Falling Oil Prices and their Long-term and Short-term Impact on Ordinary Investors

Falling Oil Prices – Oil prices for the better of human history have been subject to various factors like economic recessions and booms. All one has to do is to use history as a reference to ascertain whether these prices are likely to change when taking into account the prevailing global aspects like the change in the United Stated presidency. On the same note, it is undeniable that OPEC has acted to influence oil prices and hence the global economic setup. Bottom line, the crude oil industry experiences ups and downs and can only be treated as volatile.

It is for this reason that the effects of falling and low prices on investors ought to be interrogated in the sense that it is only prudent to assume that oil prices eventually influence investment decision makers. After all, oil prices have been found to have a tendency of affecting almost every aspect of the economy and hence both future and current investments. At the current global age, oil prices have experienced a dip and stand to remain so for a considerable time into the future according to economists and other stakeholders (Degiannakis, Filis & Kizys, 2014).

It is for this reason that OPEC, with its powers, has concentrated their efforts on ways and mechanisms to use in raising these oil prices including lowering production and hence prices. When there is a shift in oil prices, in this case, a downward shift, it means that they are losers and gainers. Thus, from a critical analysis point of view, there needs to be a careful and clear interrogation of the concept.

The purpose of this study paper is to investigate the impact of long term and short term implications of falling oil prices on the ordinary investor. The objectives of the study were to have a deeper understanding how this affects both energy dependent and independent investors. The study established that as oil prices continue to decline, it is crucial for ordinary investors to be long sighted in making their decisions. Though falling and low prices are a temporary phenomenon, it so happens that their effects can never be overlooked.

For example, low prices mean that oil and oil products consumers have a greater disposable income to spend on other products. This means that retail outlets experience a sense of business boom (Bohi & Montgomery, 2015). The same case applies for motor vehicle manufacturing industry whereby low oil prices induce prospective customers and consumers to indulge in buying more vehicles. Taking into account that the motor vehicle industry is rather a crucial sector of the global economy, it is only evident that oil prices have a causal effect on quite a large chunk of the economy.

The study further established that low oil prices have both macro and microeconomic effects which equate into more fiscal and monetary policies by stakeholders. For example, federal governments have to come up with such policies like increased tax rates due to the low revenue they get from low oil prices. Increased tax rates automatically affect ordinary investors. It is for this reason that such countries have to perform macroeconomic adjustments to cushion for these impacts. In so doing, falling or declining oil prices effects must be remedied by running substantial and rising fiscal deficits.

Additionally, falling oil prices results in reduced commercial activities around oil producing regions or areas in that such companies like truck retail and construction companies often reduce their investments due to low returns. This paper employed qualitative research methodology. Data was collected by reviewing relevant peer-reviewed economic literature on oil prices and the economy. Data was presented as a narrative essay and utilized convenience sampling method.

Statement of Problem

Though there have been numerous efforts geared towards understanding oil prices in the economy, the process has not been impressive so far. This is particularly so because ordinary investors may not be able to comprehend the underlying economic jargons, models and policies. More so, history have acted to teach investors lessons on investments in such cases where they are not sufficiently equipped to adapt to these oil changes. It has become increasingly important to have a better understanding and hence this study paper.

Thesis

This study paper investigates and establishes the long-term and short-term impacts of falling oil prices on ordinary investors. The paper seeks to help have a better understanding of oil prices impacts on the economy by reviewing both fiscal and monetary policies that are taken in accommodating these oil price changes.

Significance of the study

Findings of this paper may be used by relevant stakeholders to help curb negative effects of falling oil prices and encourage ordinary investors to enjoy the benefits that come with the same.

Review of Literature

Effects of Falling Oil Prices on Currency Devaluation and Investments

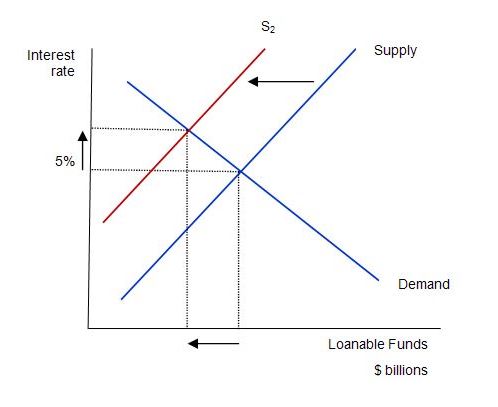

Currency exchange rate is the value which one currency is measured against another currency. With low and falling oil prices, there tends to be push-up domestic inflation due to high import prices. It is undeniable that investors require higher returns to compensate for the inflation. It the follows to compensate for inflation; the federal bank has to raise interest rates to curb inflation. With the government attempting to curb inflation, various steps are followed including Open Market Operations and Cash to Liquidity Ratio for banks (Nazlioglu, Soytas, & Gupta, 2015). The effect of raising the interest rate on loanable funds can be explained by the following economic model:

From the above analysis, it is evident that an increase in interest rate leads to a reduced supply of loanable funds and hence low investment from ordinary investors.

The aggressive measures are aimed at reducing the supply of currency in the economy by making its supply low thus increasing its value. In so doing, the interest rate in the economy automatically increases meaning that the government is in a bid to discourage banks to lend loans and funds to the consumers and discourage investors from accessing such loans and finances. Consequently, it results to reduced investments. On the same note, it is important to note that currency value is a crucial factor in attracting foreign investments (Sadorsky, 2014). Thus a low currency caused by inflation acts towards discouraging ordinary investors from investing in such countries with low currency.

In the bond market, there is an inverse relationship between bond prices and interest rates such that if a currency crash was to happen, there is a likely hood of the bond market crash. High-interest rates caused by low or falling oil prices usually results into low bond values making it unattractive to ordinary investors including foreign investors who may be willing to invest in international government bonds.

The effects of declining oil prices in the economy have never been clearer. Falling oil prices mean that countries have to cut public budgets. This, in turn, has resulted into serious social and political ramifications that have been found to have a direct relation with investments. For example, in Russia, the ruble suffered significant devaluation with falling oil prices. Consequently, the stock-market prices tend to fall. The effects of declining oil are better understood when such factors like federal or central banks reserves shrinking, capital flight, low exports and low foreign investors are taken into account (Brown,Chan, Hu & Zhang, 2017).

Furthermore, when falling oil prices are significant enough, they tend to downgrade a country’s bond value to almost junk levels which are mainly done by credit rating agencies thus acting to discourage ordinary investors. Due to oil price weakness, Consumer Price Index has shown inflation might be incumbent in the long-run if oil prices are to continue into the foreseeable future. However, falling oil prices act like a tax cut for consumers such that they can spend other than oil and energy.

Currency devaluation in some cases may be a voluntary concept whereby a country may devalue its currency to make its exports competitive in the world market. In the recent past, China devalued its Yuen currency reaching an almost six year low (Basher & Sadorsky, 2016). Consequently, it resulted into the low crude oil. As the oil market is characterized by the dollar currency and hence dollar peg, countries have to act within and beyond their limits to maintain currency levels competitive against the dollar. As of the year 2016, the IMF urged Nigeria to devalue its currency as low prices hit the economy. Being an aggressive strategy, it was a viable option in attracting investments after the currency stabilized in the long-run.

In the Nigerian case study, the government sought to restrict access to foreign currency and ban quite a wide range of imports. Though this was viewed as being detrimental by the IMF, it was a measure to curb the effects of low oil prices and inflation (Alfaro, Bloom, & Lin,2016). The effects of the same were also felt by the common consumers and ordinary investors.

The Nigerian government was of the view that it was better to restrict access to foreign currency and limit certain imports into the country rather than devaluing their currency. This, of course, had a negative effect or impact on investors who dealt with this line of imports. Similarly, restricting access to foreign currency meant that local and international investors would not transact in certain currencies limiting their diversification both in stock and currency trading. Furthermore, in such a country which is import dependent in terms of food, it meant that investors had to get less for their money (investment returns) or had to charge consumers for their products.

In choosing not to devalue the naira, the Nigerian decision makers risked severe foreign exchange that could potentially lead to decreased foreign investment and hence an increase or surge in the black-market sector (D’Ecclesia, Magrini, Montalbano & Triulzi, 2014). Thus, this is a direct attack on the business sector especially considering that oil is just but one commodity affecting all other range of consumable products and services.

Falling Oil Prices and Increased Tax Rates

In a bid to recover tax revenues lost through falling oil prices, the federal or central banks usually takes upon increasing tax rates in the economy. Changes in the top marginal tax rates influence peoples’ decision especially in terms of consumption trends. From the argument of libertarians and economists at large, tax increase dissuades ordinary investors from economically viable projects. An increase in tax caused by falling oil prices automatically reduces the amount of disposable income for consumers meaning that they will spend less or forego certain products and services meaning such investors who had invested in those product lines experience a dip and form and revenue accruing from their operations. Additionally, when corporate taxes are high, it acts to derail additional investments. High tax rates mean that there is the low after-tax rate of return on investment hence low investment esteem.

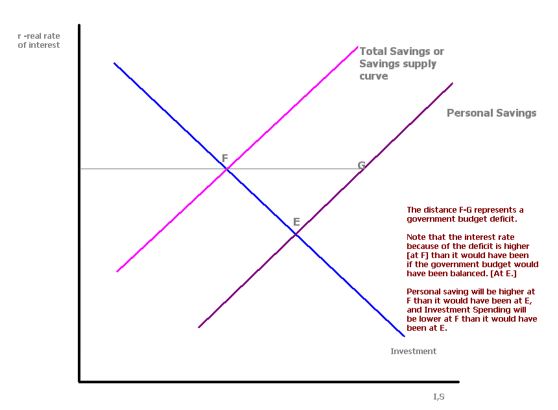

High taxes in the economy results into low personal and house hold savings. Such savings would have otherwise been used for investment purposes in the long-run or even spent on goods or services at a future date (Brunetti, Büyükşahin, & Harris, 2016). When tax rates are increased, it means that there is a strong correlation between tax, interest rate, saving and hence investment. Taking into account that increased tax rates go hand in hand with high-interest rates, the effect of the same can be explained by the model below.

In increasing taxes, it has become a common phenomenon for federal and central banks to allow for tax credits. They have been found to be more favorable than tax deductions whereby the latter rarely occurs with falling oil prices. The value of a tax credit depends on the type of credit either given to individuals or individuals. In such cases where the government offers tax credits, it enables investors to continue investing in certain sectors of the economy to balance between high taxes effects and increased investment all the same. On the other hand, non-refundable tax credits are directly deductible from the tax liability (Enriquez, Smit & Ablett, 2015). Any excess of the same potentially reduces tax liability further. This has been found to negatively affect low-income earners because they are not able to enjoy and utilize the entire credit amount. Refundable tax credit is favorable and tends to promote expenditure and investment which is a good thing for ordinary investors all the same.

Falling Oil Prices, Local Investments and the Stock Market

With falling oil prices, it is a common phenomenon that business activities in oil producing regions tend to decrease. For example, construction companies benefit less from these low prices as oil mining and refinery companies have to cut and lower their production capacity in a bid to maintain high prices. The powers that OPEC has in dictating and influencing oil prices are quite shocking. According to the author, OPEC members’ oil production account for almost forty percent of the global oil supply which puts a considerable amount of power in their hands.

By acting as a united front, they would act to shape the future of the oil industry and more so regarding influencing oil prices to their advantage (Diaz, Molero, de Gracia, 2016). The underlying question is what would happen if these countries were to hold on and stop their oil exports for some time.

As of last year, oil producing countries including Russia and Saudi Arabia acted towards ensuring high oil prices. This was meant to reduce cut-throat competition and price under cutting proving that OPEC has the ability and power to increase prices. However, this was done by reducing the production levels and hence low supply into the market (Heitner, K. L., & Sherman, 2014). It is important to note that such countries like Venezuela have a binding agreement not to increase production significantly making the agreement even more strong in pushing the oil prices high.

With reduced supply and operations, local business suffers significantly. Ordinary investors in the housing sector feel the impact whereby the demand for housing units ultimately takes a deep. With reduced operations, there will be reduced workforce and hence a low demand for housing units. It is practical that with the opening of oil companies in a certain region, local businesses and investments sprout up. Thus, such investors like shareholders have to make a careful decision on the type of portfolio they are to invest in.

For companies being quoted in the stock market, it means that their shows trade less as they are less attractive to invest in. It has been established that there is a correlation between oil prices and the stock market (Javan & Vallejo, 2016). Such factor prices in the economy like wages and interest rates tend to offset energy costs. In reading future trends of the market, investors have to factor in factor prices. With increased consumption of oil product, prices in the market might rise.

With falling oil prices, the motor vehicle and other related oil energy industries experience a surge in their revenues and hence their share prices. The same case applied to the transport sector. However, there has not been an explicit correlational explanation as to the relationship between oil prices and overall stock market. It has been identified that in surprising cases, stock markets may fall with falling oil prices. In such cases where oil and stock prices go hand in hand, it is as a result of softening global aggregate demand. The relationship between stocks and oil is rather volatile. Prices may move in the same or opposite direction. As it stands, both prices seem to move in the same direction.

Time Value of Money and Falling Oil Prices

Time of value is an accounting concept that deals with what monetary benefit one would rather enjoy now rather than later. This concept has been so far been used in valuing investments and more so in the field of oil and accounting when such factors like interest rate and rate of return are put into account. Thus, the underlying question is, should one invest now or later in the oil industry as according to time value of money.

As previous research has shown, it is advisable to invest when oil prices are high because the interest rate is low and so is the tax rate. Thus, it can only be held that with the changing oil prices, investors should invest when oil prices are high to increase the returns in terms of present and future value of money.

Methodology

The research methodology used in this dissertation was qualitative, Triangulation/Mixed Review study utilizing convenience sampling research methodology. This research method involves data integration in that illustration, triangulation (convergent validation) and deep analysis are undeniable in this study paper. Mixed method of research involves combining aspects of both quantitative and qualitative research methods through triangulation whereby data from different sources are compared and analyzed to come up with the most reliable and appropriate conclusion and recommendation.

Triangulation, in this case, involves the use of diverse data and combining various research methods. This would go hand in hand with convenience sampling where convenient and pertinent data to the study will be analyzed. It is the most applicable method in studying real life scenarios through a detailed contextual analysis of a limited number of conditions or relationships.

The study design involved went hand in hand with the triangulation of different data sources in relations to a specific issue, phenomenon or situation with an aim to deeply understand and explain it of characteristics and other aspects like rationale and distribution. It combines the strengths and reduces weaknesses of using a single method. Through triangulation, convergence and divergence of data can be established thereof.

Discussion, Conclusion, and Recommendation

From the above analysis, it is only true to hold that falling prices have both short-term and long-term impacts on ordinary investors. Falling prices tend to result in high taxes, high-interest rates and more so a change in the stock market. It is thus important for investors to have a clear understanding of oil prices changes and the corresponding effects in that it ultimately affects the general economy in various ways. This paper should prove useful for ordinary investors and other stakeholders who are willing to seek information on oil industry and investments.

References

Javan, A., & Vallejo, C. (2016). Fundamentals, non‐fundamentals and the oil price changes in 2007–2009 and 2014–2015. OPEC Energy Review, 40(2), 125-154.

Nieh, C. C., & Yeh, C. Y. (2016). Relationship of Threshold Effect among Gold, Oil, and Exchange Rate.

Enriquez, L., Smit, S., & Ablett, J. (2015). Shifting tides: Global economic scenarios for 2015–25. McKinsey & Company.

Brunetti, C., Büyükşahin, B., & Harris, J. H. (2016). Speculators, prices, and market volatility. Journal of Financial and Quantitative Analysis, 51(5), 1545-1574.

D’Ecclesia, R. L., Magrini, E., Montalbano, P., & Triulzi, U. (2014). Understanding recent oil price dynamics: A novel empirical approach. Energy Economics, 46, S11-S17.

Alfaro, I., Bloom, N., & Lin, X. (2016). The Real and Financial Impact of Uncertainty Shocks.

Coudert, V., Couharde, C., & Mignon, V. (2015). On the impact of volatility on the real exchange rate–terms of trade nexus: Revisiting commodity currencies. Journal of International Money and Finance, 58, 110-127.

Brown, G., Chan, R., Hu, W. Y., & Zhang, J. (2017). Oil Price Movements and Risks of Energy Investments. The Journal of Alternative Investments, 19(4), 24-38.

Bohi, D. R., & Montgomery, W. D. (2015). Oil prices, energy security, and import policy. Routledge.

Sadorsky, P. (2014). Modeling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Economics, 43, 72-81.

Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54, 235-247.

Nazlioglu, S., Soytas, U., & Gupta, R. (2015). Oil prices and financial stress: A volatility spillover analysis. Energy Policy, 82, 278-288.

Degiannakis, S., Filis, G., & Kizys, R. (2014). The effects of oil price shocks on stock market volatility: Evidence from European data. The Energy Journal, 35(1), 35-56.

Diaz, E. M., Molero, J. C., & de Gracia, F. P. (2016). Oil price volatility and stock returns in the G7 economies. Energy Economics, 54, 417-430.

Relevant Posts

Circular Flow Model Economics Report

If you enjoyed reading this post on falling oil prices, I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.