Globalization and Outsourcing

Globalization is a phenomenon that has swept across most sectors of the globe leaving firms to adjust to the changes that are occurring. The rise of competition Is one example of an aspect that has emerged within the twenty-first century, especially due to a dissolution in trade barrier that marked numerous markets as impenetrable. With globalization escalating gradually, businesses have gained an exposure opportunity to learn more as well as share tips on better ways of approaching futuristic growth. The following report will expound on globalization as a phenomenon, as well as its associated impacts within the modern day era.

From an entrepreneurship perspective, the duties and functions that defined the modern-day capitalist or businessperson, have significantly complicated with time. Ideally, the 21st century, unlike its predecessors, has been defined by a revolutionary economic, educational, political, and social landscapes, elements that have emerged as a result of globalization.

Interestingly, the emergence of the phenomenon has transformed the manner in which man does business, given that it has erased the limitations that were nurtured by geographical borders as well as trade barriers, an aspect that has resulted in man embracing new synergies that will offer him or her competitive advantage over other similar players in the same market niche. The following report will further expand on wise investment moves as well as tactics such as outsourcing and offshoring that managers can apply to realize a wider economy of scale as well as achieve a greater competitive advantage. By utilizing the Case study of Telstra Call center services Outsourcing and offshoring, this report will expound on the impact, opportunities, as well as challenges, Globalization, and its associated strategies, have imposed on business operations especially on the global scale.

The World as we know it is currently evolving at unprecedented levels, an aspect that is reconfiguring and transforming the manner in which business, as well as trade, is conducted. As a result of the rampant transformation, goods and services have become easily accessible for most people across diverse regions of the globe. In addition to this, the international business community has continuously expanded as a result of favorable influences that have been nurtured by the economic reconfiguration and transformation. But, what is all this economic reconfiguration and transformation? The 21st century, unlike its predecessors, has been defined by a revolutionary economic, educational, political, and social landscapes, elements that have emerged as a result of globalization. The emergence of globalization as a phenomenon has transformed the manner in which man does business, given that it has erased the limitations that were nurtured by geographical borders as well as trade barriers (Beck, U. 2018, P. 35).

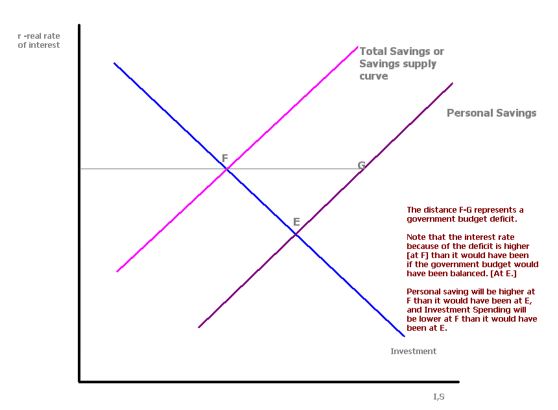

From an entrepreneurship perspective, the duties and functions that defined the modern-day capitalist or businessperson, have significantly complicated with time. Why and How? With factors such as competition escalating as a result of the globalization aspect, most entrepreneurs have embarked on redefining the rules of trade and business engagement provoked by the need to craft and embrace new synergies that will offer them competitive advantage over other similar players in the same market niche (Hay, C. and Marsh, D. eds. 2016, p. 52). As a result of the shift in momentum, it is crucial to note that today’s economic environment has shifted its dependency from the public sector to the public sector, given that the later has emerged to be the global powerhouse, while the former segment has continuously shrunk in size, cumulatively losing its prior influence and relevance in the economy setting.

Globalization and Expansion

In spite of Globalization nurturing numerous advantages from an economic growth perspective, it is crucial to note that the phenomenon has also escalated the rate of competition present across all trade sectors. The given aspect has manifested as a result of numerous entities across diverse regions entering the market, with each unit producing a similar commodity, to an already existing product. The escalation of competition has provoked most organizations to invest heavily in expanding their operations onto a global scale, efforts that have emerged based on the need to grow and expand the market niche that each organization claims and controls (Beck, U. 2018, P. 27). As an approach, the expansion to international markets has provided firms with an opening to increase their returns, realize other potential economic opportunities, as well as improve their image perception and brand loyalty. Although there are also challenges associated with the entry into foreign markets, the manner in which a venture tackles the emerging challenges significantly determines its survival chance in the new territory.

Outsourcing and Offshoring

Outsourcing is a strategy that has been employed by numerous institutions, which have pursued the global expansion route, based on its cost-cutting approach. When entering new markets, firms have always been primarily challenged by their ability to adopt, embrace, and conform to new customs, cultures as well as language that define the new market (Solli-Sæther, H. and Gottschalk, P. 2015, p.90).

Outsourcing as a platform provides a solution to such challenges among others, by utilizing the local manpower within the new economic niche as the organization’s workforce. The following report will expound on globalization and its impact on today’s businesses as its foremost agenda. Furthermore, this paper elucidates on tactics that managers pursuing expansion into the international market should observe if they wish to remain ahead of the game. In the second segment, the publication will analyze outsourcing and offshoring, coupled with their contribution to globalization, based on an Australian firm Case study.

Globalization and Today’s International Managers

Globalization as a concept is not new as one may perceive it to be, given that the concept has existed for centuries, only evolving with time to its present state. By definition, Globalization is a term that refers to the gradual but global integration of the numerous states economies, through the production of goods and services, trade escalation, as well as investment flows (Hay, C. and Marsh, D. eds. 2016, p. 11). From a phenomenon perspective, globalization emerged as a result of the global outreach fever that swept most nations, transgressing through each of the states military economic, trade and geopolitical niches. The cumulative impact of the global outreach manifested in the erosion of national economic borders, an element that embraced the emergence and growth of integrated international economies.

From a profile perspective, globalization has been defined by; the emergence of global corporations, robust internalization of production related economic activities, growth in the level of specialization, and escalating disaggregation of production. How has this been possible? Globalization as a phenomenon has consistently relied on policy changes as well as technological growth as catalyst platforms (Teece, D. Peteraf, M. and Leih, S. 2016, p. 19).

From a policy perspective, the creation and amendment of numerous trade policies has resulted in the dissolution of trade tariffs and barriers, an element that has opened up and exposed the local markets to international products, while also local products from different nations have been able to trade on the global market platform (Beck, U. 2018, P. 42). Evidently, nations such as Australia, China, and Dubai, all of which opened up their markets to trade and embraced international brands, have gained immensely from Globalization, an aspect that is visible in each state’s current market situation.

Technology as the second catalyst factor propelled the evolution of globalization to what it is today. How So? As a result of its rampant evolution, technology has been integrated into man’s life as a crucial platform in his civilization. The emergence of a technology-based lifestyle, shifted the manner in which consumers’ access, shop, and order for their products, as well as the strategy in which manufacturers, industrialists, and producers advertise, retail, and distribute their products (Hay, C. and Marsh, D. eds. 2016, p. 52). Given that the dependency on technology is still expected to escalate with time, the business world has realized of its importance in globalization and the influence it imposes in the productivity, of goods and services as well as the consumption of the products.

Impact of Globalization: A Business Perspective

Globalization as an economic exposure platform has brought along with numerous advantages as well as implications both from the producer as well as consumer’s perspectives. When focusing on the producer side, which primarily made up of entrepreneurial organizations within the private sector, it is crucial to note that globalization has exposed the sector to competition, fluctuation in prices, as well as the substandard quality of products (Kraidy, M. 2017, p. 31). The following segment will offer an in-depth view of Globalization from a business perspective.

It is crucial to note that from the consumer’s end, globalization has been perceived to bear numerous benefits over time. However, that may not be necessarily the case when the aspect is perceived from a business perspective. The increased exposure of markets has also escalated the vulnerability of ventures both in local and international economies to a myriad of unforeseen risks, aspects that will be expounded on below.

Intense Competition

Competition as the first impact of globalization emerges from the opening up of local markets as well as the integration of economies. It is crucial to note that exportation and importation, as well as outsourcing of product and services are crucial aspects of globalization. Unfortunately, the given elements have created an influx of substitute commodities to most products in diverse markets (Donati, P. 2017, p. 15). The cited aspect which has emerged as the entry of new players into the market culminated in the escalation of competition between existing firms and the new entrants. Cumulatively, although the approach has compelled previously existing firms to improve their quality of products and services, it is unfortunate to note that the cost of competition has been overwhelming for firms in markets that are defined by numerous players.

Price Fluctuations

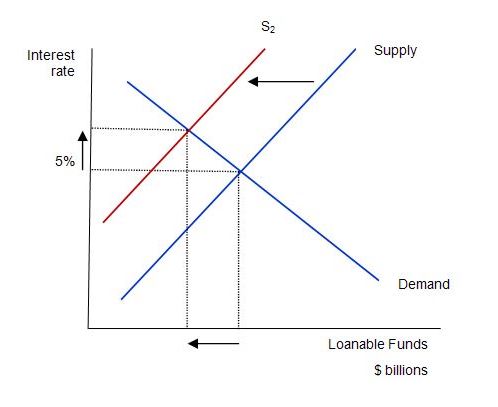

Fluctuation of prices as the second impact of globalization is highly associated with competition and market saturation. It is crucial to note that although globalization opened up local and international markets, the platform also led to the saturation of various markets that were already defined by a presence of numerous existing local players. Most of the international entrants into local markets were able to supply the consumers with alternative or substitute commodities, to local options at a lower price and even a better quality (Teece, D. Peteraf, M. and Leih, S. 2016, p. 27). Case in point, China’s products are renowned for their cheap price, although inconsistent quality. The given aspect nurtures price fluctuation of commodities because local producers will always be compelled to adjust their prices in a bid to compete with foreign producers, and the cost of their commodities, an aspect that culminates in the unsteady prices of goods.

Substandard Quality of Goods

The quality of a product as well as the brand it has crafted for itself, are aspects that significantly shape customer loyalty and satisfaction. Globalization as a phenomenon has compelled most firms operating in the international platform to outsource their products to developing nations, in a bid to realize a wider competitive advantage, margin when compared to other firms operating in the same niche (Kraidy, M. 2017, p. 22).

The downside of outsourcing is that for most organizations, the ability to observe a given set of quality standards becomes impossible especially when the firm focuses on offering services, or manufactured goods. Cumulatively, although globalization is inevitable, its impacts can be positive as well as be overwhelming for organizations without adequate control structures. The following segment will expound on strategies that international managers can adopt in a bid to remain afloat if not advance in the face of stiff and harsh globalization-induced changes.

Today’s International Managers: Winning tips amidst fierce competition

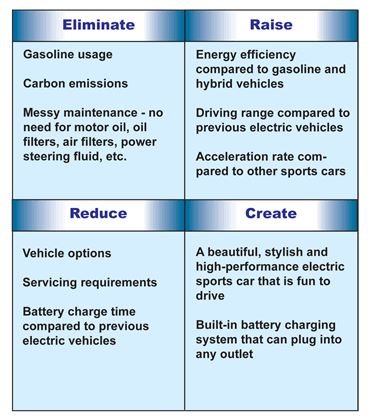

Drawing from the above analysis of globalization, it is evident that the phenomenon has significantly reshaped the manner in which organizations functions, and conduct business, especially within the international market platform. In spite of the prevalent changes, there are several tactics that wise international managers can utilize to continuously attain growth in returns, and market share. In addition to this, the tactics will enable an organization to establish a reputable image that retains a wide base of loyal customers.

Globalization, Identifying and analyzing the existing and potential Competition

For an organization to stay ahead of its competitors within any market niche, the firm should be aware of the existing threats, an aspect that can only be realized by conducting a thorough competitor’s analysis. It is crucial to note that any industry with new players and startups joining every day is considered to aggressively active, and as such, any firm operating within such a niche should consistently update its analysis in a periodical manner (McLean, M. 2018, p. 35). When analyzing the potential threats, it is crucial to identify the primary and secondary competitors as well as the level of threat each player imposes on your particular firm. By doing so, a manager can analyze the strengths and weaknesses of potential and existing competitors, in addition to making strategic moves that will consistently position the organization ahead of the competition.

Assessing and Understanding the Target Market

In any business competition, it is crucial to note that the clients or consumers always represent the judges, as their choice embodies their final opinion about their desired product. In any market niche, a wise international manager will always assess the audience, its expectation, and needs, as well as demands. It is crucial to note that consumer behaviors keep on changing depending on the influence of macro factors such as economic conditions (McLean, M. 2018, p. 54). In such an instance, an astute director establishes constant communication with the organization’s existing and prospective clients, as an approach to remain informed and update on consumer concern, predictions as well as desires. By doing so, a firm can adjust its product pricing, market strategies, product packaging, and promotional campaigns in a manner that will attract potential clients and retain the existing ones.

Outsourcing and Offshoring, Telstra Case study

Outsourcing, when defined, refers to the process whereby a firm subcontracts the organization’s tasks and mandates to various external organizations that have specialized in providing the desired service. In other cases, outsourcing also involves a practice whereby an organization acquires a smaller firm with adequate resources and employees to run its tasks. Cumulatively, outsourcing revolves around the breaking down of a given function, and it’s subsequent assigning to third parties (Oshri, I. Kotlarsky, J. and Willcocks, L. 2015, p. 15).

Offshoring, on the other hand, refers to the purposeful relocation of a specific or cumulative business procedure to another new location, such as a country. A good example of offshoring would be when an industrial firm physically relocates its manufacturing process to a new state. The main difference between offshoring and outsourcing is that the former focuses on establishing an operation in a new state as a result of repositioning, while the latter primarily refers to the subcontracting of a firms’ task or duty to a third party which in most cases is usually an external organization (Solli-Sæther, H. and Gottschalk, P. 2015, p.90).

The fierce aspect of globalization has compelled firms’ overtime to search for innovative and alternative approaches to getting the work done efficiently. Outsourcing and Offshoring have emerged to be promising alternatives means of meeting the production needs of any company. By employing the two approaches, numerous international firms have been able to regulate and cut down operational costs, free up internal resources to support other crucial sectors, and streamline time-consuming functions (Oshri, I. Kotlarsky, J. and Willcocks, L. 2015, p. 48).

Telstra Outsourcing

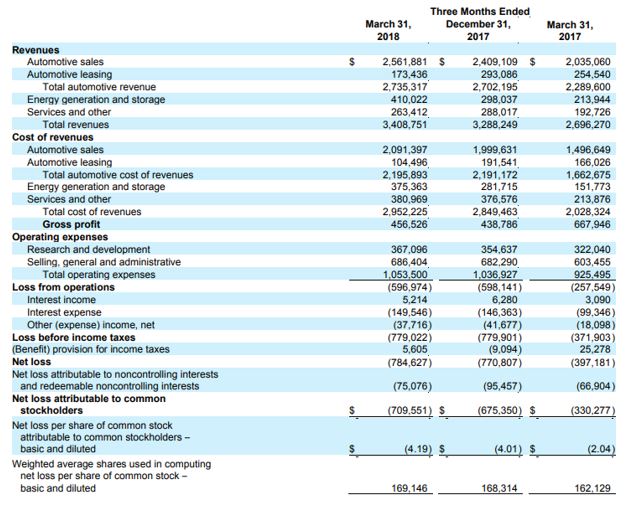

Telstra within Australia is presently recognized as the largest media and Telecommunications Company, offering services that include; operating telecommunication network, as well as a vast range of entertainment and communication product and services. As a firm, Telstra prides its purpose to be creating a brilliant and connected future for everyone, a vision it has managed to achieve over time through the expansion of its products and services towards the international telecommunications market.

Expanding into the international market is a move that Telstra implemented provoked by the need to grow the company’s portfolio onto the next level, in addition to embracing the global market platform (CX Central. 2018b, p1). In its expansion operations, the firm has gradually relied on outsourcing and offshoring as approaches to realize its economies of scale and competitive advantage over other players present in the telecommunications industry. One particular and crucial department that the firm has constantly outsourced and offshored to India, Manila, and Perth is its call center operations (CX Central. 2018, p1).

Essentially, under the firm’s international operations plan, Call centers are usually overwhelming departments that are defined by large volumes of low severity type of work. If the firm was to house most of call center operations within its main headquarters back in Australia, evidently quite extensive resources would be committed to the department, to the extent of overwhelming significance performance targets of the institution. Thus by outsourcing and offshoring call center services, the firm is primarily able to focus its resources on dealing with challenging and more severe issues affecting its product portfolio, brand depiction, and customer market base (CX Central. 2018, p1).

Challenges of Outsourcing and Offshoring

Two of the major challenges that Telstra has realized in its international expansion conquest, are cultural and language barriers. As a telecommunication firm, Telstra is constantly in touch with its customer base compelled by the need to introduce and sell new products, as well as offer supportive services (CX Central. 2018b, p1). Given that the firm opts to outsource and offshore its call center operations, most of its customer base across the western world have been complaining of an ineffective call center support base, as in most situations their needs and demands have often been unmet (CX Central. 2018b, p1).

One good example was a recent scenario, where an American customer received poor call center support services that were perceived to be abusive and culturally insensitive, especially after the firm had withdrawn its support for same-sex relationships (CX Central. 2018, p1). It is unfortunate to note that the given aspect resulted from a conflict in cultural and linguistic customs between the firm’s support staff and a worried client, an aspect that could have been deterred if the firm offered locally based call support from America or Australia.

Globalization, Outsourcing and Offshoring Opportunities

From an opportunity perspective, Telstra was able to run its call center support services at a lower cost especially given that the standard labor wage of employees in most of the countries that the firm outsourced its operations are way below what Telstra was offering its initial employees. Additionally, the firm, thanks to outsourcing and offshoring was able to free up more resources back at home and commit them to more severe and demanding issues associated with the firm’s growth and future projections.

In conclusion, it is evident that Globalization is a phenomenon that is here to stay. More so, firm’s that do not embrace this occurrence will gradually become outdated in our ever-changing and first paced world. As economies integrate, there is a crucial need for managers to begin “thinking out of their market niche, and across the globe.” Customer preferences change from time to time, and with that being a significant determining factor of choice, firms should consistently lay down moves that will secure more potential customers besides retaining the existing ones. Additionally, with competition emerging to be a significant defining factor of today’s markets, there is a pressing need for firms to adopt positive elements of outsourcing and offshoring, besides other competition analysis schemes, all in a bid to remain ahead of the curve that is a saturated market full of numerous existing and emerging start-up players.

References

Beck, U., 2018. What is globalization?. John Wiley & Sons.

CX Central. 2018. Telstra call centre staff in Perth have language problems – CEO | CX Central.

CX Central. 2018b. Telstra’s offshore call centre has a cultural alignment shocker– CEO | CX Central.

Donati, P., 2017. Globalization of Markets, Distant Harms and the Need for a Relational Ethics. Rivista internazionale di scienze sociali, 1(1), pp.13-42.

McLean, M., 2018. Understanding your economy: Using analysis to guide local strategic planning. Routledge.

Oshri, I., Kotlarsky, J. and Willcocks, L.P., 2015. The Handbook of Global Outsourcing and Offshoring 3rd Edition. Springer.

Solli-Sæther, H. and Gottschalk, P., 2015. Stages-of-growth in outsourcing, offshoring and backsourcing: Back to the future? Journal of Computer Information Systems, 55(2), pp.88-94.

Teece, D., Peteraf, M. and Leih, S., 2016. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. California Management Review, 58(4), pp.13-35.

Kraidy, M., 2017. Hybridity, or the cultural logic of globalization. Temple University Press.

Hay, C. and Marsh, D. eds., 2016. Demystifying globalization. Springer.

Relevant Posts

Global Development China Dissertations

MBA Dissertation Topics

Did you find any useful knowledge relating to globalization and outsourcing in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.