Porter’s National Diamond Analysis and Strategy – A Must Read For Business Management Students

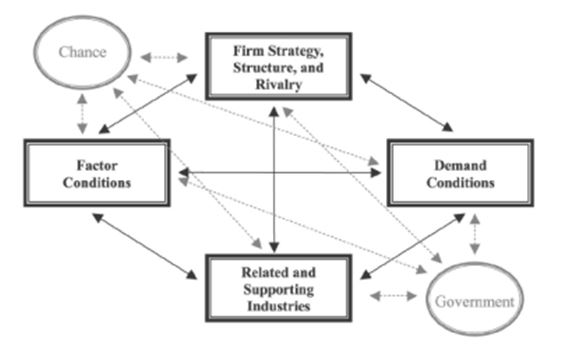

Title: Porter’s National Diamond Analysis. Porter has undeniably enhanced understanding of competitive advantage with his published studies in The Competitive Advantage of Nations (1990) and On Competition (1998), among others. His analytical framework, called the ‘diamond’ captures the major determinates of competitive advantage of international business (Porter, 1990). Influencing the major determinates are chance and government.

Although Porter has focused his studies on developing or newly developed nations, the principles may be applied to developing nations, as demonstrated by Ainslie et al (2005). The core question was whether the principles would apply to lesser developed countries such as the island nations in the South Africa and particularly South African food retail industry. In this study we will discuss the Porter’s National Diamond analysis (PND), two key management issues and the market entry strategy in the selected county South African business environment to draw a clear conclusion and future recommendations to the top management of the food retail industry.

In this study Porter’s diamond analysis will discuss, which attempts to identify the sources of international competitive advantage, may be applied to lesser developed island nations of the South Africa. Porter (1990, 675) stated that the Porter’s National Diamond framework may be applied to lesser developed countries (LDC) where they tend to have a competitive advantage in industries. In these countries like South Africa, the basic advantage factors are cheap labour, abundant natural resources, and location advantages which increase their ability for export businesses.

Exports are sensitive to world market prices, leaving LDCs exposed to exchange rate and resource cost swings. This problem is intensified when an LDC faces the protectionist policies of the developed nations. Developed nations place trade restrictions on most of what an LDC does well: textiles and agriculture. By lifting tariff and non-tariff barriers on these sectors through the implementation of regional and multilateral trade agreements lesser developed countries may have the opportunity to develop competitive advantages in certain industries (Ezeala-Harrison 2005).

Porter (1990) has rendered a major service to the global community in identifying many of the explanatory variables of competitive advantage, which has shaped a new assumption to understand why a country’s success, but in some other industries. His analytical framework, known as the “diamond”, shoots the main determinant factors of competitive advantage. This framework includes demand conditions, factor conditions, support and related industries, corporate strategy, structure, and competition. Through a review of literature, the competitive advantage on production was evaluated by investigating the existence of clusters using Porter’s National Diamond theory.

Developing Porter’s National Diamond Framework

Porter (1990) found the answer to why a nation achieves achievement in a specific industry in the course of four broad characteristics a nation possesses. These attributes shape the home business setting by which domestic firms participate to support or obstruct the establishment of competitive advantage. The four broad attributes, or what Porter defined as the determinants of nation advantage, include: demand conditions, factor conditions, support and related industries, company strategy, firm structure, and industry rivalry.

The four determinants work both as a system and individually to create the environment in which a South Africa’s food retail firms are created and compete to gain and sustain competitive advantage. Besides the four attributes of nation advantage, Porter (1990) incorporated the functions performed by the state and probability as issues affecting the proper functioning of the nation attributes.

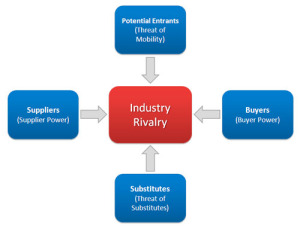

The complete framework developed by Porter was presented in Figure 1. Porter termed the framework the diamond due to the obvious shape of the four determinants that it is a vibrant arrangement in which all fundamentals interrelate and strengthen every other factor. These systemic surroundings make it difficult to imitate the precise arrangement of the business in a different country. In view of the fact that the diamond is a jointly strengthening scheme, the effect of single determinant is dependent on the condition of the other determinants.

Aiginger (2006) explained that having one favourable determinant in an industry it will not lead to a competitive advantage unless other determinants can be created to respond. Advantages in one determinant may create or have a positive effect on other determinants. Nations are most likely to succeed in an industry where the determinants or the diamond is the most positive. To gain a complete understanding of the functionality of the diamond, each determinant was examined, as well as the factors influencing the determinants and the functioning of the diamond as a system.

Porter’s Diamond Framework

Source: Wall et al (2008)

Factor conditions: Economists have termed the resources or inputs necessary to produce a product or service as factors of production, which include land, labour, capital, infrastructure, and natural resources. Porter (1990) divided factors of production into two basic distinctions, “the first involved basic and advance factors, where basic factors include natural resources, weather, position, skilled and semi-skilled labour, and capital of debt (p. 89). Porter (1990) examined that advance factors, including contemporary digital data communication infrastructure, such as a university graduate engineers and computer scientists with high academic qualifications, a complex subject and university research institutions (p. 77).

South African food retail is endowed with basic factors or they require very little investment to create. These factors tend to be insignificant to the African national competitive advantage or they prove to be unsustainable. Advanced and sophisticated features are more important for company’s economic benefits in that they are scarcer due to their creation demanding huge and continued investments in human and physical capital.

While advanced factors are often built upon basic factors, innovation requires advanced factors that are imperative to the design and creation of products and processes. The second distinction among factors of production is developed on specificity, which Porter broke down into generalized and specialized factors. Factors such as the thoroughfare system, the supply of debt capital, motivated employees with college education or pool are also included in generalized factors. These factors can be utilized in many different industries. Specialized factors occupy barely skilled workers, road and rail network with precise assets, and information basis in meticulous areas (Porter, 1990, p. 78).

Demand conditions. Porter (1990) asserted three significant characteristics of requirements, composition, the dimension and prototype of growth, and the internationalization of home demand, where the latter two are dependent upon composition of home demand. The composition of home demand dictates “how firms perceive, interpret, and respond to buyer needs” (Porter, p. 86). Home demand has important influence on economic benefit, more so than international demand as its proximity, both physical and cultural, makes it easier and quicker to monitor and recognize the buyer’s immediate needs and preferences.

The composition and quality of the domestic demand, relates to a certain extent than amount influential on competitive advantage. More complex and demanding buyers, the greater the pressure, product quality, features and services of local businesses, as well as enterprises able to anticipate the needs of the buyer, in order to meet the high standard terms and conditions. The scale and pattern of growth in domestic demand, with the ingredients, can strengthen its competitive advantage – outlined in Porter’s National Diamond.

Porter (1990) believes that several features of this property include: (a) the size of the domestic demand, it is able to take advantage of economies of scale, and (B) of the independent buyer “stimulus entry and speculation in the business reduce the apparent risk market enterprises will be shut down and limit the bargaining power of the dominant buyer, all profits (94), (c) the growth rate of domestic demand, which will lead to greater investment and technological growth, (d) anticipating buyers needs earlier than foreign rivals, and (e) saturation of the home market to create strong pressures to thrust along prices, bring in new description, develop merchandise presentation, and supply other inducements for buyers to reinstate new versions of old products.

This can happen when African domestic consumers are mobile and travel to other nations to demand the products from their home market, or when home consumers are multinational corporations with operations in other nations. Another mechanism of internationalization is “when domestic needs and desires get transmitted to or inculcated in foreign buyers” (Porter, p. 98). This can occur when foreign travellers use the domestic products or services and take the demand home.

Related and supporting industries

The presence of supplier industries and other related industries in a nation is an important determinant of creation and sustainability of competitive advantage. Porter (1998) stated that internationally competitive domestic suppliers create advantages in other industries in several ways. The competitive related and supporting industries can share common technologies, inputs, distribution channels, skills, customers, and even complementary products, to foster technological spillovers and exchange of information that can spur innovation and upgrading, and ultimately lead to competitive advantage.

According to Ketels (2006), the distribution of business knowledge would to spread between the business companies, human resources because they can be shared educational and research organisations. When internationally successful related industries are present in a nation, they can create demand for a complementary product. Porter referred to this as a “pull through effect” (1990, p. 106).

These complementary products provided by firms in the same nation may be more cost effective since the firms are used to dealing with their own rather than foreign firms. Lastly, firms from related industries may feel threatened by new firms wishing to enter the industry putting pressure on existing firms to improve their own competitive advantage.

Firm strategy, structure, and rivalry

Porter’s fourth determinant of competitive advantage included the strategies and structures in which organisations are created, planned and managed, in addition the environment of home rivalry (1990). Porter insisted that the objectives, planning, and methods of organising industries differ extensively between nations, but distinct patterns emerge within nations. The argument was made that a good fit should exist between an industry’s sources of competitive advantage and its structure, and the strategies, structures, and practices favoured by the national environment.

Government and chance

As shown in Figure 1, the government and chance are added to the diamond to complete the system. They are not determinants of national competitive advantage, but do play a vital role in influencing the four determinants. The government can influence and be influenced by each of the determinants, both positively and negatively, which is represented by the arrows pointing both ways (Porter, 1990). Each of the determinants is affected in different manners. The Government’s education policies and subsidies also affect factors conditions. Set of standards and regulations will affect demand conditions and related supporting industries.

A firm’s strategy, structure, and rivalry can be affected by the government’s involvement in capital market regulations, tax policies, and antitrust laws. Porter (1990) viewed the appropriate role of government as one of reinforcing the determinants of national advantage instead of attempting to create the advantage itself. The role of government is viewed differently as nation’s progress through successive stages of competitive development. During the early stages of development, especially relevant for developing nations, the government has the greatest direct influence on national advantage. Factor creation is a vital role for the government at this stage to encourage savings, accumulation of capital, and develop infrastructure and technology.

As a nation develops, the government must shift to an indirect role, always aware of its influence on the diamond. The tools used in the early stages of development now become counterproductive, so the government’s role is to create an environment where firms are the innovators, and the government is the “facilitator, signaller, and prodder” (Porter, p. 672).

Chance, also lying outside of Porter’s National Diamond, plays an important role in influencing competitive advantage. Some illustrations of chance events include development and innovation, oil shocks, major changes in world financial markets, and wars. Chance events may alter the diamond by creating forces that reshape an industry’s structure and allow for discontinuities that shift an industries competitive advantage.

Contemporary Management Issues

When we start talking about management issues within the South African food retail industry, there are some very basic internal as well as issues which are increasing the impacts of management at internal level. There are a large number of contemporary issues in South African food retail industry; however, here we will discuss the flowing two among them.

Crisis Management as an Internal Issue

Crisis process is a threat for the current situation and future of a business, it is very clear that administrative and organisational structure will require a significant change. During the crises, organisational stress reaches the top level. On the one hand try to find suitable solutions to resolve the crisis, on the other hand, the tension created by uncertainty and running time pressures negatively influence the management structure of enterprises.

Business managers have to try minimizing damages with precaution actions. To do this the first way is to make a series of organisational and administrative structure changes. Crisis requires rapid reactions, for this reason business structure is developed to provide quick decision. Standard decision-making methods are insufficient to resolve the crisis; these force managers for new decision-making methods. The important thing is to adapt personally to new environment (Basuroye t al 2003)

For this adoption instead of keeping current values South African food retail industry has to accept new values. Accurate collection of information, communication, which cannot be easily settled up well, and psycho-social status of employees are changing the organisations atmosphere. The atmosphere which is changed will effect significantly communication, motivation, organisational justice and moral, such as organisational trust and organisational citizenship (Stone & Ranchhod 2006).

Another issue which may increase the negative effects of crisis is an absence of proper plan for dealing with crisis, which has to include customers, competitors, vendors, partners, and credit agencies, various internal and external environmental factors. South African food retail industry must have crisis plan, in case they can face the reduction of mobility and flexibility.

Change in income of Company

There are also some external issues besides the internal issues. Biggest external issue is change in income of company and rapid price changes. The increase in costs will automatically come with preventions such as: reduce the number of employees, reduce the social benefits for employees and loading more work to the existing workers. New law and regulations can also increase effects of it. The new taxes, increasing social security contributions, to collapse of the credit facilities, the new customs legislation can also affect business dramatically (Boatwright et al 2007).

When Business managers or owners fail to follow international business changes and when they cannot keep pace with global developments or the country’s economic situation, it can increase negative impacts. If managers of South African food retail industry would not establish an early warning system by making the internal and external business environment analysis, they can face it as an another issue in their industry (Siggel 2006).

Market Entry Strategy using Porter’s National Diamond Strategy

A sound international market entry strategy is becoming gradually more important to the success of new products. The time interval between the launch of the two important issues of related to international market entry strategy are undeveloped international launch window of time (the focus of the country’s national launch of the product) and the sequence.

An important decision relating to international market entry strategy is the decision on the timing of entry into international markets. Two international entry timing strategies are commonly practiced (Chandrasekaran, Deepa, and Gerard, 2008). A waterfall or sequential release strategy is one in which the new product enters multiple countries sequentially. A sprinkler or simultaneous strategy, in contrast, involves almost simultaneous entry into multiple countries- Porter’s National Diamond.

Duan, Bin and Andrew (2008) use a competitive game theory framework to examine simultaneous and sequential strategies and show that sequential entry strategy is appropriate if (1) the product has a very long life cycle, (2) the foreign market is small, not innovative, and characterized by a slow growth rate, and (3) competitors in the foreign market are week.

However, empirical evidence for the success of each of these strategies is mixed. For example, Chandrasekaran, Deepa, and Gerard (2008) find that the takeoff of a new product category in one country increases the probability of takeoffs in other countries, suggesting a sequential release strategy is preferable to a simultaneous release strategy. Duan, Bin and Andrew, (2008) examine international market entry strategies in terms of market scope and the speed of rollout. They find that late mover brands that sequentially enter many large international markets show greater marketing spending efficacy through marketing spillover effect.

Foreign market entry is one of the most important strategic decisions for firms. Managers should consider cross-country spillover effect when they decide country sequence. Firms can increase overall performance in foreign countries, so enhance return on investment by taking advantage of these spillover effects. A firm should launch its products first into countries that are culturally closer to its home country and countries that are more open. Managers also need to consider factors such as potential adopters’ familiarity with the new product and cultural fit of the product with the country when deciding the order of country in the international launch sequence. They need to carefully consider the determinants of country sequence because they affect product performance in foreign countries (World Economic Forum, 2008).

Conclusion of Porter’s National Diamond

To conclude we can say that international business strategy is critical to the success of some products in several industries. Departing from Porter’s approach allowed focusing on the possible affects the regional trade agreement had on clustering. Porter’s (1990) viewing of international competitiveness of industries through the diamond framework seems to hold for the lesser developed nations like South African nations.

References

Aiginger, K. 2006. ‘Competitiveness: from a dangerous obsession to a welfare creating ability with positive externalities’, Journal of Industrial Trade and Competition, 6: 63–66.

Ainslie, A., Xavier D., and Fred Z., (2005), Modeling Movie Lifecycles and Market Share, Marketing Science, 24 (3), 508–517.

Basuroy, S., Chatterjee S., and S. Abraham R., (2003), How Critical Are Critical Reviews? The Box-Office Effects of Film Critics, Star Power, and Budgets, Journal of Marketing, 67 (4), 103–117.

Boatwright, P., Suman B., and Wagner K., (2007), Reviewing the Reviewers: The Impact of Individual Film Critics on Box-Office Performance, Quantitative Marketing and Economics 5 (4), 401–425.

Chandrasekaran, D., and Gerard J. T., (2008), Global Takeoff of New Products: Culture, Wealth or Vanishing Differences? Marketing Science, 27 (5), 844-860.

Duan, W., Bin Gu, and Andrew B. W., (2008), ―The Dynamics of Online Word-of-Mouth and Product Sales: An Empirical Investigation of the Movie Industry, “Journal of Retailing, 84 (2), 233-242.

Ezeala-Harrison, F. 2005. On the competing notions of international competitiveness’, Advances in Competitiveness Research, 13(1): 80.

Ketels, C.H.M. 2006. Michael Porter’s competitiveness framework: Porter’s National Diamond recent learnings and new research priorities, Journal of Industrial Trade and Competition, 6: 63–66.

Porter, M. E. (1992, June). The competitive advantage of European nations: The impact of national culture – A missing element in Porter’s analysis? A note on culture and competitive advantage: Response to van den Bosch and van Prooijen. European Management Journal, 10, 178.

Porter, M. E. (1998). Clusters and the new economics of competition. Harvard Business Review, 76, 77-90.

Porter, M. E. (2003). The economic performance of regions. Regional Studies, 37, 549-578.

Porter, M. E. (1990). The competitive advantage of nations. (Porter’s National Diamond) New York: The Free Press.

Porter, M. E. (1994). Comment on “Interaction between regional and industrial policies: Evidence from four countries,” by Markusen. The World Bank Research Observer, Cary, 303-308. Retrieved June 8, 2004, from ProQuest database.

Porter, M. E. (1998). On competition. Boston: The Harvard Business Review.

Siggel, E. (2006), International competitiveness and comparative advantage: a survey and a proposal for measurement, Journal of Industrial Trade and Competition, 6: 63–66

Stone, H.B.J. & Ranchhod, A. 2006. Competitive advantage of a nation in the global arena: a quantitative advancement to Porter’s diamond applied to the UK, USA and BRIC nations, Strategic Change, 15: 283–294.

R.S. Wall, M.J. Burger and G.A. van der Knaap, (2008), National Competitiveness as a Determinant of the Geography of Global Corporate Networks, GaWC Research Bulletin 285.

World Economic Forum, 2008. Global Competitiveness Report (2006–2007). Geneva: Switzerland.

Relevant Posts

Business Dissertations

Top 10 Business Studies Essays

Did you find any useful knowledge relating to Porter’s National Diamond in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.