Predicting Economic Market Failure and Collapse in The London Housing Market and How It Compares to a Collapse in The Wider UK Housing Market – A VAR Approach

The general objective of this dissertation is to (i) test whether a collapse in the London Housing Market would affect the UK economy and (ii) see if its impact on the economy is more significant than the impact of a UK Housing Market shock. We use a Vector Auto-regressive model (VAR) to analyse how GDP, Inflation and Uncertainty might react to a shock in either the London or the UK Housing Market. To do that, we go through the Impulse Response Function (IRF) which helps us identify the sign, significance and duration of the responses of our variables to a simulated shock in one the Housing Market.

We then go through the Historical Decomposition which calculates the contribution of the housing markets to the different structural accumulated shocks of our variables; and, helps us estimate whether the results found through the IRFs make empirical sense. We expect GDP to fall, Inflation to slow down, and Uncertainty to be negatively affected. We also consider the possibility of a recession being created in the economy, if GDP growth is affected negatively for more than three quarters. Lastly, we suppose that the London Housing Market will have a more significant impact on the economy.

London Housing Market Dissertation Contents

Chapter 1 – Introduction

Chapter 2 – Literature Review

Chapter 3 – Analysis

Objectives

Methodology and Data

Empirical Model and the Data

Identification Strategy

Results

Impulse Response

The London Case

The UK Case

Historical Decomposition

Comparing the London case with the UK case

Sensitivity Analysis

Robustness Analysis

Changing the order

Replacing Uncertainty with other variables

Dividing the sample

Results prior to 1992

Results following 1992

Comparing our two sub-samples results

Critics and limitations of our model

Chapter 4 – Conclusion

Bibliography

Appendix

Relevant Posts

London Housing Market Collapse Dissertation

Economics Dissertation Topics

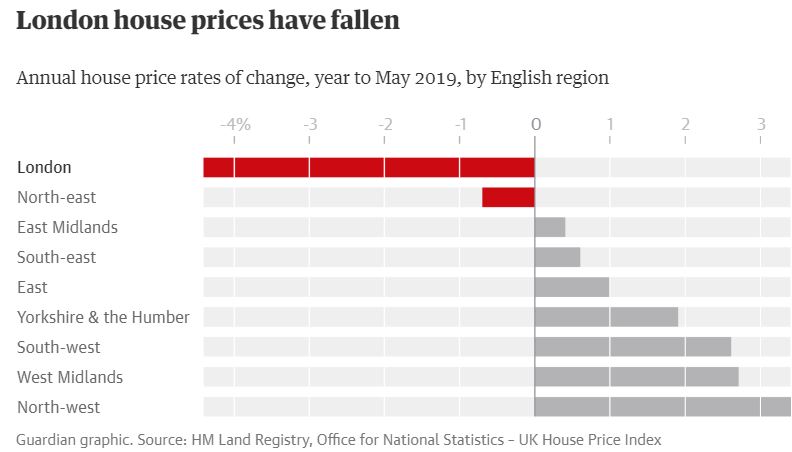

It is the biggest plunge since the 7.0% annual drop recorded in August 2009, says ONS. “House prices in London have fallen at their fastest pace since the financial crash a decade ago as the capital bears the brunt of the nationwide torpor in the property market. Amid a dearth of potential buyers, the cost of a home in London was 4.4% lower in May than a year earlier, according to the latest official snapshot of the market from the Office for National Statistics.

The ONS said it was the biggest drop in London prices since the 7.0% annual fall recorded in August 2009 – a period that included the near-meltdown of the global banking system in the autumn of 2008” (The Guardian, 2019).

If you enjoyed reading this post on economic market failure and collapse in the London housing market and how it compares to a collapse in the wider UK housing market, I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.