Strategic Planning Explained

View MBA Projects Here

Title: Strategic Planning – When we travel we usually have a clear destination in mind. We know what mode of transport we want to use, how long it will take to get there, who is travelling with us and what route we are going to take. This is because we have spent a bit of time beforehand planning our trip.

You would not simply turn up at an airport with no luggage or ticket and expect to end up at your ideal destination (although some more adventurous people might argue that is the best way to travel). Instead you would have to waste time with last minute paperwork, have limited options, you may end up going to a less desirable place or even have to go home and start again.

The same can be said of strategic planning a business or organization. If there is no clear plan then the owners or management have no way of knowing what outcome they want to achieve or how to get there. Successful organizations use strategic planning to map out the best way to achieve their desired outcome.

A strategic plan is a document created specifically for an organization and clearly states the core values, mission statement and objectives. It covers the available resources such as staff, supplies and technology and states how these are to be used for the advancement of the overall business. It is a valuable tool that can be used to measure progress at any stage and to determine when all the objectives have been met. Strategic planning is the process used to create a strategic plan.

This post will look at the following points.

- Who uses a strategic plan?

- What are the key elements or features?

- Why use a strategic plan? What are the benefits?

- When to use strategic planning?

- How to use strategic planning effectively?

- What are the potential problems?

Who uses a strategic plan?

These days businesses both large and small use strategic planning. While it is not essential to have a strategic plan in place when starting a business it is certainly advisable. It is important to note at this stage that it is not a business plan. A business plan is generally focused on facts and figures such as budget forecasts, prospective markets, products and the like. Simply put, a business plan outlines the ‘who’ and ‘what’ of an organization. A strategic plan looks at the ‘how’ and ‘why’. It involves the creation and implementation of strategies to shape and guide how all resources are best used.

A plan can be created by a single person, outsourced consultants or by a dedicated committee over a period of time. The larger the organization, the more beneficial it often is to involve a greater cross-section of relevant people. For example a national software development company may choose to include staff from upper and middle management, sales, research and development, marketing, accounts, production and dispatch. The owner of a small chain of bakeries may find it more beneficial to use the experience of a business advisory service either on a once-off or an ongoing basis.

What are the key elements or features?

Strategic planning is a process, not a one-off action. The process involves a series of discussions or meetings between interested parties in which key ideas and concepts such as corporate culture and common goals are brainstormed and analyzed. As with planning a holiday, strategic planning looks at:

- “Where are we now?”

- “Where do we want to go?”

- “Why do we want to go there?”

- “How are we going to get there?”

- “How do we know when we have reached our destination?”

Through this process a document is created that communicates all the values, goals, strategies, procedures and desired outcomes at every level of the organization.

After a series of drafts the plan is laid out in a final document that then becomes a valuable resource for management, employees and anyone else connected to the business. The final format may be unique to the organization or based on one of the numerous templates available. The completed strategic plan is often produced as a printed booklet and also as an online resource.

Why use strategic planning? What are the benefits?

The starting point

The use of a strategic plan benefits an organization in many tangible and intangible ways. The main benefit is in the process itself. The ongoing analysis and reflection through a series of steps allows for organic growth and development. Those with a clear, proactive plan are more likely to achieve an outcome that meets their specific goals and once implementation begins they have a clear pathway to follow.

Many businesses fail within their first few years due to lack of careful strategic planning. If they do manage to keep going, they may find the rate of growth disappointing or they may move from obstacle to obstacle without being able to see way ahead. They may waste a lot of time and money ‘putting out spot fires’ simply reacting to unplanned situations as they arise.

Trailblazing corporations such as Google and Apple not only know where they stand in the world market now, they know where they intend to be in 5, 10 and even 50 years time. Their strategies would be flexible enough to allow for changes in technology and the market conditions.

Shaping the future

To begin with, companies need to establish how they want to be positioned in the marketplace and what themes will form the backbone of their corporate culture. Defining these core ideals will shape the whole nature of the resulting plan.

A very successful company with unique and readily identifiable ideals is The Body Shop. Founded by Dame Anita Roddick in 1976, Anita’s first store was initially set up as an income source for her family but her personal experience and beliefs set the scene for the company culture that followed. She had travelled widely and was interested in the different ways in which women around the world looked after their bodies. Growing up in post war Britain also influenced her thoughts on recycling, giving value for money and on general consumer culture.

“Anita believed that businesses have the power to do good. That’s why the Mission Statement of The Body Shop opened with the overriding commitment, ‘To dedicate our business to the pursuit of social and environmental change.’ The stores and products are used to help communicate human rights and environmental issues”.

More than 35 years later, The Body Shop now has an outstanding global reputation. The ongoing commitment to the original core values such as recycling, sustainability, ethical trade, and community involvement have benefited many thousands of people across the world.

“There is no doubt that The Body Shop and Anita have always been closely identified in the public mind. Such was the inspiration she provided, that The Body Shop has become a global operation with thousands of people working towards common goals and sharing common values. That’s what has given it a campaigning and commercial strength and continued to set it apart from mainstream business”.

Visions, missions and values

One of the key benefits of the strategic planning processes is that it creates an opportunity for an organization to carefully consider why they exist in the first place. “Why are we doing this?”

They can break this concept down further into vision, mission and value statements.

A vision statement portrays the ideal future that the organization would like to achieve. In the case of a not-for-profit group this statement would depict the ideal outcome for the community whereas the vision statement of a corporation would naturally be more focused on growth and profits. In either case, this kind of statement serves to establish the purpose of the organization.

While it may be tempting to write a long, flowery vision statement that would look good on an inspirational poster, it is far better to keep it simple and relevant to the company. The following vision statement for technology giant Samsung is short but very well focused. It clearly shows the desired outcome for both the company and the people it serves.

“Samsung is dedicated to developing innovative technologies and efficient processes that create new markets, enrich people’s lives and continue to make Samsung a digital leader”.

Mission statements relate more to what will be done. It takes the vision a step further and briefly outlines the core approaches that will be used to allow the vision to be fulfilled. McDonald’s needs no introduction as a corporation. They are not only an internationally recognized brand, but they are also an outstanding example of how having a well constructed mission statement impacts on every aspect of the company.

“McDonald’s brand mission is to be our customers’ favourite place and way to eat and drink. Our worldwide operations are aligned around a global strategy called the Plan to Win, which centre on an exceptional customer experience – People, Products, Place, Price and Promotion. We are committed to continuously improving our operations and enhancing our customers’ experience”.

A carefully considered value statement becomes a valuable tool for all employees to refer to as a guide when making complex decisions. While some organizations may not take the time to create this third type of statement, in reality they make value-based judgements constantly. Whenever they have to make a choice to establish what is more important to them that are a value based decision. For example; when deciding what area of the market to focus on, where to base their production or what to include in a staff development program they need to reflect on their core values. If these are clearly stated and easy to access, then that decision becomes much easier to make.

The Coca-Cola Company uses a handful of value statements but they are extremely efficient and effective.

“Our values serve as a compass for our actions and describe how we behave in the world.

- Leadership: The courage to shape a better future

- Collaboration: Leverage collective genius

- Integrity: Be real

- Accountability: If it is to be, it’s up to me

- Passion: Committed in heart and mind

- Diversity: As inclusive as our brands

- Quality: What we do, we do well”.

One thing all of these successful brands have in common is that their branding is uniquely identifiable. They stand out from all their competitors and ensure their market position because they knew their destination from the outset and they have maintained their focus ever since.

On the other hand, businesses that have not given thought to how they can offer a unique experience to their customers run the risk of getting pushed out of the market by more pro-active competitors. They may manage to stay afloat with a steady turnover but it is very unlikely that they will grow significantly in the long term.

Drafting the map

The next step in the strategic planning process is to carefully map out how the company’s goals will be implemented. This stage is beneficial in a number of ways.

The plan helps to define how all the available resources can be used most effectively to achieve these goals. This includes employees, raw materials, production equipment, initial capital and much more. These are no right or wrong answers when it comes to making these types of decisions. Individuals have their own preferences and biases so in order to avoid successive board members or employees making decisions that move away from the original company goals it is vital for them to have clear cut guidelines to follow.

An example of this would be if the organization had a very strong environmental emphasis in its’ value statements, then the person responsible for managing the company car fleet should consider things like fuel types and efficiency, materials used and possibly other more sustainable methods of getting the employees to work. It would be counterproductive for them to order fuel-guzzling SUV vehicles for inner-city travel even though they are generally cheaper than electric or hybrid cars.

Having a strategic plan does not mean that the resulting procedures have to be rigid and mapped out to the last minute detail. Imagine having a travel itinerary so strict that it doesn’t allow for interesting detours or changes in the weather. Having broad guidelines and boundaries enables an organization to respond to changes in both internal and external conditions as they occur.

The Global Financial Crisis unfortunately saw the demise of many organizations across countless industries. Some businesses have products or services that have gone out of fashion or have become more automated. There are many reasons why a business that was doing well suddenly faces an unforeseen roadblock that can cause everything to grind to a resounding halt.

The ones that survive are those who have people who think ‘outside the square’ and come up with new areas to focus their attention. The printing industry used to be very labour intensive with staff needed to set the machines or create the lino cuts by hand. Computers have rapidly changed many of these processes to the point where the majority of printing is now produced digitally.

Modern printing businesses now offer customized products such as books, calendars or posters in small quantities that would not have been feasible with the large manually operated presses. They have found new paths that are still compatible with their original goals even if the goalposts have been shifted slightly. The companies that did not have the desire or flexibility to keep up with the changes in technology have now largely gone out of business.

An intangible benefit of the strategic planning process is the increase in job satisfaction for those involved at every level. Knowing that their contribution is valued and appreciated encourages people to participate more fully and gives them the confidence to put forward new ideas.

This is true not only for businesses but for other organizations such as community groups and local councils. Whenever there is an open and clear communication pathway and people can see that their ideas are well considered they are far more likely to step up and take ownership of their proposals.

To refer back to the values of The Coca-Cola Company above, “If it is to be, it’s up to me”.

“Are we there yet?”

While the strategic planning process is usually ongoing, organizations do need to periodically review if they are still on the right path. Using the previous holiday analogy, imagine that you are in your car with your family, you have all your luggage well packed and are driving along the same highway your parents used to take so you don’t consult the map. Slowly you realise that you don’t recognise the scenery and the signs don’t make sense. You’ve missed a turn off and now face some choices. Continue on the same road and just ‘make do’ when you get somewhere that could be ok to stay? Turn back and keep trying different roads that look as though they might be right? Or do you pull out the map (or consult your GPS), work out where you went wrong and find your way back to the original route?

When organizations start showing signs of losing their path, those that continue anyway will most likely end up in a position they don’t really want to be in. That could be a poorer financial position, they could have missed some great opportunities or they could have drifted away from their original goals and values. The same could be said of those that do attempt to address the problems but not in a cohesive or organized manner.

By having a well focused plan and referring to it regularly an organization can determine when the goals have been achieved and whether the plan has been successful. The desired outcomes can be measured using Key Performance Indicators (KPI’s) and other measures. These could include indicators such as increased profit, more patronage or participation or faster turnover.

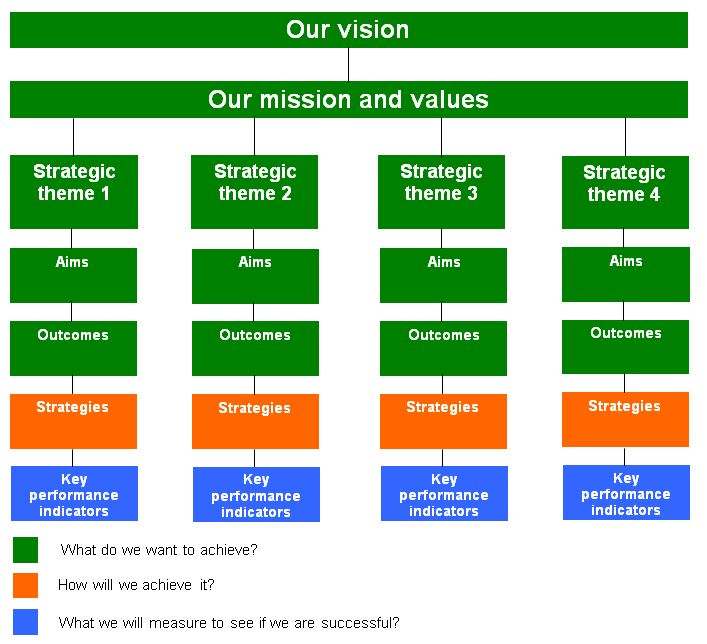

The following flowchart shows how all these planning factors interact.

When to use strategic planning

The nature and size of an organization usually determines how often strategic planning should be carried out. New companies or those in rapidly evolving markets may need more frequent planning reviews than other, more stable organizations.

A brand new company would develop a strategic plan at the same time as their business, marketing and financial plans. The original plan would require more time and effort than subsequent reviews.

More established companies or organizations should review the progress of major strategies quarterly, however most areas could be reviewed annually. They could then do a new strategic plan every 3-4 years. The faster an industry or focus area is changing, the more often the plan should be reviewed or re-done. The key is to keep the plan fresh and relevant to the current situation.

A new plan should be developed at the start of a new venture or development stage. This could include opening additional stores, adding a new department or moving into a new community or market.

Strategies can also be altered when internal feedback shows a definite need. If an aspect of the plan is clearly not working at ground level then the employees or other parties should be able to communicate this to the decision makers. Communication is a two-way process so an effective plan would have provisions in place for receiving feedback and responding to it accordingly.

Most people would be familiar with the classic board game Monopoly. The stages of this game make a good analogy for the stages of strategic planning. At the start of the game (the opening of a new business or venture) the players move in a fixed direction with known resources and pathways. As the game progresses, players have to make decisions about how to use their resources. They may choose to widely invest or to hang onto their capital according to their personal strategy (or lack of one).

Passing ‘Go’ could represent the end of the financial year or the end of a project. At this stage the players (competitors) have changed the status of their finance and assets. Some may have even ‘gone to jail’ or collected bonuses along the way. This is a time to review their initial strategies and to alter them as needed in order to win the game. Regular review and changes to strategy leads to more profits and a stronger enterprise.

How to use a strategic plan effectively

People power

Initiating a strategic plan needs planning in its own right. The key decision makers (business owners, board members, etc) need to decide who to involve in the planning process and how and when it will take place. Ideally they would include people with established skills in areas such as group facilitation, meeting management and conflict resolution. These people may already be part of the organization or they may be external consultants or facilitators.

If the right people exist within the organization already it is very beneficial to include them in the planning team as they are more likely to be passionate and focused. It is more meaningful to them and gives them a sense of ownership and belonging.

Inviting people from different departments or with varied experience has many advantages too as it helps them see situations from different perspectives. For example an accounts person may not understand why a higher priced piece of equipment could be more beneficial to the company until an engineer shows them that it generates more units per hour or is safer to operate.

The team members participating in the meetings may vary as each meeting will have a different agenda and desired outcome. If there is uncertainty as to whether to include a specific person in a meeting it is generally best to invite them anyway. They may not have much to say but they could also put forward the best ideas of the day.

Outside knowledge

Hiring a professional planner as a facilitator also has many advantages especially if their experience is related to the industry of the organization. It would be similar to the choice between planning a holiday yourself online and seeking the services of a travel agent.

Of course there will be costs involved but as with any aspect of business, utilizing resources that will ultimately lead to increased profits is always a sound investment

The level of involvement a professional consultant has can vary greatly from several meetings with an individual consultant to a series of meetings over several weeks with a dedicated team. This would be influenced by the size of the organization and the amount of time and capital they have available.

Using an impartial moderator in meetings may help to manage conflicting ideologies and personalities. They are generally trained to consider all points of view with respect and to present them to the group without bias. They can keep the group on track rather than going off on tangents not relevant to the core strategies.

A professional consultant also has the advantage of being able to look at the whole organization objectively and provide a fresh perspective. They should have a strong working knowledge of current industry trends and be able to accurately compare similar organizations.

Getting started

Having the right people sitting around the table does not guarantee a successful planning meeting. They need a purpose and a pre-planned agenda to follow. This is where the vision, mission and value statements come into play. These can either be read aloud, given as handouts or be visible on a large screen or board. They don’t have to be discussed in great detail but they should be available for quick reference. These statements will set the scene for the meeting and provide a focal point whenever a decision on important matters is required.

In the first meeting one of the vital tasks the members need to undertake is a SWOT analysis. This stands for Strengths, Weaknesses, Opportunities and Threats and it is used worldwide as a key tool in assessing the current status of any given group or organization.

SWOT Analysis

Strengths

Quality staff

Positive corporate culture

Strong market position

Unique products

Research and development

Weaknesses

Lack of training

Supply Chain gaps

Poor cash flow

Not enough staff

Outdated systems

Opportunities

Niche markets

New technology

Competitors weaknesses

Change in tactics

Production capabilities

Threats

Sustainable finance

Location issues

Government policies

Loss of key contracts

Economic conditions

The first two components, Strengths and Weaknesses, assess the internal aspects of the organization. Planning team members use a variety of discussion techniques such as brainstorming to produce a list of what they perceive to be the major factors in each of these two categories. Some factors may be immediately apparent but others may not come to light until the discussion process starts. This is especially true of weaknesses as people can be uncomfortable with talking about any flaws and may take them personally.

For example the sales team might have doubled their new customer list but deadlines for outgoing orders may have been missed due to insufficient stock being supplied.

Data showing the external factors that influence the direction of the organization can be sourced from various reports, economic trends, patterns and customer feedback. This data is often collected by internal staff but professional planning consultants can also provide valuable information on the status of the industry.

A SWOT analysis brings together all the components that make up the picture of what is currently happening in the organization. What it doesn’t do is make recommendations on how to act on that information. That step comes later in the planning process.

Setting priorities and themes

Before moving on to strategy development, the planning team needs to review all the information gathered through the SWOT analysis and decide which areas need the most urgent attention.

Collecting the data can be a major time consuming exercise in itself. It would generally include reports on areas such as sales history and forecasts, industry trends, research and development and customer feedback. This information would need to be gathered and collated well before the planning meetings start. It may take the form of spreadsheets and charts, surveys and reports.

These days that process can be made faster and more efficient through the use of compatible or fully integrated database, accounting, sales and workflow applications. Automated data collecting applications are readily available and could save lots of time and money.

Deciding priorities can be a challenging exercise as it is influenced by personal opinion. A useful approach can be to ask team members to prioritise the lists generated in the SWOT analysis individually and then poll the top responses. Some weaknesses may call for urgent action before anything else can take place such as the purchase of new applications to manage the incoming data.

The planning team also need to refer back to the original vision, mission and value statements and break these down further into several key areas or themes. The factors listed in each section of the SWOT analysis can be grouped under these themes.

Strategic themes form the link between the organization’s vision and the actions required to achieve them. The themes can be used to develop a strategic framework by forming the pillars or pathways. Each theme can be given its own set of aims and desired outcomes as shown in the previous strategic planning flowchart. Examples of strategic themes could include:

- Organizational outcomes

- Customer outcomes

- Working together

- Capable and engaged people

- Embracing change

It is important not to have too many themes on the table at the same time. Generally two to five themes are manageable. Undertaking more can create too much pressure for the team and not allow each theme to be tackled thoroughly. Less urgent themes can be handled in future strategic plans.

Action time

This stage of the planning process creates the guidelines for implementation within each strategic theme. It maps out the steps that need to be taken, who will be required to take those steps and how their progress will be measured.

For example, the theme of ‘Embracing change’ might cover the acquisition of new equipment and the hiring or training of staff to operate it. The steps involved would need to include the selection of a person to manage the entire process with a team to support them. They would need to research types of suitable equipment, how many operators would be required, what training they would need and then create budget forecasts for the accounts department.

The strategies generated though this process should be measurable and have a reasonable due date for completion. Using a variety of Key Performance Indicators (KPI’s) at this point is a way of measuring and evaluating if the strategy aim has been successfully achieved. KPI’s could include:

- The purchase of new equipment within budget and before the due date

- Satisfaction ratings given by customers at the conclusion of a sale

- Having all the required staff trained within a set timeframe

Mission accomplished

The final strategic plan does not need to be a huge document but it should be clearly communicated throughout the organization and be readily accessible (not locked on one computer or sitting on a lonely shelf). Everyone involved should be aware of their individual responsibilities and the strategies they need to use to achieve the desired results.

There is never an end to the strategic planning process. Once the goals of the initial themes have been reached they should be reviewed periodically and new plans put in place as required. An organization that regularly reviews its strategies and takes action on them is one that will ultimately be very successful.

What are the potential problems?

Ideas vs strategies

If the leaders and the planning team are not clear on the difference between the abstract visions or goals and the concrete strategies required to achieve them then they run the risk of creating a plan with no real substance. They could create a lovely looking document with poetic vision, mission and value statements but without clear cut strategies to achieve them the goals will always remain floating somewhere just out of reach.

Ignoring the finished product

For a strategic plan to be an effective tool then it needs to be utilized and updated constantly. Why spend all that time, money and effort creating the plan and then not use it?

The people and their roles

Selecting or hiring the wrong people to develop the plan is a real gamble. Leaders may like the power that comes with their role but they may not be effective communicators or delegators.

Leaders must be willing to make the tough decisions and follow them through. They must always be conscious of the organizations’ goals and adhere to them at all times in order to keep them on track.

If responsibility is delegated then it must be followed though. There is no point in assigning a key task to someone and then not checking on their progress. This could potentially cause major gaps in the whole process and make it less likely to succeed.

Other members of the planning team may lack the commitment or motivation to participate fully. For example they may feel their ideas are not seen as being valid or they may not have a clear understanding of what the organization is trying to achieve.

Ideally the team should consist of the same core group of people for as long as possible or as new people are introduced, some of the original members should still be involved. This not only ensures a sense of continuity but those involved will retain a sense of ownership of their tasks.

Too much, too often

Planning too frequently uses up valuable time and resources. It can take many days or weeks out of the teams’ regular work times which can be very disruptive. The resulting stress could become a deterrent for them to be involved in future planning activities.

Too little, too late

Not scheduling planning sessions frequently enough could mean that opportunities are missed or that people are drifting away from the desired pathway. Getting the timing right allows planners to respond to changes in the internal or external environment with relative ease. It also means that if some individuals or groups are not on track they can be guided back to the path without losing too much time or money.

Ignoring the signs

Not being aware of potential roadblocks or economic fluctuations could stop planners in their tracks. They need contingency plans so that when the first signs of a problem appear they can take appropriate action. Avoiding these potential problems through proper planning and forethought gives an organization a much greater chance of achieving success.

Summary

Strategic planning helps organizations to clarify and understand their philosophical goals and gives them the tools to develop these goals into clearly defined business strategies.

By having targeted approach to planning an organization creates the opportunity to increase market share and profits.

When run properly it gives all those involved in the planning process a sense of belonging and purpose. It is important to remember though that a system is only ever as good as the people who use it. Plan ahead and plan well and everybody benefits.