Five Forces Model Automobile Industry Case Study Analysis

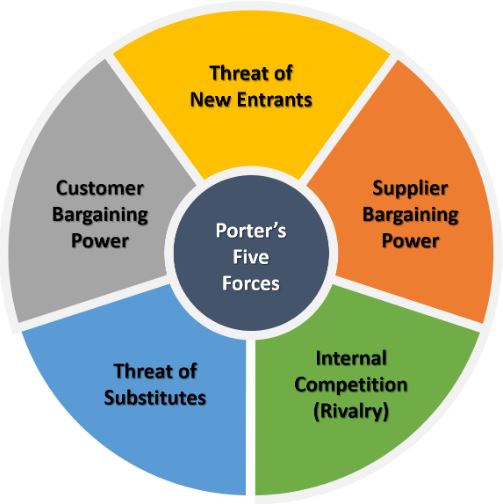

Title: Five Forces Model Automobile Industry Case Study Analysis. Michael Porter’s Five Forces Model is a simple yet effective business analysis tool that is used to determine whether a strategy has the potential to be profitable in a company’s competitive environment. When carried out in the right way, with the right tools, the Five Forces Analysis can provide invaluable insight into your business’s competition and how much power you hold in the market, so you can adjust your strategy for success. As its name suggests, there are five forces which include the intensity of rivalry, power of buyers, power of suppliers, threat of substitutes and threat of potential new entrants (Porter. 1981).

Intensity of Competitive Rivalry

The key factors that influence the intensity of rivalry in the automobile industry include the number of competitors, the brand recognition of the competitors and the frequency with which new automobile products are introduced by competitors. According to Potter’s case study the global automobile industry is highly concentrated.

However, none of the companies in the industry has achieved donation of the market. The case study indicates that about seven firms have around 10 to 15 percent of the market share. The reason for this is the high acquisition levels and collaboration activities in the global automobile industry, which minimizes competition regardless the frequency of purchase or recognition of the different brands in the industry.

As a result, the intensity of competitive rivalry in the industry is moderate. The implication of the moderate competitive intensity is that automobile firms still manage to make significant profits especially since the level of competition is suppressed by the joint ventures and alliances among automobile firms in the industry.

Power of Buyers

The factors that shape the power of customers in the automobile industry include the number of buyers in the industry, frequency of purchase, and the size of purchases. According to Potter, the global demand for cars is associated to a nation’s economic performance.

The data on Worldwide Car sales in 2016 indicate that China, which is among the top best performing economies in the world had the largest had a percentage increase of 10.7 in car sales in 2016. This demand can be viewed in the context of the wider process of a country’s economic development which leads to selective ownership that causes mass market volumes of short time cycles that reduce within mass volume causing delays in purchases or consumer changing segments.

This means that buyers demand for automobiles is determined by eternal elements that they cannot control. In this regards, the intensity of the power of buyers is moderately weak, which means, firms are still able to make reasonable profits.

Power of Suppliers

The power of suppliers is influenced by the following factors, the number of suppliers, replaceability of the supplies and the exclusivity of the supplies (Porter, 1980). Potter indicates that suppliers of the global automobile industry have become solution provider and knowledge partners with the automobile firms. Moreover, technology is increasingly becoming more intelligent enabling the suppliers to gain larger economies of scale giving them the power to bargain.

However, in the global automobile industry 33% and 17% of all suppliers have their manufacturing facilities in Eastern Europe and China respectively which raises the issue of Intellectual property rights and theft of technology. These has caused a decline in the power of mot suppliers as this trend is expanding to other parts of the world. For this reasons, the intensity of the power of suppliers is moderately strong, which means that the firms are forced to collaborate and partner with suppliers to minimize most of raw material to maximize profits.

Threat of Substitutes

Threat of substitutes in the automobile industry is determined by technology advancement, affordability and availability of potential substitutes and customer’s acceptance (Porter, 1980). According to the case study, the global automobile industry threat of substitution is mainly due to environment issues and economic consideration, where people see alternatives that are cheaper and greener.

The automobile industry contributes about 70% of the emission of CO2, and consumers are ready to take up alternatives that are more environmentally friendly. However, such substitutes are mostly provided by the same automobile firms. In this case, the intensity of threat of substitutes in the industry is weak making the industry attractive and profitable.

Threat of New Entrants

The threat of new entrants is influenced by the strength of brands of existing competitors, technology and financial requirements and entry barriers (Porter 1980). Potter indicates that there are issues related to the outward and inward direct investment that firms seek to use to expand or grow into new markets affect entry strategies adopted by these companies. However, on a positive note most governments around the world are attracting investors by providing a range of grant aid and subsidised domestic rates, but the capital and cost of production and manufacturing is quite high. For this reason the intensity of treat of new entrant is weak, which makes the industry competitive ad highly profitable.

Five Forces Model Conclusion

From the case study, it is evident that competitive rivalry in the automobile industry is moderately strong, while the buyers bargaining power is moderately weak. It is also evident that the suppliers bargaining power is moderately strong, while the threat of substitutes is weak. The threat of new entrant is weak considering that the firms in the industry have gained strong market positioning that are hard to compete with and the high investment capital needed. Based on this analysis, is evident that the automobile industry is a feasible market especially for the companies that are already operating in the market.

References

Porter, M. E. (1980) Competitive Strategy. New York: Free Press

Potter, N.S. The Global Automotive Industry: The Turbulence Increases

Five Forces Model Relevant Links

Management Practices Business Strategy

Did you find any useful knowledge relating to Porter’s Five Forces Model in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.