Strategic management

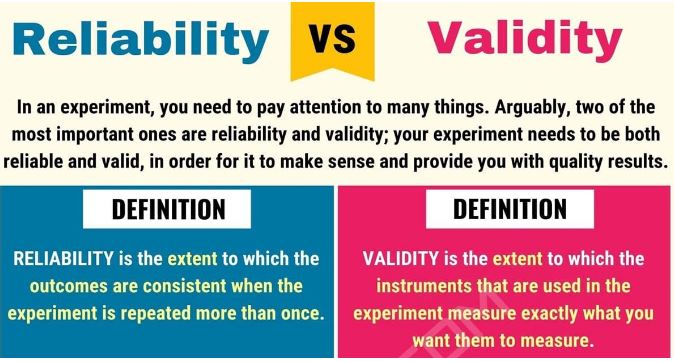

It is true to consider strategic management as an evolutionary and a destination because it plays a significant role in ensuring that a corporation such as Tesla is successive in its endeavors. The success of the firm largely depends on the management that has the key role in making key decisions that will dictate the way forward by facilitating the achievement of organizational mission, goals, and objectives. By definition, strategic management covers all the company’s stakeholders interest by relying on the management to make decisions that safeguard each stakeholder’s interest by considering the available resources, how well they can be utilized and at the same time keep in mind both internal and external forces acting on the firm (Sekhar, 2009).

Among key roles that the management of a corporation is required to play is ensuring that the company chooses the best strategies that will give the company an advantage over its competitors to ensure that maximum profitability is achieved and maintained. Therefore, it is important for a company to be competent by ensuring that products offered are able to meet the customer’s expectations and also balance the needs of other stakeholder’s such as suppliers, the government and employees among others.

Examples of Strategic Management

Recently, there has been rising concern about climate change and the negative impact that the situation has on the environment with regard to environmental pollution which poses a threat to all existing life forms. Among the cause of environmental pollution include emission of greenhouse gases such as carbon dioxide as a result of human activities and depletion of natural resources such as oil. Consequently, Tesla Inc. being a strategic company, Elon Musk who is the company’s CEO has opted for the company to explore alternative renewable energy to ensure that sustainable development is achieved.

One of the ways that the company is practicing strategic management is through environmental preservation by manufacturing electric powered automobiles to get rid of carbon emissions in the atmosphere (Doeden, 2015). The company employs a supply chain management strategy whereby unlike most automobile manufacturers, the company owns that whole supply chain from the points of manufacture to distribution. It also facilitates a growth strategy whereby the corporation invests significantly on Research and Development so that it can be able to come up with new inventions such as the Model X and Model 3. Autonomous cars are among the latest inventions whereby vehicles will not only be able to drive themselves, but also will be powered by electricity instead of gasoline (Bilbeisi & Kesse, 2017).

Tesla Goals and Objectives

Among the companies goals are to have as many electric-powered cars as possible on the road after it launched the first semi-autonomous autopilot system back in 2016. Musk had the objective of having 500,000 cars on the road by this year depending on governments’ efforts to pass laws that will allow consumers to possess and drive the cars. This kind of technology is referred to as “level 4 autonomy.”

Another goal is to put in place the necessary charging infrastructure that will be able to supercharge the vehicles in 30 minutes or so. This will ensure that drivers will be able to add a range of 200 miles in their cars in half an hour. This makes the corporation the only manufacturer to offer drivers such a range in the shortest recharging time. In addition, the company has partnered with Panasonic to provide customers with lithium batteries (Bilbeisi & Kesse, 2017). This will not only ensure that the company cuts back on battery cost but also ensure that the same are available to customers at a reasonable price. To facilitate battery production, the company opened a Gigafactory in Nevada. The batteries are not meant for use by cars only but also supply alternative energy to residences and factories.

Corporate Governance

Traditional Roles of Board of Governors

The success of every business organization relies on the competency of the management which is why the Board of governors plays a significant role in corporations such as Tesla Inc. One of the roles is corporate governance. The board is responsible for overseeing the governance practices and structures to ensure that work ethics are adhered by seeing to it that corporate responsibility is followed to the latter. The board facilitates evaluation by conducting annual assessments which are meant to identify areas that need change or modification so that the firm can be able to improve its performance (Magliacani, 2014). Compliance is another issue of concern especially to companies that deal with emissions such as Tesla Inc. it is the duty of the board to ensure that the company complies with the relevant laws as stipulated in the constitution of the relevant government where the business is located.

Organizations are required to have a compliance and risk framework whose activities are monitored by the Risk and Ethics Officer and the Chief Compliance. These managers are required to report to the CEO and the Board of Governors to ensure that the company does not incur unnecessary costs such as lawsuits. Another role played by the board is strategic oversight. The company’s management is charged with the responsibility of the firm’s strategic planning to ensure that proper planning is facilitated.

As a result of strategic planning, the company is able to come up with strategies that improve performance by maximizing output thus making the organization effective, efficient and profitable. After the management has formulated and proposed new strategies, it is the duty of the board of governors to assess and evaluate the proposal and determine whether it is a viable option or not. Therefore, it is the responsibility of the board to oversee the company’s strategy and ensure that the most effective measures are undertaken in the firm’s activities (Ferlie & Ongaro, 2015).

Major Philanthropic Initiative/Program

Companies have a responsibility of ensuring that the practice corporate responsibility by giving back to society and also ensuring that they promote the growth of their employers apart from making a profit. In the case of Tesla Inc., the American company is involved in designing, manufacturing and selling electric power train parts and electric cars. The company was founded by Elon Musk, Ian Wright, Martin Eberhard, JB Straubel and Marc Tarpenning in 2003. The company realizes that environmental pollution is a major concern accompanied by negative impacts such as the depletion of natural resources.

In its initiative to safeguard mankind from the devastating effects of climate change, the company manufactures electric cars to eliminate the emission of greenhouse gases by automobiles (Doeden, 2015). By so doing, the company will reduce overreliance on oil to provide electricity and offer alternative renewable energy sources. According to Musk, the global population will be able to access electricity through harnessing wind and solar power which can be stored in batteries for later use.

Not only is the use of renewable energy conserve the environment, but it will also be accompanied by increasing the standards of living since people can access luxurious electric cars at affordable prices. The firm adopts a corporate social responsibility strategy that protects the interests of its various stakeholders through the design and nature of its products which are concerned with the ecological benefits of the aforementioned. The corporation has a lot of opportunities that will enable it to contribute to the global community. Its products for generating electricity and storing energy are all environmentally friendly and therefore makes it possible to achieve sustainability and environmental preservation (Blue, 2016). The organization’s management practices and products are designed to integrate corporate citizenship and also boost their brand and corporate image. Consequently, the company manages to balance both profitability and also consider the welfare of the society.

Porter’s Five Forces

Tesla Competitive Advantage and Core Competency

Tesla Inc. stands a good chance of maintaining the leading position in the electric car market segment given that it has a comprehensive leadership headed by competent managers led by the visionary CEO Elon Musk. As a result, the firm has a competitive advantage over its rivals some of which include the battery supply chain (Kauerhof, 2017). The factory in Nevada manufactures lithium batteries thanks to its collaboration with the electronics giant Panasonic. Tesla has included in its processes a supercharge network that will enable electric car owners to charge their automobiles incredibly fast. Unlike its rivals that have slow charging stations that are scattered, Tesla had approximately 3000 stations and intended to increase the number significantly.

Due to the numerous stations, the company has managed to build its customized supercharger network (Grant, 2016). In addition, the company has a software and electronics culture that ensures it keeps up with technological advancement which takes place on a daily basis. The company employs software that outperforms its competitors and ensures enhanced customer service and therefore customer experience. Among the software used by Tesla include Mobile App, Traction and Stability Control, Motor Control, Battery Voltage Management, and Core focus and Tesla DNA. Another boosting factor is that all these software are updated over the air.

Five Forces Including the Sixth Force

Like all other firms, Tesla is not immune to Porter’s five forces which means that its performance is affected by both internal and external factors. These forces can be categorized into two groups namely that which is beneficial (opportunities) and the other which might have negative implications (threats). The company is affected by the bargaining power of customers and through its cheaper electric cars compared to its rival companies, the firm stands a chance of commanding market presence. Furthermore, customers prefer energy efficiency since it saves their money and also there has been increasing awareness in the global arena on the negative impact of environmental pollution.

Although the company has rivals, the threat of new entrants is not a major concern since entering into the disruptive technology is an expensive venture and therefore most companies lack the required capital (Krippendorff, 2011). On the other hand, there are negative forces such as the bargaining power of suppliers. Most parts required by the company are manufactured by a few specific suppliers who are in a position to determine the prices according to what is in their best interest. Tesla faces competition from rival firms that manufacture cheaper combustion engines that are also efficient. Also, the companies can innovatively produce hybrids and low-end electric cars and parts.

Diesel engines are also a threat to the company since they are cheaper while some are capable of using hydrogen which is environmentally friendly. Another factor that threatens the existence of the firm is rivalry whereby the company competes with large firms that have already established good relations with suppliers. In addition, competitors also produce brands that are internationally recognized. According to Wheelen and Hunger, there exists a sixth Porter’s force which they call complementary and it involves other companies that compete with a firm by producing products that are complementary to the one being offered by the firm in question. Considering this aspect, it may not be always necessary for Tesla customers to recharge their vehicles only at the company’s outlet. They have the option of going to other recharging stations to charge their cars although they may not necessarily provide fast charge.

Blue Ocean Metaphor

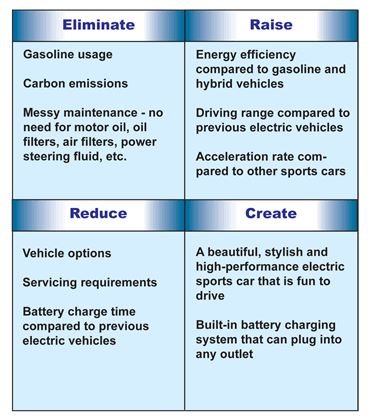

To make the company relevant and successful at the same time, the company incorporates four elements in its strategy to increase its value innovation potential. These elements are illustrated in the figure below.

Value Chain

Tesla’s Business Model

Tesla has used creativity and innovation to ensure that it provides consumers with an alternative renewable energy source thus making its business model different from other companies. To begin with, the company has a comprehensive supply chain management whereby it has reduced the number of middlemen by owning the whole chain from manufacturing to distribution. This supply chain has enabled Tesla to reduce the costs of doing business significantly.

A reduction in product costs and manufacturing costs has ensured that the company is able to achieve sustainability. In addition, the company has digitized its supply chain by using the latest software to ensure that its products are up to date (O’Marah, 2016). Tesla’s vehicles are a hybrid of both digital and mechanical technologies which enables the firm to ensure that it has products that offer customer satisfaction. To expand its supply chain and add value, Tesla has put in place supercharger stations in different parts of America and intends to put more in other countries once the relevant governments enforce regulations that will allow the use of electric cars and also have the necessary technology compatible with the automobiles’ (Adam, 2016).

Tesla Inc.’s supply chain ensures that the company maximizes its profitability through cost reduction and eventually keep minimal inventory. In its production process, the company has an order-production strategy that enables customers to wait for their car to be produced and therefore it is possible to customize the automobiles according to their preferences. Furthermore, order-production avoids storage of excess inventory and therefore risk associated with inventory can be mitigated. Considering the growth, inventory and supply chain management strategies, Tesla’s business model can be said to be unconventional.

Areas That Need Improvement and the Profit Margin/Goal

When Tesla was venturing into the electric cars market segment, the company had anticipated producing 55,000 units in 2015 but was faced by challenges especially since the company had projected that it would stock sales worth $500 million but this was not so and the management had to adjust the value to $640 million. The reason for the necessity of the change was a decrease in cash reserve accompanied by increased feasibility costs (Crawford, 2016). The company had also opted to invest in assembly robots to reduce the overall production cost and the robots incurred additional costs exceeding the anticipated value. As a result, the robots required reprogramming and therefore the company was forced to delay the anticipated time to complete installation and setting up the production plant (Young, 2015).

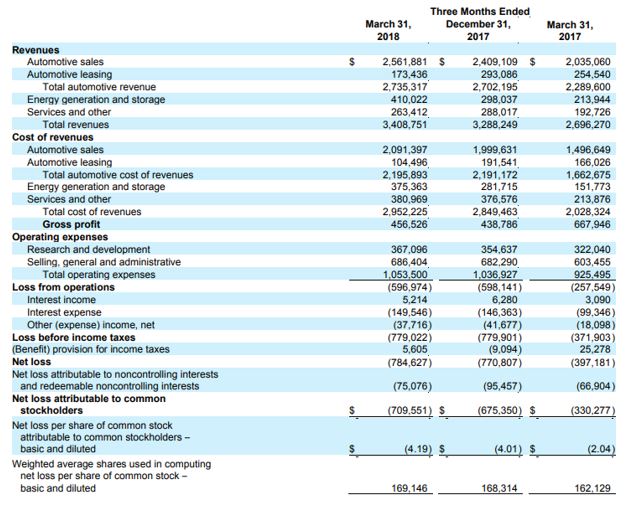

The increased usage of assembly robots leads to a reduction in the number of human workers required since the option is perceived to be more economical. Consequently, job opportunities become less which means that the company hires fewer people than it would if it relied more on human labor. Therefore, the company needs to find ways of ensuring that it provides more job opportunities for the sake of corporate responsibility. According to a report released by Tesla, the company recorded an increase in production of Model 3 with the number of units reaching 2,270 on a weekly basis. In the first quarter, the gross margin for the Auto GAAP went up by 80 bp and also the non-GAAP rose by 500 bp. At the end of the first quarter, the cash balance was $2.7 billion and the amount was expected to rise in the following third and fourth quarter. The company’s financial position is indicated in the figure below.

Central Pillars Of Elon Musk’s Corporate Theory And Tesla’s Unique Assets And Activities

The key to the success of Tesla is the company’s CEO and co-founder Elon Musk. Elon is known to be a person who makes decisions based on values. Often than not he disagrees with others but always has reasonable explanations as to why he does not concur with the ideas he disputes. He is also known to be respectful as he allows others to be themselves and values everybody to the extent of interacting personally with all workers regardless of their status. He has also offered employment opportunities to people who do not have a college education by simply looking at the individual’s interest in engineering and considering whether that person has built anything in their life. He is humane as he deems others as human beings and does not elevate himself to levels that he is unreachable to his junior workers. Elon is of service to others and does not leave others to do everything for him. Instead, he is always active and works long hours to achieve organizational goals and visions.

Elon practices justice as he treats all his followers equally. From the sentiments of his workers, working around Elon is very hard as all of them are expected to work equally hard due to the high expectations that he has not only from himself but also his workers (Northouse, 2013). Elon practices honesty with his workers and is not afraid to speak out his mind regarding organizational matters. Musk’s honestyenables him to win the trust of his fellow investors and even governments as he is predictable and also reliable. He has been known to fund Tesla ‘through financial difficulty with his own money by investing approximately $100 when the company was manufacturing the electronic car (Jacoby, 2011). The company’s unique assets are its management and employees that apply creativity and innovation to design and manufacture remarkable products such as its Sedan, Model X, Model 3, software and its supercharge network among others.

Tesla General Strategy

Current Business and Corporate Strategies

After the release of the first quarter report, the management adjusted its goals and among the corporate strategies is to increase production. The company intends to do this by reducing bottlenecks experienced across lines and the plan is to shut down production for approximately 10 days. However, the company did not change its 25% gross margin target for model 3. Tesla intends to increase Model 3 production to 5,000 units weekly. The corporation plans to advance sustainable energy by increasing its energy storage products up to three times. It intends to achieve this by enhancing its solar power harnessing (Tesla, 2018).

Strengths and Weaknesses of Current Strategies

The major strength of the current corporate strategy is the increased production of Model 3 and one of the reasons is that the model is very energy efficient which means that customers will be exposed to a unique organizational experience. Also, the model will enable the achievement of sustainable development goals while at the same time remaining profitable. The major weakness of the strategy is that the decision is based on a crucial assumption. The performance of Model 3 is assumed which may be affected by external factors such as competing models from rival firms (Tesla, 2018).

Tesla – The Most Urgent Decision Required

Tesla Inc. registered a decline in its solar deployment in the previous quarters which means that the firm had not reached its profit maximization potential. Therefore, the most urgent decision that the company ought to make is maximum tapping of solar power. The main area of concern is the Buffalo Solar Roof facility. As a result, the company should come up with a manufacturing and design process that will increase the quality of electricity and also reduce the cost of manufacturing. Consequently, it will lead to improved customer experience.

References

Adam, M. (2016). Accelerating E-mobility in Germany: A Case for Regulation. Springer.

Bilbeisi, K. M., & Kesse, M. (2017). Tesla: A Successful Entrepreneurship Strategy. B> Quest.

Crawford, A. (2016). Tesla Lowers Production Forecast, Sells US$500m-plus in Stock.

Doeden, M. (2015). SpaceX and Tesla Motors engineer Elon Musk. Minneapolis: Lerner Publications.

Ferlie, E., & Ongaro, E. (2015). Strategic management in public services organizations: Concepts, schools and contemporary issues. Routledge.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

Jacoby, O. (Producer & Director), (2011). Bloomberg Risk Takers: Elon Musk [Television Broadcast]. United States: Bloomberg Television.

Kauerhof, A. (2017). Strategies for Autonomous, Connected and Smart Mobility in the Automotive Industry. A Comparative Analysis of BMW Group and Tesla Motors Inc. GRIN Verlag.

Kim, W. C., & Mauborgne, R. A. (2014). Blue ocean strategy, expanded edition: How to create uncontested market space and make the competition irrelevant. Harvard business review Press.

Krippendorff, K. (2011). Outthink the Competition: How a New Generation of Strategists Sees Options Others Ignore. John Wiley & Sons.

Magliacani, M. (2014). Managing Cultural Heritage: Ecomuseums, Community Governance, Social Accountability. Springer.

Northouse, P.G. (2013). Leadership: Theory and Practice. Los Angeles: Sage Publications.

O’Marah, K. (2016). Tesla and the 21st Century Supply Chain.

Sekhar, G. S. (2009). Business policy and strategic management. IK International Pvt Ltd.

Tesla. (2018). Tesla First Quarter 2018 Update.

Young, A. (2015). Tesla Motors Inc. (TSLA) Says Robots Are Holding Up Its 2015 Sales Growth.

Related Tesla Blog Posts

Strategic Management Dissertations

Tesla Motors Case Study

Did you find any useful knowledge relating to Tesla and strategic management in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.