Supply Chain Mapping is crucial to any organisation regardless of its size, specialization or region. A typical supply chain system is composed of resources, activities that facilitate the movement of products from the supplier to the client and vice versa, i.e., upstream and downstream (Kozlenkova et al., 2015). However, the keeping track of all these supply chain activities, i.e., delivery and supply of necessary materials, information and other elements is getting complicated day by day.

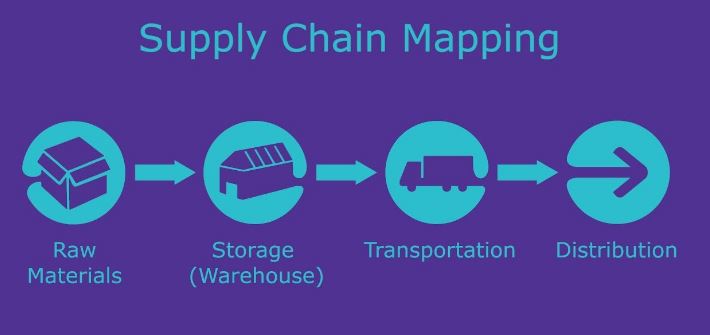

Henceforth, it’s essential for organizations to manage these activities through visualizations which can help in identifying supply risk factors for necessary actions to be taken (Ho et al., 2015). And this is where supply chain mapping comes in handy. Supply chain mapping refers to the use of visual maps in monitoring the activities linking suppliers and customers. The supply chain map shows how all partners and actions are connected such as supply, transport, warehousing, retailing and so on.

Moreover, a supply chain map takes into account the transactions and information exchanged by all parties, both upstream and downstream (Jayaratane et al., 2018). Breaking down the composition of the supply chain mapping reveals interesting factors such as how it’s mapped, parts that are included in the map and criteria used to select. This paper thus discusses these elements of supply chain mapping in addition to the implications of various types of integration in the supply chain management.

Supply Chain Mapping Deployment

Mapping is meant to reveal opportunities and obstacles so that an organization can be able to formulate a winning strategy. To do so, a supply chain map has to indicate two crucial components; the supply chain flow and supply chain entity (Dujak, 2017). This can be achieved by following these steps.

Mapping the Physical Structure

An existing supply chain model already has physical locations that contribute to its value stream. These include the warehouses, factories and retail stores that support the movement of products and services upstream. However, the networks that support that these facilities can be at times complex, even for established organizations. For instance, it may be hard determining who supplies to the organization’s suppliers.

Which facilities or methods do suppliers or producers use to ensure that the raw materials are produced legally and ethically? This requires an organization to step up its involvement by in its analysis of supply chain structure. Nuss et al., (2016) claims that identifying the relevant physical structures during mapping helps in determining the degree centrality of the supply chain.

Degree centrality is used to determine the level of physical sites that a particular organization owns. This, in turn, determines how the level of control they have on the supply chain and associated risks.

Networking Environment and Context Analysis

The environment that a company operates comes in handy in understanding the supply network system that they can tap into. Rodriguez (2016) claims that this stage of supply chain mapping entails determining four different types of ties: similarities, relations, interactions and flows. These elements affect how a company is perceived by the society that it operates in.

For companies to successfully succeed in this state, they should take into consideration factors such as;

- Cultural and ethnic differences,

- The geography covered,

- Politics and legal systems within the target markets,

- Expectations of the end users.

- The environmental protection laws.

A company that understands these factors will experience more success since it will be able to determine the trends, the drivers and conditions that affect the flow of goods and service both upstream and downstream.

An organization should consider any unique factors which present in the supply chain to determine if they are risks, threats or opportunities. This affects how the organization responds (Rodriquez, 2016). For instance, an organization can critically analyze:

- Whether to standardize or customize the products:

- The complexity of the products

- Customer tastes and preferences

- Bureaucracy and complexity within the organization

- Cost of switching for customers

- The degree of Competition in the market.

All of these factors affect the type of supply chain an organization selects. The more complex and customized the products are, the more complex the supply chain will be.

Considering the Buying Process:

This organization must consider how many hands the raw material or finished product pass through before reaching them or their target client respectively. For instance, the company should determine if it buys the products directly from the producers, or from brokers and third-party companies. To do so, a chart is created, showing how the current transactions and exchange of products are carried out in the supply chain. From this, the organization can determine which parties that they can away with to loosen up the supply chain model.

Dujak (2017) claims this part of the analysis can be classified under the extended value supply map. Brokers and re-suppliers can at times be adding no value to the whole production process, especially if the main producers of raw materials are within reach. In addition to hoarding products and inflating prices, brokers may also become unreliable parties when transacting with them. For instance, if products are not delivered on time despite being paid for, should you hold the broker or the producer accountable?

Can you eliminate the broker and purchase directly from the producer or supply directly to the final clients? Analyzing these elements will help determine how to approach non-value adding-component of the supply chain such as bypassing them.

Supply Chain Mapping – Accounting for Transparency of Information

Mapping a successful supply chain model entails ensuring that the information being passed across the various parties is consistent and credible. For this reason, a company has to define the types of reports that it expects from all the actors in the supply chain. The expectations will be based on the type of contract that an organization has with these parties.

The suppliers should provide information on their production process and their transport mechanisms (Gardner et al., 2015). Passing information on sample products or services ensures that expected standards have been met before the commercial production start. In this case, the information being passed down or up the stream covers concepts such as order status, product testing and such. There two ways of ensuring consistency information flow, i.e., manually or electronically.

Moreover, each actor should be provided on information about their expected roles and limitations (Gardner et al., 2015). When all these factors are considered, the supply chain mapping will be based on the transparent information. This implies that each of the party will be accountable and responsible for any issues that they are expected to handle. This stage is usually called the current state map.

Should the map include connected firms or primary firms?

The supply chain map mandates that every activity within the supply model must be accounted for. In doing so, the visualization of how the raw materials are produced to how they reach the final customer must be accounted. Henceforth, this takes into account all the primary and secondary activities that facilitates this process. For this reason, it’s essential to include the connected firm in the supply chain map

Means of determining who should be part of the supply chain map

Heat mapping:

This method entails identifying the main company priority regarding the products that it produces. Each activity of the firm is assigned a grade/ colour/size in the order of its overall importance to a company. In doing so, the company can be able to trace the main parties behind such activity. The parties that become part of the supply chain are those whose roles are found to be invaluable to the company, i.e. those whose grades are much higher (Bryan, 2015). Regarding this, the supplier of a company has a high priority since the raw materials that they provide; facilitate normal running activities within the firm.

The degree of Risk:

Oliveira et al., (2017) claim the supply chain activities are proliferated with operational threats due to uncertainty in business environments. Such threats can lead to immense losses for a firm. For instance, Boeing suffered a loss of $2.25 Billion, while Cisco lost $2.25 Billion due to supply chain problems (Oliveira et al., 2017). Henceforth, when considering who to include in the supply chain, the main question should be if the party selected is ready to partake in the losses due to risks?

Secondly, how can the party help in mitigating risk? How accountable is the party in the organisational objectives? If a party feels the wrath of consequences related to risks and threats, then they should be included in the supply chain map.

Florian et al., (2015) break down this concept by assigning each risk category with the composition of risks that may proliferate it. All of these activities have a domino effect on the whole supply chain, any parties supplying these activities must be included in the supply chain map.

Supplying Risks: Poor quality good, non-delivery of agreed products, inflated prices, delayed delivery schedule.

Transporting Risk: Loss and damage to good when in transit

Warehousing Risks: Spoiling and damage to goods; changes in storage costs and taxes being levied on them.

Marketing Risks: Wrong promotional strategies, excessive, demand volatility.

Production Risk: Equipment failure, overproduction, poor quality outputs (Florian et al., 2015).

From the above, it’s evident that these are high-risk issues that may face an organization. Henceforth, an organization should monitor all activities carried out by these parties to ensure everything goes as planned. Moreover, when an issue arises, it can be easy for the organization to track through the use of an already established supply chain map. Henceforth, under this criteria, the supplier, the transporters, warehousing companies and marketing agencies must be included in the supply chain map.

Benchmarking

If a company wants to have a successful supply chain, it must study its competitors or other companies who have established a successful supply chain model. This is where benchmarking comes in handy where a company studies the processes, performances and products from the best practices (Routroy et al., 2015). This strategy helps a company select the right partners for its supply chain model, who are more likely to help it achieve its objectives fast.

Hettiarachchi (2016) claims that Apple Inc. has probably the most successful supply chain strategy due to how it has mastered mapping and visualization technologies in monitoring the movement of all products, both upstream and downstream. Once the company has benchmarked other companies supply chain maps, it then decides on how it can visualize its map for maximum benefits. The bigger the firm and the more complex its activities, it might find itself integrating even the secondary parties to the map, just like Apple Inc does (Hettiarachchi, 2016). On the other hand, if the company activities are just simple and use basic raw materials, its supply chain map should include the basic parties, i.e. supplier, warehouses, the firm, and the retailers.

The Importer-Exporter Criteria

The Importer (Buyer): This is a connected firm who supplies to the organization supplier. The importer is usually the source of goods within that region if he got them from the foreign nations. The importer negotiates purchase terms with the main supplier, which affects the final price of the raw materials when the reach a firm. This party offloads and inspects the shipment to ensure that all the products that had been ordered are in place. This importer is categorized as a source to pay (S2P) within the supply chain map.

Supplier (Exporter): Usually categorized as an Order-to-Cash Component in the Supply chain map. The exporter receives the purchase order from company clients and validates their credentials. After confirming the order, they fulfill their services by shipping the goods to the clients. He then collects the payment from the clients and reconciles them for analysis. The reason the exporter is accounted for in the Supply chain map is that he can help a company determine the level of demand from customers. The exporter is a connected firm within the supply chain model.

Exporter (Supplier): This type of exporter falls under the connected firm category and is a Fulfill-to service component. This supplier is in charge of fulfilling the order of all the raw materials scheduled for production. The exporter procures materials from their direct sources and delivers them to the company for processing. This type of exporter is placed in the Fulfill-to-service component.

Implications of a Good Supply Chain Management Practice

Vertical Structure:

More Control: Under this arrangement, the company control major activities within its supply chain, e.g. Apple Inc. As a result, the company can make amendments or any changes in the supply chain with minimal tussles (McCandless et al., 2015). For instance, when a manufacturer acquires its product retailers, he can be able to dictate the prices of all the products, just like he would if he were to acquire the supplier. As a result, they may have more bargaining company than the customers’ especially if there are no alternatives.

Differentiation: Having more control over the distribution channels, retails outlets, production materials inputs can enable a company to distinguish itself from competitors. Consumers may be able to notice these differences which can be leveraged upon further by clever marketing tactics.

Higher Profit and Revenue margins: Upstream and Downstream markets such as selling products to the customers or accessing raw materials directly from the source may become new sources of revenues. For instance, a company can also supply raw materials or provide transport and warehouse facilities to other companies on a fees basis. Moreover, having access to these elements eliminates middlemen and intermediaries who usually hike the prices by the time the products are reaching the company or end users. Henceforth, eliminating these intermediaries implies all these profits they were enjoying will be redirected to the firm.

Higher Level of Certainty: Florian et al., (2015) claimed that the more the parties involved in the supply chain, the higher the risks due to reduced control the company may have in overseeing all the activities. With vertical integration, all the acquired companies are acting as subsidiaries to the main company; hence it may be easy to standardize products and regulate their quality. This implies that a company is guaranteed of quality raw materials, quality freight and transport, warehousing and even retailing of goods.

Supply Chain Mapping Horizontal Integration

Market Expansion: Horizontal integration refers to the process of acquiring business activities that are at the same level. For instance, a fast-food company can try to gain a footing in another country by merging with another fast-food company in that nation. This enables a company to have a larger market share, which in turn leads to more revenues and profits for a company. The supply chain model also becomes flexible and loosens up, since they can experiment with different supplier simultaneously to determine the best one.

Industry Control: the merging of two similar businesses implies that their bargaining power also increases. As a result, they can use this power to set the market prices for their products, set standards for customers as well as dictate the quality they expect from their suppliers and prices.

This is an immense power which may lead to more third-party vendors focusing more on such companies due to being assured of continuous contracts and high demand for their goods.

Economies of Scale: An integrated company will be able to order quantity raw materials, engage in more productive activities at a much lower cost than if it were ordering low quantity products. This may in turn, lead to bigger profit margins and optimal use of all the facilities within the company.

Increased Differentiation: if the company continues acquiring and merging with businesses along with all lines it operates in, it can have more control over the features of its products. For instance, the products may be either cheaper, high quality, long lasting in a way that other companies which have not integrated themselves cannot replicate.

Focal Company:

Better relations with consumers: Under this structure, the company has a direct contract with the end users (Wang et al., 2016). This may help the company gain more trust and loyalty, leading to repeat sales from customers.

Better insight for better marketing and product strategies: The company taps to first-hand information from clients from matters about complains, suggestions that they may have on the type of services provided. The company may use this information to re-align and strategize itself so that it meets their demand or needs adequately.

Increased Accountability of suppliers and distributors: Since the company has contact with the end user, it may also provide guidelines that their vendors should follow to provide the best quality services and products for their customers. This may lead to the company monitoring the activities within the supply chain more closely than with other forms of integration (Wang et al., 2016). This may lead to a domino effect where the suppliers and other service providers to the company are also more keen, leading to quality products in the end.

In conclusion, it’s evident that supply chain mapping is very crucial for companies. It supports information distribution, shows channel dynamics and enhances strategic planning process for an organization. This enables the company can track all activities. It helps companies get more insight on all activities that are crucial to its functioning, be it upstream or downstream.

How can a supply chain mapping be successful? Well, the answer lies in who is the parties that are included in the map, criteria used to select them and their contribution to overall organizational goals It’s also worth noting that the supply chain map will be dependent on the type of integration that a company uses in its acquisition and delivery of goods/services, both upstream and downstream.

References

Dujak, D. (2017, January). Mapping of natural gas supply chains: Literature Review. In 17th International Scientific Conference Business Logistics in Modern Management 2017.

Florian, G. L., & Constangioara, A. (2014). The impact of risks in supply chain on organizational performances: evidence from Romania. Series Economy Management, 17(2), 265-275.

Gardner, T. A., Benzie, M., Börner, J., Dawkins, E., Fick, S., Garrett, R., … & Mardas, N. (2018). Transparency and sustainability in global commodity supply chains. World Development.

Hettiarachchi, H. (2016). Apple’s Supply Chain Strategy. 10.13140/RG.2.2.32075.49448.

Ho, W., Zheng, T., Yildiz, H., & Talluri, S. (2015). Supply chain risk management: a literature review. International Journal of Production Research, 53(16), 5031-5069.

Jayaratne, P., Styger, L., & Perera, N. (2018). Role Of Supply Chain Mapping In Sustainable Supply Chain Management. 2nd International Conference on Management Proceeding.

Kozlenkova, I., Hult, T., Lund, D., Mena, J., & Kekec, P. (2015). The Role of Marketing Channels in Supply Chain Management. Journal of Retailing. 91. 10.1016/j.jretai.2015.03.003.

Bryan, C. (2015). Handbook of Research on Global Supply Chain Management. IGI Global. ISBN-10: 1466696397

Mccandless, E., Abitbol, E., & Donais, T. (2015). Vertical integration: A dynamic practice promoting transformative peacebuilding. Journal of Peacebuilidng and Development. 10(1).

Nuss, P., Graedel, T. E., Alonso, E., & Carroll, A. (2016). Mapping supply chain risk by network analysis of product platforms. Sustainable Materials and Technologies, 10, 14-22.

Oliveira, U.R., Espindolar, L.S & Marims, S.F (2017). Analysis of supply chain risk management researches.

Rodríguez, R. R. (2016). Social network analysis and supply chain management. International Journal of Production Management and Engineering (IJPME), 4(1), 35-40.

Routroy, S., & Shankar, A. (2015). A benchmarking approach for supply chain risk management. International Journal of Services and Operations Management, 20(3), 338-357.

Supply Chain Mapping Protocol. (2017). Supply Chain Sustainability. Version 1.

Wang, X. & Wood, L.C. (2016). The Influence of Supply Chain Sustainability Practices of Suppliers.

Other Relevant Blog Posts

Supply Chain Management Business Success

How Sustainable Supply Chain Management Can Increase Sales In Fashion Clothing. A Study of Marks and Spencer

If you enjoyed reading this post on Supply Chain Mapping, I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.