Finance Assignment – Various normative theories, measurement issues under IFRS and Conceptual framework

IFRS IASB Frameworks – This report basically provides an analysis of different financial accounting measurement techniques, their advantages and disadvantages and practical implications. Accounting measurement has become a controversial issue due to its assorted nature in financial reporting system. The conceptual framework developed by both systems is unable to provide accurate cost of assets and liabilities at the end of financial year.

There is a misunderstanding behind the rationale that whether measurement is a set of calculation or numbers but it provides no as such vivid explanations and is totally cognitive based. A lot of research work and publications have been made about this topic but the matter is still under consideration. Financial reporting measurement is a debatable issue and still under consideration.

Most of the literature has been published on the issue of historical cost and value accounting. It shows that it is never ending issue. Historical cost measurements narrates that total assets and total liabilities should be recorded and reported at the procured price while current cost accounting states that assets and liabilities should be recorded and reported at existing market value.

Role of IASB & FASB frameworks

International Accounting Standard Board Framework

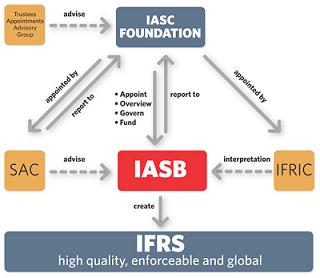

International Financial Reporting Standards (IFRS) are based on the IASB framework developed for the sake of preparation and presentation of financial statement.

Financial Accounting Standard Board Framework

FASB is U.S primary body for the development of accounting standards. It issues new rules so called Statement of Financial Accounting Standards (SFAS) based upon FASB which are basically derived from Generally Accepted Accounting Principles (GAAP).

IASB and FASB frameworks present a facility of persistent and logical formulation of IFRSs and SFAS respectively. Both of these also aim to provide its users with a platform to resolve various complex accounting issues. Hence, framework has the benefit being the status of conceptual base for development of IFRSs.

The IASB issues IFRS to more than hundred countries which also include European Union but it excludes United States. There is a strong co-relation among both IASB and FASB standards. It is probable that U.S will also move to IFRS in 2016. Despite of all this, both IASB and FASB sat together to reach at a final conclusion about this matter but still there is a room for improvement.

Mary E. Barth has concluded that Fair value measurement provides somewhat precise and specific value of both assets and liabilities. The core objective of this report is to determine why other frameworks lack behind. (Mary E. Barth, 2013, pp 2-3)

Comparison of various cost approaches

There are many cost measurement techniques which are used to record assets and liabilities in financial statements; some of these are as follows:

Unmodified historical cost

This type of cost includes those amounts which were paid at the time of procurement of assets no matter whatsoever the life of asset is. It is totally inadequate way of recording measurement.

Modified historical cost

This cost is modified due to various factors like impairments, amortization due to depreciation or appreciation of asset with the passage of time. It seems to be relatively more valid type of measurements.

Fair value measurement

It is a net price which can be received while selling an asset or paying any liability in a logical transaction among market participants at the measurement time frame.

These are frequently used in financial reporting and possess different characteristics. Only one of these techniques is used to record assets and liabilities in common practice so as to draw conclusion based upon performance. Financial statements are comprised of total assets (both current and fixed), total liabilities (both current and long term) and owner’s equity. The framework indicates that equity is the difference between the assets and liabilities after proper measurements. (Mary E. Barth, 2013)

IFRS IASB Frameworks – A Critical Analysis

The aggregation is a qualitative attribute which slightly affects the quantity. Hence, a minor change in assets and liabilities generally affects net income and expense. However, the Framework does not elucidate the factors behind balancing effects on Statement of Financial Position (SOFP) and Comprehensive Income.

Fair value provide more effective results as compared to un modified and modified costs in case of single assets and liabilities as it contains both qualitative and take into account assets and liabilities. Whereas unmodified cost is totally irrelevant and invalid. Modified cost if not supported with accounting standards cannot be explained in a scenario.

Fair value determination is only more reliable and accurate if it is acquired faithfully with an ethical mentality. Still there is an ambiguity whether modified historical cost is more appropriate than fair value determination. Hence we may conclude that fair value and unmodified costs are set according to a specific economic objective while modified is an accounting calculative work.

Despite of all these measurement techniques, only one selected technique should be used for estimation so as to achieve significant accounting results. Anyhow, other technique can be used where direct measurement is impossible for estimation. This approach will be helpful to maintain consistency, comparability and significant aggregation of accounting data. . (Mary E. Barth, 2013, pp 19-20)

IASB recommended approach

IASB also endeavours to find a single measurement technique in its own projects. IASB also favours fair value measurement that it provides more effective results, though it sometimes fails to assess the cost of any asset. Practically, all the framework of accounting regulations except IFRS is not using single approach of measurement.

For instance, measurement of cost to predict operating cash flows will provide major share of turnover in going concern business approach, while fair value would be more appropriate, relevant and reliable for the valuation of marketable securities and investments. However if you use different approaches in each financial year, the descriptive authority of such aggregation would be more poor and risky.

Preliminary and Subsequent measurements

However, measurement approaches can be distinguished according to preliminary and subsequently with respect to nature of the measurement subject matter. For example, in case of going concern business, long term assets meets the pre-requisites while current liquid assets (inventories) and marketable securities are measured differently. However, it all depends upon standard setters that which measurement technique should be selected.

All the regulations of Accounting including IASB, FASB, UK Accounting Standards Board and Australian Standard Boards possess a common thing that financial statements are primarily developed to help its stake holders (external and internal users) so that they may analyze the organization. Investors can depict growth rate, market value and share value (Jiri Strouhal, 2014).

Effects of choosing wrong measurement approach

Determining right choice of measurement is very important for organizations. There are five different approaches like as fair value treatment of costs, historical cost accounting, modified historical cost accounting, current purchasing power accounting, current cost accounting and continuously contemporary accounting. All these techniques have various pros and cons. But fair value treatment of costs is mostly used and reliable approach to recognize costs. Accountant should be prudent while choosing cost approach.

Wrong choice of cost approach may adversely affects the financial statements, shareholders image towards firm’s assets and liabilities. Historical cost accounting deals with recording assets on purchased price which is wrong measurement. If any asset is to be sold, then we need to consider again choose either fair value approach or modified historical cost accounting as a measurement rather than historical cost accounting value. This type of costing is only helpful for long term basis if re-procurement of machine or asset is to be needed.

Current purchasing power accounting measurement shows the impact of inflation on the net value of money. To achieve CPP, firstly historical costs are changed into current prices with the help of consumer price index (CPI). But Price indexes quality includes simply averages and perhaps not matches with expenses incurred by even a single shareholder. It sometimes becomes ridiculous that if re-stated asset values considered everything while the changed amount is neither paid nor is asset value increased. Current cost accounting despite of its importance is not reliable for long term basis. Then we move to historical cost accounting for decision making.

International Accounting Standards

Some of the most important International Accounting Standards have been explained below to elucidate the effect of measurement and reporting accounting on current assets and liabilities.

Fair value measurement (IFRS-13)

Fair value measurements are mostly used and reporting standard. IASB, FASB, AASB lays stress to use this standard but each one provide their own standard guidelines for the determination of fair value. IFRS-13 also tells how preliminary fair value is to be measured and how successive fair value is found.

Fair value: It is an amount which can be gained when an asset is sold or a liability is transferred among market participants in normal transactions at measurement date. Market participant are usually those buyers which have economic and ethical rationale.

Fair values should be gained from principal market as it is pure competitive market and possess large volume of desired nature. If it is unavailable, then accountant should concern from advantageous market. Final fair value must contain location of asset and its condition

Assumptions

- Transaction cost should be ignored

- Transportation cost should be incorporated

- In case of most advantageous market, both transaction and transportation costs should be incorporated

Inventories (IAS-2)

This standard has been developed to assist and provide a valuable accounting treatment for physical inventory which is a current asset. This treats cost of the inventory like an asset which can be easily carry forward unless it is sold. The standard also aimed to provide assistance to recognize and determine the costs along with net realizable value.

Scope

This standard is valid for all inventories excluding:

- It is not valid for construction contracts specially treatment of work in progress

- Financial instruments including marketable securities

- Natural assets or biological assets

Measurement of inventories

Inventories must be recorded at the lesser cost and net realizable value (NRV).

Cost of Inventory

Inventory cost includes cost of purchase, conversion cost (Labour and Production overhead) and the cost freight charges incurred to bring an asset from vendor place to factory.

Cost of purchase

This cost is comprised of purchase price, transportation charges, import duties, taxation other costs incurred to attain asset and trade discount and other discounts are deducted from original cost of purchase.

Cost formulas

Inventory once purchased can be calculated by using first in first method (FIFO) and weighted average cost method while last in first out (LIFO) is not allowed.

Cost of the inventory can be calculated through FIFO and Weighted Average Cost Method. However, LIFO method is not permitted.

Record of reversing (Expense)

Reversal of note down of equivalent inventory might be prepared up to the cost.

Events after reporting period (IAS-10)

IAS-10 tells the treatment for those events which occurs after the financial period. So, adjustments are to be made in financial statements. Management will provide final approval of accounts on 31st Mar, 2014 while final accounts will be forwarded to annual general meeting (AGM) to get approval for shareholders on 30th Apr, 2014. After this, reports will be authorized for issuance.

IAS-10 is appropriate for those events which are took place after the balance sheet date but to the date of authorization by the management i.e. 31st Dec, 2012 to 31st Mar, 2013. Event can be adjusting or non-adjusting.

Adjusting Events

Those events which present supplementary proof of their existence at the financial statement i.e. balance sheet are called adjusting events. Adjusting events are needed to be documented in the financial statements.

Example:

- Errors and inaccuracies in financial statements if discovered after reporting period, their adjustments will be covered in adjusting events.

- If a court case was settled validating the compulsions at the end of financial period.

- If an asset was purchased earlier but cost of purchase confirmed after reporting period.

Non Adjusting Events

Those events which doesn’t support supplementary proof of their existence at the financial statement i.e. balance sheet are called non-adjusting events. Non adjusting events are needed to be disclosed in the notes of financial statements.

Example:

- Declaration of dividends is a non-adjusting event as these are recorded once these are proposed after reporting date.

- Anomalous loss, natural disasters, amalgamation, renovation and acquisitions do not provide supplementary events so these are adjusting events.

Historical Cost Accounting

Historical cost is a sum of price which is paid by firm to acquire an asset for use. It includes all costs incurred to bring the asset for smooth operation. It is an ancient accounting standard which was developed with a rationale that prices are smooth and normal changes occur with a passage of time. Such conservative style of accounting doesn’t make and stipulation for change in purchasing power. There is less manipulation of mangers as it is only recorded at acquisition price every year. Accountants have to meet the expected return of its shareholders and investor despite of the net wealth of the firm. This shows that primarily focus is upon income statement which will be a vivid glance whether firm is working efficiently or not. (Jiri Strouhal, 2014).

Advantages

- Historical cost has a substantive effect on appraisal evaluation and assortment of decision rules.

- If management has to determine which decision would be more useful, it may get help from past performance.

- Historical cost is directly associated with past decision. Past data is helpful to forecast for better decision making. There prime object is to determine what profit did they earn in past not what they can increase.

Disadvantages

Historical cost is inappropriate for decision making as it doesn’t follow stewardship function. Investors have more concern with up and down in their investments return rather stable return.

Modified historical cost

This historical cost is modified by inculcating various factors like impairments, amortization due to depreciation or appreciation of asset with the passage of time. It seems to be relatively more valid type of measurement. Modified cost basically provide better picture of firms assets and liabilities. In Australia, modified historical cost system is used instead of historical cost accounting. It states that assets should be recorded in balance sheet after fair value determination.

Current purchasing power accounting

It is an accounting measurement which shows the impact of inflation on the net vale of money. To achieve CPP, firstly historical costs are changed into current prices with the help of consumer price index (CPI).

This theory is basically derived from macroeconomic “inflation” perspective that persistent rise in general price level of commodities also called inflation adversely affects currency value. If pound value is decreased then it becomes difficult to compare financial statements by using this approach.

Strengths

- CPP recognized the worth of money which should be generated and maintained in business to sustain overall shareholder’s purchasing power.

- It is comparatively easy, cheaper and improves overall shareholders worth by eliminating inflationary elements which arise from change in currency from monetary profit.

Weaknesses

- Price indexes quality includes simply averages and perhaps not matches with expenses incurred by even a single shareholder.

- It sometimes becomes ridiculous that if re-stated asset values considered everything while the changed amount is never paid nor is asset value increased.

Current Cost Accounting

Assets are usually values at specific amount of cash or its equivalents if same asset is to be acquired for use in firm. Similarly, liabilities are also settled with the discounted amount of cash or its equivalents needed to reconcile the obligation presently.

Advantages

Current cost accounting use present clearer picture of an asset as compared with historical cost accounting which is helpful for decision making. Due to high degree of precariousness in business environment, financial statements should also demonstrate reality instead of past transactions. A study on New Zeland company directors by Duncan & Moorers (1988) signified that current cost accounting presents more valid and reliable information than historical cost accounting.

Disadvantages

Peasnell et. al. (1987) stated that cost accounting information is used by investors in short term assortment decision making. It also doesn’t work as a driving force for long term returns. Shareholders are more concerned with historical cost accounting to get information about investment returns.

Continuously contemporary accounting

This famous accounting theory commonly known as CocoA was given by an Australian Raymond Chambers. The purchasing primacy of money is highly volatile or current and is subject to change with the passage of time. This model basically tells that the current worth of the business is equal to the total cash equivalents of its assets. It just like current cost accounting system measure both assets and liabilities at the existing cash price.

Strengths

The model is designed in this way that accountants can easily deploy it in developing balance sheets and financial statements. The true picture of assets and liabilities in cash price provide an assistance to firm in rapidly changing environment. CoCoA balance sheets only estimates what will be received if its assets are sold to meet short term liquidity challenge.

Weaknesses

CoCoA system requires from the management to shift from cost based system to way out price which is highly opposed by top management in many firms. The CoCoA balance sheets are mostly failing in calculating internal worth of the assets as they only focus on market prices.

Case Study (valuation of roads and highways)

Renewal accounting method basically determines the impairment of highway infrastructure and roads. Highway infrastructure is considered a single asset and many performance indicators are applied to evaluate impairment on asset. Asset valuation involves measures to calculate firm’s assets and their current value in monetary terms. Current monetary value is also evaluated by depreciated replacement cost method for highway infrastructure assets specially.

DRC = Gross Replacement Cost – Accumulated Consumption

Impairment should be calculated by a consistent approach. Once an approach is set, valuation should be prescribed. Finite life assets and components by using conventional method is valid valuation impairment approach for highway infrastructure and roads.

All the assets and components can be categorized into two types:

- Conditions based maintenance

This identifies physical condition and performance data is also used for estimation of consumption of the asset whereas maintenance cost is also paid to make it look new.

- Time based maintenance

This approach identifies the asset consumption by its age and condition

Modified historical cost would be more applicable for smooth reporting and recording of costs in this case. As roads and highways are long term projects and their value also changes with the passage of time.

References

- Mary E. Barth (2013). Measurement in Financial Reporting: The Need for Concepts. Forthcoming, Accounting Horizons 2014, 40(1) 2-20

- Jiri Strouhal (2014) Historical Costs or Fair Value in Accounting: Impact on Selected Financial Ratios, Journal of Economics, Business and Management 2015, 3(5)1-5

- IASCF Staff (2005). Measurement Bases for Financial Accounting-Measurement on Initial Recognition 70(1) 101-180

- International Accounting Standards Board, 2011, International Financial Reporting Standard 2 IASB, London.

- International Accounting Standards Board, 2011, International Financial Reporting Standard 13 Fair value measurement. IASB, London.

- International Accounting Standards Board, 2011, International Financial Reporting Standard 10 Events after reporting period. IASB, London.

- Current-purchasing-power (CPP)

- Continuously contemporary accounting (CCA), retrieved Dec, 2014

- Guidance Document for Highway Infrastructure Asset Valuation taken