expansion into the Chinese market via a robust international marketing strategy.

The implication of the entry strategy for the country is the most critical position to take from the marketing perspective. If the pricing is too high or if the segment catered is too small, the venture could be a disaster. If the pricing is too low and if the segment cannot be defined properly, resulting in a sell to everyone situation, the company cannot survive in the long run. Thus, planning for market entry in an international expansion scenario (international marketing) is a challenging and engaging process for any organization. Vic’s has chosen to have a strategy to market its products based on its product differentiation and cost leadership or competitiveness and these are two factors which need careful balancing, as these are two opposing approaches to pricing and product development.

The Product Portfolio

Vic’s is a meat wholesaler, supplying to restaurants, butchers and customers, based out of Australia. Australian meat is known for its purity and this is a major leveraging factor for meat exports. Meat, beef, lamb and pork are the largest export products from Australia, with more than 60% of the meat produced being exported and Australia being the second largest exporter of beef, after Brazil (Australian Trade Commission, 2010). China has a meat embargo from the USA and this is a major factor for driving focus of Australian meat industry towards China, which, owing to its size is a large meat consuming nation (Ausmeat, 2010).

Vic’s deals with primal cuts in beef, lamb, pork, poultry, game and exotic meat and more processed food like handmade sausages. The products are procured from farms and butchered at Vic’s state of the art processing plants and dispatched to their ultimate destinations. These products are exported as sealed, vacuum packed containers and shipped to worldwide destinations, where they are packed and marketed. Beef and lamb are specialized into signature series, with special grass and grain fed meat being sold at a high premium because of the assured quality and meat tenderness. Such meat is sold as specialized portions, available to customers, primarily butchers, restaurants and supermarkets, who need specialized cuts to attract customers and to reduce their complexity in acquiring butchering licenses and maintaining inventory at the shop level of these special customer preferences.

Vic’s also procures and markets a number of exotic and game meats, including venison, Spanish Jamon, rabbit, ducks, kangaroo and crocodile. Such exotic meats are preferred by large restaurants who seek differentiation in their offerings with such meat, which are usually signature presentations of their chefs.

The entire product range of Vic’s is assured of hormone free feeding and exclusive breeding conditions and processing with hygiene and health consciousness. Though the meat industry is mature and there are very few new opportunities in the global arena, the ultimate factors which interest consumers in meat products are price, quality, volume and traceability, with the last factor being the latest to be added because of the increasing focus on food safety and knowledge and awareness of the consumer (Australian Trade Commission, 2010).

The competitive advantage of Vic’s is the fact that its products are considered and intended to be of the best quality. The impact of the increase in awareness among consumers is a major factor which accounts for its premium pricing and quality. Due to its status of being an evolved meat consuming nation and due to its cutting edge standards in the meat processing industry, Australian meat has become one of the most preferred choices in quality and premium meat (Ausmeat, 2010). Also, the competitive advantage will lie in serving customers in China, which takes a lot of understanding of power, logistics and supply chain practices.

Vic’s practices the Ausmeat language in all its trading and product marketing and for developing specifications for its products (Vic’s, 2010). This unified language enables meat producers to phrase and specify their products as per industry standards set by Ausmeat, and thus to ensure quality of products delivered to customers (Ausmeat, 2010).

Marketing Strategy – Vic’s China

Vic’s has firmed up its strategy, organizational structure and command structure. Now it has to begin identifying the marketing strategies for itself. Vic’s has to follow a Polycentric Orientation of marketing in the EPRG framework, which places marketing entirely in the hands of the subsidiary (Wind et al, 1973). An organization’s different countries function as different business units with different marketing approaches, depending on its market dynamics.

When an organization is entering a new market, it has to understand the market in its present condition. This understanding is brought about by market segmentation. The market may be segmented in a number of ways, and discussed below are two options.

The demographic segments in the market for meat in China are,

- Chinese families who buy local produce at a low cost

- Chinese middle class families who can afford costlier meat for its safety

- Expats – Aussies and other foreign nationals who may be resident in China

- Chinese middle class families in Tier II cities who don’t have access to imported meat

Australia shipped more than 24,000 tons of sheep meat to China in 2009 and 13,000 tons of beef. This makes China the largest consumer of sheep meat and the fourth largest beef consumer in the world. Vic’s has to target to acquire about 5% market share (1850 tons) in these shipments during the first year, doubling its share in the next year (3700 tons). The premium meat demand in China grows at about 15-20% every year (Bernoth, 2007) and consumption of all meat is rising at the rate of 3-5% per annum (Thepigsite, 2007), because of change in consumption practices. The average price of a kilogram of beef is at about $7 in the open market. But this is the price of local produce and premium beef is offered at anywhere between $15-20 depending on the portion and cut (Bernoth, 2007 & Pugh, 2010). Considering an average price of $17 per kg of beef, the estimated revenue size of Vic’s could be at $314 million in the first year, doubling to over $650 million in the second year.

The primary targets for Vic’s are upscale restaurants, hotels, expats from Europe and America and the local middle class which can afford premium meat. The scope for business expansion exists because of the fact that the per capita meat consumption in China is 67 kg per person in 2008, compared to an Australian average of 120 kg per annum. High growth projections discussed above are possible because of the fact that premium quality meat is still new in China, with the main competition coming from local, small time meat enterprises and smuggled meat from North America.

Vic’s China’s Marketing Mix

- Product – Vic’s should deliver top quality products in the market in line with its strategy. Its products must reflect the tastes of the customers in China, in terms of the cut, animal and the portions. The products launched by Vic’s must add significant value against the products of its Aussie competitors, in terms of variety, packaging quality and finish.

- Price – Vic’s should go in for on par pricing with its Aussie competitors in China, but a premium position to the local produce. It could even enter at marginally lower price than its Aussie players in China, to bring enjoy a cost leadership in the market.

- Place – Vic’s must be distributed through super markets, its own retail shops and also through the digital channel – internet and phone ordering. Vic’s meat must be available within reach to any Chinese or expat customer who lives in the geography concerned.

- Promotion – Vic’s must promote its products through various media. Expats in China can easily be targeted by social networking sites and online media, while the Chinese segments have to be catered to with the mass media. The plan would be to go in for a grand launch of a retail showroom of Vic’s in Beijing or Shanghai and then building the brand from there, using various other media.

The Target Market

The target market for Vic’s is constituted of consumers and businesses that can afford and realize the value of quality meat. Australian beef importers have been primarily targeting expats and the affluent restaurants of the major cities. This is an attractive segment which is readily available, already being catered to by other importers and brands. But this could also be a segment where there is significant competition and set customer preferences, considering that Vic’s is a late entrant in the market.

There is a large market with Chinese who buy meat from the local grocer or butcher, and considering Vic’s competency in being a wholesaler of meat in Australia, this could be a segment which could provide it the success and the volumes necessary. With increasing demand for quality food products from the affluent middle class (Garnaut, 2010) and with increasing reliance on imports for meeting meat demand, the local market could be the biggest and most lucrative market for Vic’s.

The size of the affluent in China was about 2.9 million and expected to rise to 8.5 million by 2015. Adjusting for purchasing power parity, an income of $60000 per annum in the largest cities of China could be equal to $1, 00,000 to $ 1, 50,000 per annum in the US. The affluent class in China is very young (86% less than 43 years old), highly educated (83% with university degrees) and very busy (23% has less than 10 hours leisure in a week). These figures show the perfect target for a meat brand which understands the customers, is prepared to educate and elevate its customers towards quality food and create a valuable premium market for itself. This could be a very valuable segment, if it can be sold directly to, through various channels of distribution.

Considering that meat consumed per person in about 70 kg per annum in China, this affluent segment is bound to be the leader in consumption, consuming average or above average quantities of meat. The numbers of these affluent is concentrated in the three major cities of China, Beijing, Shanghai and Guangdong (33% in 2007 and estimated to be more than 50% by 2015). This shows a concentrated set of customers who are educated, affluent and shop in supermarkets, are bound to expect high quality of food and general quality of living. Consumption decisions of the affluent class in China are hinged on luxury or social status, environmental consciousness or high quality and convenience (Hedrick-Wong, 2007).

By being present in Shanghai, Beijing and Guangdong, Vic’s could target 33% (1 million households) of the affluent population, with potential consumption of 70 million tons of meat (at the rate of 70kg average consumption per individual per annum) in the first year. This is a sizeable market which is available to Vic’s to exploit and grow. The key will lie in understanding consumer behavior of this class of people, where they buy, why they buy and what they buy. The socio-economic factors, ethnocentricity and culture of the locale are also very important because of the cultural diversity in a large country like China.

Competition

The main competitors for Vic’s in China are local butchers and other Australian meat brands already present in China. While the local butchers could be eventually unviable and become dependent on imported meat, due to lack of support from Government and due to sheer un-suppliable demand (Garnaut, 2010), other Australian meat brands could be the major competitors for Vic’s.

As of 2008, premium meat had touched only about 5% of the market available for such quality meat (Pugh, 2010). This means that Australian have a lot of space to grow and expand within China. But the real competition is going to come from other meat exporting nations, like the US, Brazil and New Zealand. Each of these countries has their own strengths in meat exporting. US beef is banned; aiding other countries, but this is a medium term advantage and could go away. Brazil is a low cost producer of beef, and also the largest exporter of beef and with its low cost production capacity. This makes Brazil a significant competitor for Australian beef. New Zealand is strong in game and exotic meats, with even Aussie companies procuring such meat from the Kiwis.

Another factor in competition that needs to be considered is that China’s meat consumption is composed of 65% pork and 20% poultry (Liu & Deblitz, 2007). This preference could place significant strain on Vic’s which is string in beef. This also presents an opportunity to cater to the top of the pork eating segment with the exotic pork it serves in the form of Spanish Jamon. The changing consumption patterns also mean that beef consumption holds significant opportunity for Vic’s, whose strong point is beef production.

The largest Australian player in mainland China is Elder’s, one of the pioneers in exporting meat to Australia and holds 50% of the market for premium meat exported from Australia. Other meat importers are marginal and small players. Elder’s is a major meat producer in Australia and is right now targeting supermarket chains and internet business to touch retail customers. It has all among been targeting restaurants and expats through ultra-high pricing, to customers who look for Australian meat specifically and for signature dishes in upscale restaurants.

The market position as of 2010 finds the industry for restaurants and expats being stagnant, with meat importers having to set up their own supply chain to cater to the other segments in the market. This creates an attractive opportunity for Vic’s to get its business model right and go for the mass market, which its other Australian competitors are only now beginning to target.

Price

Vic’s, like its Australian competitors has to import meat in containers and process, package and market its finished products in China. This serves two purposes – to cater to the differences in meat consumption preferences in China and also to reduce costs by handling bulk of the processing in China and utilizing its low cost labor and other infrastructure. This will also enable Vic’s to have much leverage in promoting and discounting its product, by having much better control over its cost and hence it’s pricing structure.

The cost of production, transportation and processing and delivering products to customers takes about $10 per kg for Vic’s, to get the product to shelves in supermarkets, as per the study conducted by the management team which designed the market entry vehicle for the company early in the year. This provides a leeway of about $7-10, depending on the product, for Vic’s to leverage on for its profits and its marketing expenses.

In such a scenario, Vic’s can practice simple markup pricing to support a fixed profit for each product unit sold, and utilize a portion of these profits for its marketing budgeting. This method of pricing is suitable because the price is not the deciding criteria and because the competition in the premium meats segment is still low. This allows the few players present in the market to effectively exploit being the pioneers in the industry in China, this must be factored into the international marketing strategy.

Also, the decided marketing strategy of the company is to use a combination of product differentiation and cost leadership in its business. Such a pricing strategy will allow Vic’s to set its expectations of profit at an early stage and then fix its price to accommodate for these strategic positions it intends to take.

Vic’s can fix a markup of 50% approximately on all its products and allocate 10-20% of this to promotions and discounts. This will allow the company to be strategically placed in the supply channel and retail segment and also afford it a healthy to very high profit margin in China. The discounting could be to the retailer and the butcher, as discounting a premium product to the customer could erode the value of the upscale brand in the long run. Thus, the discounts passed on to the channel will enable Vic’s to command a special position within its channel and thus create valuable loyalty from butchers and supermarkets.

Channels of Distribution

Vic’s will enter as a wholesaler of meat, by setting up its cold storage and warehouses in Shanghai. It will start operating through supermarkets and restaurants in its first phase. It will have a sales team of 5 people, under a sales head, who will market the product to supermarkets, retail chains and large butchers. The ordering mechanism will work on a daily basis, considering the perishable nature of the products. The customer will place an order through the phone or through a dedicated internet account with Vic’s and the order will be fulfilled the next day. This mechanism will enable its channel to be fast and responsive to evolving market demands, this must be incorporated into the international marketing strategy.

To enable such a channel, Vic’s has to develop its logistics capability in China. Chinese logistics providers are traditionally single person operated with low costs and standards of operation quality. Since meat transportation is a complex operation and considering the value of the merchandise, Vic’s will set up its own logistics service, which will deliver products based on orders. This is not different from the logistics model it uses in Australia, with its own fleet for servicing orders in the market.

This initial channel setup will require a management team, to handle sales and logistics and also investments in resources like commercial vehicles, software and other management tools. The sales team will be composed of 5 people at the initial stage, to build relationships with major clients, and the proposed compensation for each sales person would be $12000 per annum, considering that the middle class of China earns above $6000, and this salary could bring in experienced sales people from the meat industry in China. They will be supervised by a sales manager, who will be paid approximately $25000. The sales team will be supported by a back end operations team which will be three strong and will cost the company $25000 per annum.

From the second year onwards, Vic’s will start targeting its consumers and butchers, through its own retail outlets and e-commerce. This will enable consumers to directly buy from Vic’s and buy all of Vic’s products under one roof. This will also enable Vic’s to earn higher margins, by cutting down on the discounts or margins it has to afford when selling through the channel. This channel strategy will take better understanding of the market and consumer behavior in China, which is why this plan is deferred to the second year.

Advertising, Sales Promotions and PR Plans

In the first year, when Vic’s is going through the retailer and the trade, it need not go in for mass marketing and advertising. It knows who its customers are and it can directly contact them for generating business. So, during the first year, the business promotion will be focused on PR and sales promotions. After a grand launch of the brand in Shanghai, Vic’s must embark on a PR mission to ensure that all stakeholders and major decision makers in the meat trade in China perceive Vic’s as an important player in the market and a serious competitor and value addition in the market. This could involve participating in trade shows, agriculture meets, food fests, chambers of commerce and prominent business councils and key ingredient in international marketing strategy.

Depolying an international marketing strategy, Vic’s must embark on a sales mission to get Vic’s into as many supermarkets, menus and restaurants as possible, in as many meat shops as possible. This will be possible through aggressive sales promotions, having great discounts for retailers and butchers, who prefer to stock Vic’s in their stores. The focus of the promotion must be in adding value to the customer, in enabling the restaurant to utilize its premium status among its consumers and to enable them to make better margins by selling Vic’s rather than other meat brands.

From the second year, Vic’s has to enter mass international marketing through various media, including television, radio and outdoor advertising. This is necessary because of the fact that the segments catered are larger and more widespread to target through rich media, like a direct sales pitch. The focus of these advertisements has to be the natural taste of Australian meat and beauty of Australia and the heritage of Vic’s. This will create a strong connection with the affluent customers who are being targeted in this channel. Such advertising will also create run offs to the wholesale business also.

The multi-pronged international marketing strategy of promoting the product through attractive trade discounts is a push strategy and advertising and communicating directly with consumers is a pull strategy. When both the push and pull strategies are applied in tandem, the effectiveness of the marketing program is higher than using just the push or the pull strategies in isolation from each other.

Budgeting

The first two years will need high marketing expenditure, with the brand needing to be established in the market and with each year targeting a new segment of customers, from the trade to the consumer. This will reduce profits from the first two years, but considering the string growth in meat consumption; such expenditure is justified as shown below:

| 2018 | 2019 | 2020 | |

| Units Sold (Metric Tons) | 1,850 | 3,200 | 4,000 |

| Cost/ton (USD)* | 10,000 | 11,000 | 12,000 |

| Advertising / Promotion expenditure per ton(USD) | 2,500 | 2,500 | 2,200 |

| Management Expenditure per ton(USD) | 500 | 600 | 600 |

| Total Cost/ton(USD) | 13,000 | 14,100 | 14,800 |

| Price/ton(USD) | 15,000 | 16,000 | 17,000 |

| Profit/ton(USD) | 2,000 | 1,900 | 2,200 |

| Total Profit (USD Million) | 3.7 | 6.4 | 8 |

*Cost/Ton includes cost of logistics, transportation, taxes, packaging and other levies and duties

Conclusion

Vic’s is entering China, a very promising market for meat producers in Australia. The environment at present is very conducive to expand into this country, and hence the company is building its strategies to find the best way to enter the market and cater to Chinese customers. The company has so far firmed up its entry strategy, organizational structure and control mechanisms and marketing strategy. Now the company has to go ahead and start its China project, by working towards setting up its supply chain in China, getting the necessary clearances and licenses and recruiting the people required.

Appendix 1

International Marketing Strategic Entry Positions for a New Market

Source: Roderick E. White (1986). Generic Business Strategies, Organizational Context & Performance: An Empirical Investigation. Strategic Management Journal, Vol 7, Pp 217-231.

References

Australian Trade Commission (2010), Meat overview international marketing journal Vol 1:54

Thepigsite (2007). The story behind China’s rising pork prices.

Pugh, Wendy (2010). China to buy more Australian meat, Rabobank’s Voss

Liu, Hongbo & Deblitz, Claus (2007). Determinants of meat consumption in China. Asian Agribusiness Research Center, Working Paper 40.

Garnaut, John (2010). Getting Aussie beef into Chinese hot pots. International Marketing

Dr. Hedrick-Wong, Yuwa (2007). Understanding the affluent consumers of China. The Insight Bureau, Issue 17-July 2007.

Bernoth Ardyn, (2007), Slow roast to China.

Dess GG & DS Davis (1982). An Empirical Examination of Porter’s (1980) Generic Strategies: an Exploratory Field Study and a Panel Technique. Academy of Management Proceedings.

Porter ME (1980). International Marketing Competitive Strategy Techniques for analyzing Industries and Competitors. NY: The Free Press

Roderick E. White (1986). Generic Business Strategies, Organizational Context & Performance: An Empirical Investigation International Marketing. Strategic Management Journal, Vol 7, Pp 217-231.

Vic’s Premium Quality Meat, Company Profile (2008).

Wind Yoram, Douglas P. Susan & Perlmutter V. Howard (1973). Guidelines for developing international marketing strategies. Journal of Marketing, Vol 37 (April 1973), pp 14-23