Patterns in Foreign Direct Investment

Patterns in Foreign Direct Investment – One of the greatest phenomena that the era of globalization has witnessed is that of rising Foreign Direct Investment. With technological advancements, end of the cold war and the boom witnessed in the financial services sector, we see firms increasingly looking towards foreign shores to establish their interests and thus boost profitability. Simply put, Foreign Direct Investment is the act of making an investment on part of a company in a business in another country. This paper will discuss the merits and faults of FDI and the role that it plays in the calculus of global business.

There are three forms of foreign direct investment. Firstly, the firm may acquire stocks in a host country’s company or may form an affiliate of sorts. This is a rather complex form of FDI. A simpler form is where the company simply reinvests the profits of the affiliate in the host country. Finally, the third method is where the companies raise capital through stock market in the host country.

In today’s world, a company can transform through an evolutionary process. Ohmae (1990) described the stages of evolution as early internationalization, exporting, production, complete and true globalization. Basically, the firm goes from using agents for export to setting up shop in the host country until the point where the company becomes truly global. In many cases, this process is sped up by the use of FDI, which is a wonderful miracle for the businesses of today.

Why a company may turn to FDI can be explained by a number of motives. Dunning (1993) identifies 4 primary reasons. Firstly, it could be to attain access to resources that may not be available in the home country. Secondly, FDI could be a tool to gain access to untapped markets with massive potential. Usually, alternatives to FDI such as exporting and licensing may face trade barriers or challenges such as monopoly laws, customs restriction and high tariffs. By using FDI, companies can avoid all such issues. A third reason for opting for FDI could be that it allows greater efficiency. The country being invested in may have low-cost labor or raw material or may provide low-cost manufacturing. Finally, FDI may be a tool for acquiring strategic assets. Often, in markets where there is rising monopolistic or oligopolistic behavior, firms can turn towards FDI to protect themselves in such harsh business environments. They may acquire certain assets, build specific capabilities or establish themselves in certain markets by using FDI, all for the simple reason of protecting the business against oligopolies.

It is important to first understand the nature of MNCs and how they integrate. When a company acquires or combines with another company that is producing a similar product which happens to be at the same stage of production as that of the company itself, we call such a company as horizontally integrated MNC. The motivation behind such an integration may be to diversify risk or lower costs. On the other hand, vertically integrated MNCs are such that acquire or merge with a company that is involved in a different stage of production for the same product as that of the company. An example could be that of an oil marketing company acquiring an oil drilling company. An entirely different type of MNC is that called Conglomerate MNC. It occurs when a company acquires or merges with another company that is producing a different product.

Another important distinction to understand is in that of the multiple kinds of investments and the purposes that they serve. Firstly, Brownfield Venture means an investment that is intended to improve the existing capacity or efficiency. In contrast, a Greenfield Venture means an investment that results in the construction of a new establishment or plant in the country where the investment is being made.

Foreign Direct Investment trends are often hard to identify and it is even more difficult to pin down the underlying factors that cause such trends. A recurring theme, however, has been that of the effect that global recessions and financial market meltdowns have on the FDI trends. As is evident from figure 1, FDI understandably fell after the 2008 recession. Slowly, global economies have been getting back on their feet but it is curious to note that FDI inflows to developed economies has generally followed a downward trend.

Developing Countries and Patterns in Foreign Direct Investment

In contrast, the developing economies have seen a rise in FDI, albeit at a slow rate and with many fluctuations. To further argue this point, author argues that “Notably, the high-wage differential between West Europe and Asia has been the most significant factor contributing to the restructuring of US FDI during 1981–2000” and that “Populous countries such as China and India have been further liberalizing their economies and improving infrastructure” (Sethi et al 2003, p.325).

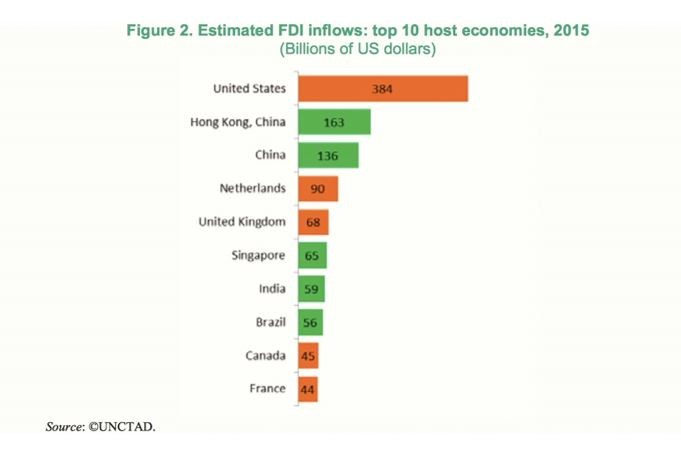

Figure 2 shows data for year 2015 identifying the countries that attracted the greatest FDI inflow. The United States leads it all the way followed by China and Netherlands. While this data confirms the understanding that the US and Western Europe continue to be the recipients of most of the FDI, it must be noted that China, India and Brazil also receive a considerable amount of the FDI which shows the rise of what is called the ‘BRICS’ bloc.

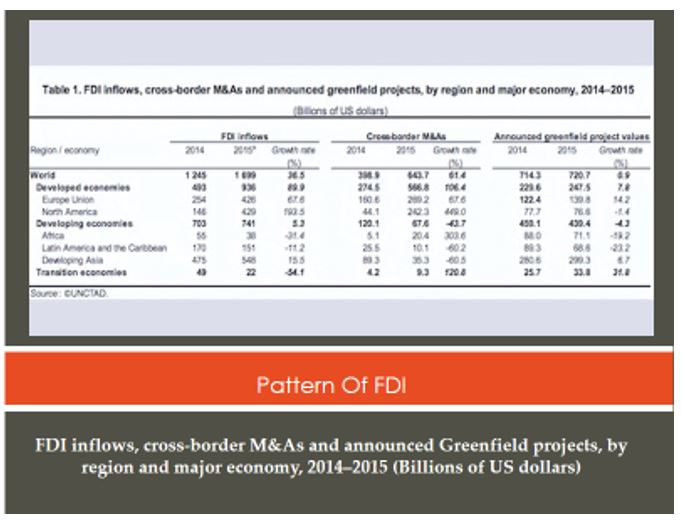

Table 1 identifies huge growth in the FDI inflows for developed countries and developing Asia. Quite curiously, it may be noted that the inflows to Africa and Latina America actually fell.

Following the same trend, Cross-border mergers also grew enormously for developed countries. While on the subject of developing Asia, it will be pertinent to consider the trends in FDI specific to this region, given the fact that it is rising to play an increasingly important role in global economy. The ASEAN Investment Report 2016 notes a number of interesting observations.

It identifies the close relationship between USA and this region in the following words: “South-East Asia is host to the largest number of United States companies in Asia, with over 1,500 companies operating in ASEAN. Some 70 per cent of the 130 United States MNEs listed in the Global Fortune 500 in 2015 are present in the region. United States FDI stock in ASEAN has risen sharply in recent years, from $50 billion in 2000 to $226 billion in 2014”.

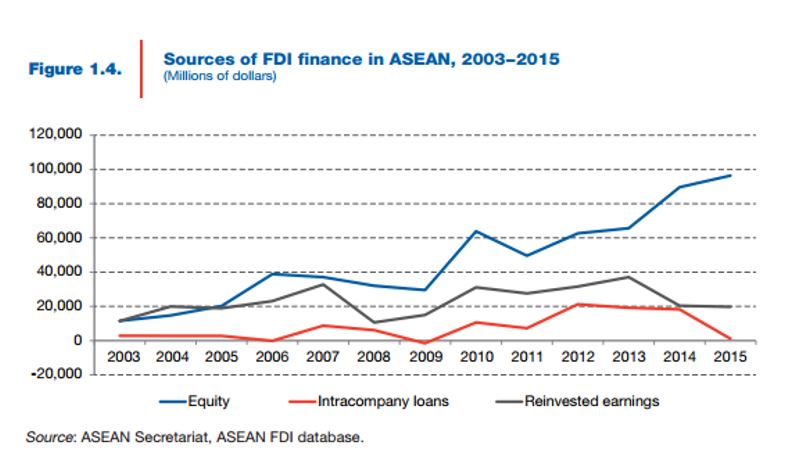

The report also indicated that while FDI flows declined in 2015 as compared to 2014, “FDI in manufacturing rose, equity capital financing of FDI activities was at an all-time high, and regional investment expansion by MNEs remained strong” (The ASEAN Secretariat xiv, 2016). Finally, the form of FDI that was most popular continued to be equity investment as is evident from figure 1.4.

Developing Asia has enormous influence with regards to the inflow of FDI in these economies. A UNCTAD identifies that “developing economies saw their FDI reaching a new high of US$741 billion, 5% higher than in 2014. Developing Asia, with its FDI flows surpassing half a trillion US dollars, remained the largest FDI recipient region in the world, accounting for one third of global FDI flows” (Global Investment Trends Monitor). Having said that, the same report concludes that while FDIs have indeed increased, there is little constructive impact on the global economy because there is little Greenfield investment. Overall, a slowing global economy and fragile geopolitical scenarios are making analysts all over the world issue grim outlook regarding the FDI flows globally.

It is appropriate to discuss the structural variations that have been noted in FDI. Primary and manufacturing sectors have been involved in increasingly lesser FDI flow while the service sector has been on the rise. This has multiple implications because services, unlike manufactured goods, cannot be stored and sold later. This is why we see that service industry firms are increasingly establishing outfits/branches in other countries, often at heavy costs.

The reason why such firms are willing to bear these costs is because globalization offers greater payoff in the long term as getting established in multiple markets allows these firms to attract a greater number of customers. Furthermore, many economies in the world have been moving towards deregulation which has also boosted service trade. A point to be noted here is that the rise of nationalism can certainly hurt FDI as politicians with ‘protectionist’ agenda are voted to power.

To understand FDI patterns, it is also important to consider the several theories regarding this topic. One theory presented by Raymond Vernon suggests that FDI really depends upon the product lifecycle. What this basically means is that there is a period of growth which stimulates production both at home and abroad. Soon, the foreign production becomes competitive which marks the beginning of the maturity stage in the cycle. This competition then seeps into the domestic market thus leading to a decline in sales. This is the product lifecycle theory.

The International Production theory which basically states that a firm considering foreign investment is likely to be swayed by the attractions presented by the home country relative to those provided in the country which is under consideration for investment. A number of economists have presented arguments against this theory citing the relatively recent patterns noted globally. A key argument is that while the theory would suggest that businesses should move to developing countries since they provide a cost advantage, the actual pattern is quite opposite because businesses are moving to developed countries to take benefit from the greater market opportunities in those economies.

Another curious business behavior is explained by the oligopolistic theory. This theory says that when one major firm of an industry moves abroad, its competitors feel obliged to copy the behavior. This may be done with a motivation to prevent the competitor from tapping into an unexplored market. While this doesn’t necessarily explain why a business might move to a developed country, some economists suggest that in a lot of cases, firms are simply copying each other in moving to developed countries.

Internalization theory talks about controlling activities in the intermediate market and bridging the gaps in the various stages of production by moving into new markets. What this means that a company may use its subsidiaries to attain raw materials for its primary concern. It is curious to note that while this theory may hint towards a Greenfield pattern with regards to manufacturing companies, the reality is quite different as such firms have stayed away from investing in developing countries.

Patterns in Foreign Direct Investment Theory

Another interesting theory is the market imperfection theory. What this basically means is that a company’s decision to invest in foreign economies may be motivated by a variety of factors. This includes its competencies and capabilities that are unique to the company and not shared by any of its competitors. There exists great information asymmetry especially with regards to the relationship between exchange rates and its impact on FDI. This can cause variations in the cost of external financing as compared to internal financing.

A very important theory to consider is the OLI eclectic paradigm which was developed by John Dunning. He argued for the benefits of FDI as compared to exporting or licensing. His argument was that if a firm is to involve itself in profitable FDI, it must have 3 advantages: ownership-specific, location-specific and internalization. The first one is self-explanatory; FDI cannot be successful until the firm undertaking it has a competitive advantage in form of a tangible asset e.g., manpower, capital.

It may also have an advantage in intangible assets such as knowledge, access to markets. The second advantage is location-specific which means that the country being invested into must have an advantage as a location such as infrastructure, natural resources, government incentives etc. Finally, internalization is necessary otherwise the firm may as well simply hire a firm in the other country to do the task. Internalization is basically a tool to exploit the market imperfections in price.

While these theories are important to understand, what is even more crucial is the effect FDI can have on the country receiving all the investment. Some of the more obvious benefits include greater employment, tax revenue generation, transfer of technology and other spillover effects. A more subtle effect can be increase of competition which makes markets more efficient thus ultimately helping the consumers.

Disadvantages include the fact that the firms investing in a country are usually large MNCs which have greater market power than local firms engaged in the same industry. Thus, greater FDI could really hurt local business. In some cases, FDI can also adversely affect the balance of payments. This happens when the investing firm imports its capital from abroad. Finally, there is the feeling of the economy being high jacked by powerful MNCs. Many consumer protection groups thus argue that FDI can hurt the local consumer and national interest in the long run.

In conclusion, it may be argued that while FDI has its merit, the current global outlook does not seem too hospitable for such form of investment. While unemployment and terrorism have allowed the rise of nationalist governments in most of the western civilization, it can lead to decreased FDI in the less developed countries. Governments may pressurize companies to invest within the country rather than taking the business to a low-cost country.

This will not only reduce FDI, it will also reduce efficiency and may contribute towards abject poverty and a whole host of other problems for the developing nations. Increasing concerns over China and its overheating economy will also have implications for investors’ investment behavior and it will be curious to watch whether the concerns over China’s alleged credit bubble have any effect on FDI patterns globally.

Works Cited

Sethi, D et al. “Trends and Patterns in Foreign Direct Investment Flows: A Theoretical And Empirical Analysis”. Journal of International Business Studies 34.4 (2003): 315-326. Web. 12 Jan. 2017.

Ohmae, Kenichi, The Borderless World; Power and Strategy in the Global Marketplace, London: Harper Collins, 1990

The ASEAN Secretariat, ASEAN Investment Report 2016 – Foreign Direct Investment and MSME Linkages. ASEAN Secretariat and United Nations Conference on Trade and Development, 2016. Print.

United Nations Conference on Trade and Development, Global Investment Trends Monitor. United Nations Conference on Trade and Development, 2016. Print. No.22.

Relevant Patterns in Foreign Direct Investment Research

Foreign Direct Investment (FDI) In Bulgaria Dissertation

Competitive Dynamics in Emerging Markets: The Case of China’s FDI Inflows

Impact of FDI from Developing Countries to Developed Countries

Where Can I Find Finance Dissertations

Question: What other patterns in foreign direct investment have you encountered that have not been covered in this post? Feel free to leave a comment below