Tesla Motors Case Study

With the increased focus on renewable energy driving all, sector the country’s economy. The transport sector has also received numerous recommendations to reduce carbon emissions. It is against the backdrop of these ideal that Tesla Motors Company was created. This case study will examine Tesla motor companies strategies as well as assess their internal and external environment in order to create viable recommendations for a sector, which is highly competitive. This case study report will begin with background information about the company then assess the organisation strategic positions and this will be undertaken with the use of Porter’s five forces and SWOT analysis. The outcomes from this model will aid in the recommendation, which will be vital for the organisations.

Tesla Motors Background

According to Tesla (2014) the organisation was formed in 2003 as a revolutionary car business using the latest technology as its competitive advantage. The car was able to conceptualise and create an independently electric vehicle known as the roadster. The concept of the car designs was Silicon Valley inspired. According to Ehrler et al. (n.d, p. 381) the organisation “designs, manufactures and sells zero emission electric cars and power train parts, such as lithium-ion battery packs”. The organisation has sought for strategic partnerships with companies such as Daimler, Panasonic, Toyota and US department of energy (Ehrler et al., n.d, p. 383).

Tesla Motors PESTEL Analysis

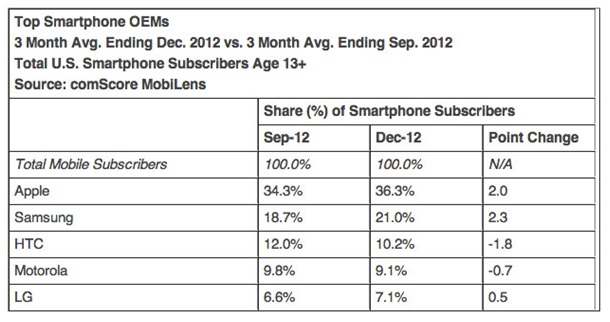

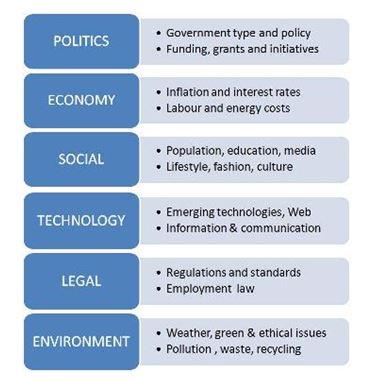

PESTEL analysis is a viable tool used to examine an organisation environment and is crucial in the identification of key areas of improvement as well as potential problems likely to emerge (Yuksel, 2012). The external environment is a factor, un-controlled by the organisation and all the eternities function as influences to the organisation operations as seen in figure 1 below. The models take into consideration the political, economy, the social, technology, legal and environment.

Figure 1 PESTEL Model

(Sourced from: Business and Management: 4th November – 11th November 2013, – PESTLE Analysis, 2015).

Political

According to Tesla (2014), Tesla motors sell their cars in numerous countries across the United States, Europe and Asia and hence, the company is exposed to different political situations occurring in all those countries. According to the Environmental- protection.org.uk (2014), some countries political environment are affected by climate change issues and hence, law enacted to cut carbon emission by a particular percentage and this affects car manufacturers. The US government is offering incentives to car manufactures that endeavour to product cars more efficient and better in utilising green car technology.

Economic

There is an alternative avenue for growth for cars offering cars, which utilise alternative energy. The increase costs of petroleum have made business more difficult and hence, businesses and individuals are in need of an alternative solution to the rising fuel costs. Most developed countries are now recovering from the financial crisis; the purchasing power is now higher, great new for manufacturers who have products that at needed.

Social

Today the word green technology is associated with companies that are considered to be producing products that are good for the environment. Carbon emission from vehicle exhausts are a big contributor to greenhouse gases affecting the earth environments (Wunch et al., 2009).

Technological

The car sector has seen tremendous changes due to technological innovation affecting several aspects of the car efficiency. Vehicles have been going through metamorphosis with car manufactures looking for way of reducing the fuel intake in order to improve efficiency.

Environmental

Eco friendly car is the word spoken to car manufacturer if they rare to remain competitive by customers across the world. With fuel leakages reported in some places, resulting in a loss of marine and bird life, there have been a growing number of environmentalists forcing their government to regulate the sector and allow only fuel-efficient cars on their roads. What happens to the ozone layer is another factor pushing some individual and institutions to consider vehicles, which do less damage to the environment.

Legal

The US has a market presents challenges for Tesla as a car manufactures especially due to the franchise laws in the country (Fisher, 2014). The energy loan program also in the country increases the chances of car manufacturer to produce more green cars in the sector.

All the factors seen above have the effect of directing the way a car manufacturer does business in US. It is vital to determine how external environments affect the organisation in order to work from there, building competence in a way, which is likely to result in a more beneficial manner. Of major significance in the assessment of Tesla’s external environment are the franchise laws, which would stop the company from distributing their cars in some states in the country. However, the much of the external influence faced by the car manufactures geared to more in support of the company and trends show the vehicle sector is set to follow Tesla direction in the future.

Tesla Motors Competences (SWOT Analysis)

In order to determine Tesla’s competences in the vehicle industry, a SWOT analysis is carried out to examine the organisations strengths, weaknesses, opportunities and threats (Hill, & Westbrook, 1997. It is vital to assess the organisation internal capabilities for a more effective recommendation outcome. A SWOT analysis model is presented in figure 2 below.

Figure 2: SWOT analysis

(Sourced from: Doing a SWOT Analysis to Focus Your Marketing Strategy, 2015)

Strengths

Tesla motors have been able to create executive cars, which are totally fuel free and are energy efficient since they are based on electric power, which are saved on batteries. Tesla cars have been able to go for more than 300 miles without having to recharge their batteries and the closest competitor can only reach 100 miles, which is a significant benefit to the company. In 2013 their car, the “Tesla S” was awarded the price as the trendiest car of the year.

Tesla has been able to reduce its input costs significantly through outsourcing of other parts needed for the manufacture of their vehicles and this has allowed the organisation to reduce its costs. Its collaboration with Panasonic is likely to have an even more powerful battery, which is likely to push their cars even further. In addition, its collaboration with Daimler and Toyota has greater advantages and the company is set to provide vital parts for needed for electronic cars for the two companies.

The organisation has invested a large amount of research and development and this is key to pay off in the future when new technology which is likely to further revolutionise the car sector will be a necessity and this goes in hand with their objectives which is to be in the forefront of the electric vehicle sector.

The organisation has been able to utilise just in time JIT manufacturing systems and only those cars, which are ordered, manufactured and this reduces storage costs and enables them to have a smaller facility. This form of lean management process allows staff to become specialised in a vast number of skills hence, fewer staff are able to accomplish the task of the organisation.

Weaknesses

The major problem that Tesla Motors has is a lack of adequate capital base on which to sustain its operational successfully. Despite having sales for its vehicles, the organisation is not making profits and is due to a low demand and high cost of sales, which are eating up the sales revenues.

The organisation is running on debt financing which is expensive and puts the company at greater risks of being taken over if they are not able to pay up its debts on time. The large research and development costs do not seem to bear profits at this time.

The Tesla car brand is not international recognised as compared to other brands such as the Toyota Prius. The organisation has focused on the higher end of the market, attracting only those with considerable resources to purchase the cars.

Opportunities

The opportunities for Tesla are enormous today especially with fuel prices rising, making life difficult for those who have cars that consume a lot of fuel. The car manufactures need to communicate the benefits of their vehicle to the entire car market since the benefits accruing with owning their cars far outweighs having a regular gasoline car. There is a ready market for small fuel-efficient vehicles also which the company has not tapped (Pollet, Staffell & Shang, 2012). Already the car manufacturer is in a sector, which few have tried to venture fully. Those car manufactures who have tried to venture either have hybrid cars of inefficient electric cars as compared to Tesla motors.

Threats

Other car manufacturers have greater financial resourced or sources, which could easily allow them to venture into the niche market, Tesla is viewed as a smaller inexperienced car manufactures are compared to the long term experienced car manufactures in vehicle sector. If other car manufacturer with greater capability for economies of scale to start making electric vehicles, this could affect Tesla revenue sine the organising is not able to manufacture as cheaply as those who are established worldwide.

Tesla Motors Competences (Porters 5 Forces Analysis)

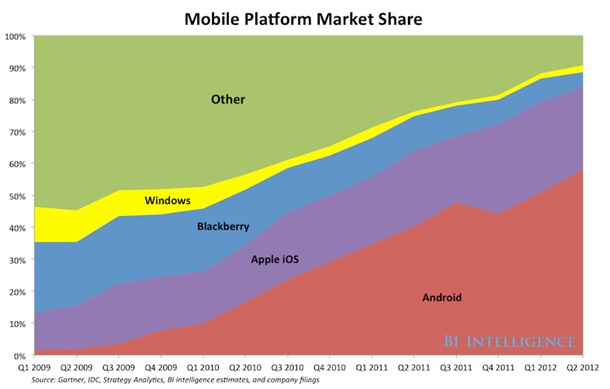

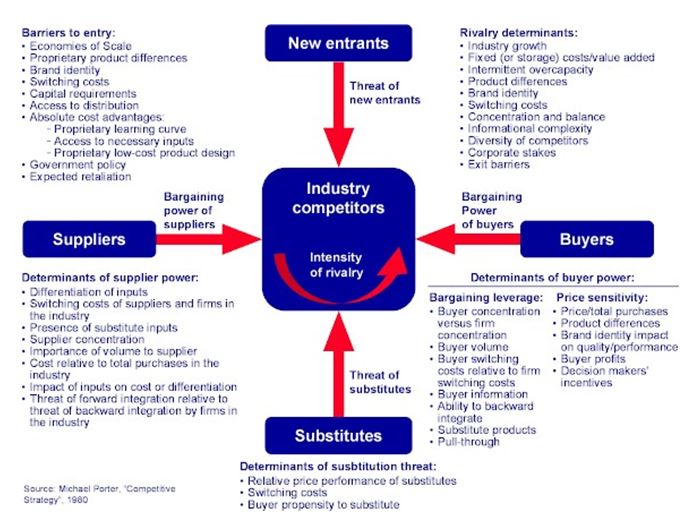

Porters five forces as seen in figure 3 below is useful in assessing a business sector to find how attractive the sector is and who has influence in the sector.

Figure 3: Porters 5 forces Analysis Model

(Sourced from: Porter, 1981)

The Threat from New Entrants

The sector which Tesla Motors company is in has challenges for those who want to enter that market segment. The capital expenditure needed for this electric vehicle sector is very high and keeps new business away from this sector. The only business which may find it easy to enter this market are those existing car manufacturer that have large resources readily available as well as have the capacity to venture fully into this sector.

The Bargaining Power of Buyers

Tesla is a vital company in the electric vehicle sector and today they have a very solid relationship with their customers. Since the company has invested a lot of money and skill in research development, they have been able to manufacture quality products, which are useful for companies such as Daimler, and Toyota hence Tesla Motors power is very high. Tesla has a manufacturer, produces cars which are unique and scarce hence, with increased demand likely to set in the market, they will have considerable power thought, this is only vital if they are able to generate awareness of their brand.

Threat of Substitution

The threats of substitution are the Tesla Motors market segment can be seen from hybrid cars, diesel cars as well as other electric cars and solar power cars. There are also substitutes arising from people choosing to ride buses, trains as well as use bicycles instead of purchasing an electric vehicle.

The Bargaining Power of Suppliers

Since Tesla Motors is highly dependent on its suppliers and this is due to adopting lean management system where parts sought when an order is availed. This means that the suppliers have a higher bargaining power. If the suppliers do not bring the raw materials in time, Tesla is likely to suffer as a result.

The Intensity of Rivalry in the Industry

The global car sector is fiercely competitive with car manufactures competing on a global platform with different categories of their products to cater for different clientele. In the electric vehicle, sectors server car manufactures have created cars, which have not been able to meet the standard of Tesla though; companies such as Nissan have created compact affordable electric cars, which are selling in different countries.

Porter’s five forces show a growing threats to the Tesla car company if they do not work quickly and cater for other segment. This threat can only be from already established car manufacturer. The sector is still inaccessible due to the high capital-intensive investment an organisation will have to undertake and the skill needed to ensure an organisation is competitive.

Conclusions

This case study features Tesla Motors a company that was set up to create in 2003 as a revolutionary car business using the latest technology as its competitive advantage. The car was able to conceptualise and create an independently electric vehicle known as the roadster. The company’s revolutionary cars are set on a global stage, as a car with moves without the conventional fuel. The external environment scanning undertaken through PESTEL analysis of the organisation revealed that the organisation had greater opportunities to enhance their business with support from the American government. The international analysis undertaken using the SWOT analysis revealed that organisation has inherent weaknesses, which saw the company perform in a sector, which is very lucrative due to a lack of adequate finances. Threats in the electric vehicle sector were seen to arise from existing car manufacture, with greater competences as well as finances to build electric vehicles even cheaper than Tesla. Porters 5 forces analysis that was undertaken on Tesla Motors revealed that the sector was very hard to enter by new players in the sector. This was due to the high capital intensity the sector demanded as well as the skills necessary for a business to actually undertake the business successfully. The case study also showed that Tesla Motors strategy was more focused on the upper clientele of the car market with quality, better performance as well as expensive vehicles, which used electricity as compared to petrol.

Recommendations

Tesla was advised by its customer to manufacture a car that was of a lower price but the company has still manufacture a car that is half the cost of its pioneer car thought still relatively high for many to purchase.

Since Tesla is in a sector, which has the highest potential in the vehicle sector, the organisation should find ways of building a cheaper option, which can be bought by a number of people worldwide. Since the companies cars are of the best quality, in order to capitalise on this aspect, selling on mass production could be more beneficial to producing on demand. It is better to derive fewer profit margins and sell more cars, which then equates to a greater profit as compared to selling premium, which affects demand. With threats evident as existing car, companies have started embarking into electronic car sector, this is poised to destroy Tesla cars in the market if those car manufactures are able to manufacture and sell at a cheaper price. This is an aspect Tesla should not forget and having beautiful expensive cars does not equate to profits but rather having a car, which has demand.

The company’s strategy on focusing on premium cars and attracting the rich to purchase their cars is failing with little or no demand. The rich have the capacity to purchase any other car despite the consumption and hence, a change to their focus can create changes to the financial reporting. Coming out early and capturing a greater market share will hinder even existing car manufacturer from venturing into Tesla niche market. The organisation should come out with different models from compact small cars to their SUV since this is a car concept which any individual is unlikely to pass out.

Tesla should embark on selling key part to other car manufacturers to ensure they have a steady stream of revenue apart from selling their cars. This ensures that the car manufacture remains relevant even with increased competition, which is set to grow in the coming years. Being in the forefront or provision of vital innovative electrical parts for car manufactures can even bring in a greater percentage of revenues. Samsung Company has been able to remain competitive as a result of producing vital parts for iPhone which is a major rival.

Tesla should continue with its research and development and produce batteries, which are able to take the car further as well as reduce the time it takes to charge the car batteries, which many view as a challenge when using electric vehicles.

Most importantly, Tesla needs to create awareness of its products to the international market not just in American and Europe. There are many government and organisation, which could benefit from having a car that utilises less harmful substances as compared to petrol of diesel. A greater percentage of the revenue should be spend in advertisement and education on harmful carbon emitted in petrol and diesel consuming cars.

References

Business and Management: 4th November – 11th November 2013, – PESTLE Analysis (2015) Business and Management: 4th November – 11th November 2013, – PESTLE Analysis.

Doing a SWOT Analysis to Focus Your Marketing Strategy (2015) Doing a SWOT Analysis to Focus Your Marketing Strategy.

Ehrler, C., Gillis, J., Huesemann, M., Sandoval, M., & Turckes, L., (n.d) Tesla Motors: charging into the future? Case 29 1(1) pp. 381-395

Environmental-protection.org.uk, (2014) Car Pollution | Environmental Protection UK.

Fisher, D. (2014) Tesla’s Elon Musk Learns An Old Lesson Fighting Protectionist Dealer Laws.

Hill, T., & Westbrook, R. (1997) SWOT analysis: it’s time for a product recall. Long range planning, 30(1), 46-52.

Pollet, B. G., Staffell, I., & Shang, J. L. (2012) Current status of hybrid, battery and fuel cell electric vehicles: from electrochemistry to market prospects. Electro-chimica Acta, 84, 235-249.

Porter, M. E. (1981) The contributions of industrial organization to strategic management. Academy of management review, 6(4), 609-620.

Tesla Motors, (2014) About Tesla | Tesla Motors.

Wunch, D., Wennberg, P. O., Toon, G. C., Keppel Aleks, G., & Yavin, Y. G. (2009) Emissions of greenhouse gases from a North American megacity. Geophysical Research Letters, 36(15).

Yuksel, I. (2012) Developing a multi-criteria decision making model for PESTEL analysis. International Journal of Business and Management, 7(24), p52.