Balance of Payments and Multinational Corporations

Introduction

Balance of Payments – Over the last two decades, the world economy has been changed to an extent on which the nations are interconnected with each other in terms of commerce and financial relationship. This circumstance is popularly known as globalization (Vinals, 2004). This interconnection not only helps to exchange goods or service but also force to keep account of financial payment between two countries (Dabrowski, 2006). This record is known as balance of payment. Generally, a multinational corporation has a strong relationship with the balance of payment between two countries (Stein, 1984). The multinational corporation may be affected positively or negatively in the host or home country by the balance of payment (Wilamoski and Tinkler, 1999). The positive relation between MNCs and Balance of Payment creates many opportunities for the multinational corporation. A manager of multinational company must take necessary steps to grab those nice opportunities.

What is Balance of Payment?

Balance of payment is a process of keeping record of transaction of a country with the rest of the word. It includes not only payment for goods and services but also all others payment over the border (Chamberlin, 2009). According the Sloman John, Balance of payment is an account that contains all monetary transaction of a country with the other countries of the world (1998). The transactions contain exports, import, incoming payment and transfer of finance. The balance of payment is usually evaluated based on certain period such as year. It is also calculated on a single currency, normally US dollar (Mcbride, 2007).

Sources of money are considered positive and deployed of funds is negative items. According to Investopedia, the balance of payment generally should be zero to be optimum (2013). However, it does not happen most of the time. The balance of payment is normally surplus or deficit for maximum country. A surplus balance of payment is said to be exist when the incoming payment is higher than total transfer. On the other hand, a deficit balance of payment is said to be exist when the transfer payment is higher than the incoming payment.

What is Multinational Corporations or MNCs?

A multinational corporations or MNCs, also known as Multinational enterprise (MNE), is a company that operates is business or produce and sale product in more than one country (Daniels, Radebaugh and Sulivan, 2001). According to Van De Kuil, a multinational corporation follows the internationalized philosophy and operates its business both home and host country (2008).

He also added that to be a multinational corporation, a company must have the assets and facilities outside the border of national country. The host country, home country and the multinational company get benefits from a multinational trade (Kokko, 2006). The host country gets higher tax or vat, the home country get foreign currency and the multinational company get profit. Here is some example of well-known multinational company Honda, Toyota, Google, HSBC, Wal-Mart, Samsung and chevron etc.

Relevance of Balance of Payments to Multinational Corporation

There is a strong relationship between the balance of payment and Multinational Corporation. A multinational corporation helps both host and home country to increase their balance of payment. In the contrary, the balance of payment situation of a country impact the operation of a multinational corporation by changing the rules and regulation based on country specific needs (Ker and Yeates, 2013). Let us look the relevance of balance of payment to Multinational Corporation in terms of different situation.

Relevance Based on “Direct impact”

A country in which a multinational company is located tends to be get higher balance of payment. It experiences capital inflow when a multinational company get started with a certain fee. It also gets funds or money from the portion of profit of that Multinational Company (Shoo, 2005). On the other hand, the multinational company helps to improve the balance of payment of home country. The home country gets funds when the MNC make profit and return the money to the home country.

Relevance Based on “Regulatory Relation”

Another positive or negative relation between balance of payment and the MNCs is regulatory relationship. The balance of payment represents the foreign reserve of a country. The trade policy of a country changes with the changes on balance of payment position. If a country has negative balance of payment, it tries to hold the money by encouraging more export than import (Hale, 2013). It also tries to get more tax or VAT from the normal sources. This tighten money policy affects the business flow of multinational companies. They have to give more tax to the government. The sales volume of MNCs may rise because the local producer is busy to export in other countries. The MNCs can be the market leader. It may not happen all time.

The rules and regulation may be strict for both domestic and multinational companies. On the other hand, if a country more reserve or balance of payment, it tries to deployed money. It encourages import than import or it invests money to another country as FDI or foreign direct investment. It may reduce the tax burden for MNCs (Bhusnurmath, 2011). By this way, the MNC can get maximum profit. The host country may be benefited from this policy by getting portion of profit when it will get back to it.

Relevance Based on “Measurement Challenge”

The MNC puts a measurement challenge of balance of payment for both home and host country. The goal of a Multinational company is to maximize the profit in after tax all over the world. To do this, they allocate resources, make mixing price system and make extra bill. These conducts is very difficult to measure for the regulatory bodies (Landefeld, Moulton, and Whichard, 2008). There are some good reasons behind this; the resources of production are not same in all countries and the price too. Therefore, it is very tough to evaluate the perfect amount of balance of payment. The mix price is also difficult to detect. Therefore, the proper amount of payment is in question in all countries due the inappropriate recording of MNCs transactions.

Relevance Based on “Foreign Exchange”

The balance of payment is a better indicator of country’s financial status. It helps to evaluate the foreign exchange rate of a country. This exchange rate has direct or indirect effect to the multinational corporation (Wang, 2005). When a currency of a country is strong, the import will cheaper and the export will less competitive. This situation puts pressure to the MNCs to adjust the situation. At that price of goods tends to be cheaper so that the multinational corporation must adjust their price level. Again, when the exchange rate of a country is weaker, the import will expensive and export will high competitive because of inflation. This situation makes higher price level within the country and the MNC have to adjust their price in a high level.

Relevance Based on “Asset Reserve”

The balance of payment also consists of asset such as gold reserve. The higher gold reserve means country has higher trade surplus and thus the higher money supply. This tends to create inflation within the country. Therefore, the MNCs can make higher profit by raising their price level. Conversely, when there is a trade deficit means low assets reserve. This makes the price lower because there is a low money supply. Therefore, the MNCs must adjust their prices level to cope up with host country’s policy.

Relevance Based on “Decision Making”

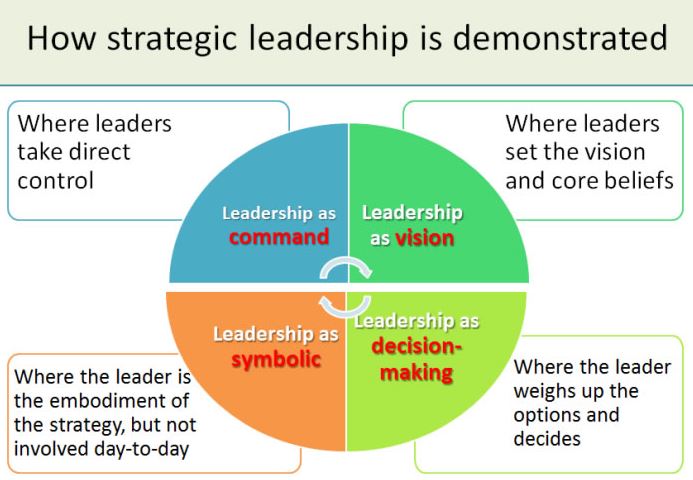

The balance of payment statistics is very important for all kinds of decision makers. The authority of a country looks carefully the flow of balance of payment. The balance of payment generally is a great indicator of future exchange rate of a country. This put pressure to the monetary authority to take necessary steps to control the money supply. Again, the balance of payment indicates the proper amount of assets reserve for a country. This makes concern for the fiscal authority. They should determine the trade policy, VAT, income taxes and the policy for the multinational corporation. Therefore, we can say, balance of payment accounts are closely related to the overall saving, investment and price policy of a country.

Relevance Based on “Business Policy”

The MNCs are also a good user of balance of payment statistics. They must assess the balance of payment both host and home country for their business policy. The policy of a MNC much depends on the balance of payments flow because change in balance of payment also changes the rules and regulations. When a multinational company try to start their business in another country, they must assess the domestic balance of payment. Because the domestic balance of payment, indicate the permission. If the host country has surplus balance of payment, the MNC can start their operation.

Conversely, if the balance of payment is in deficit position the MNC may not get the foreign investment permission. Again, the MNC must assess the host country’s balance of payment. If the host country has already huge surplus balance of payment, it may not give permission to a new MNC because it tries to invest their money not get money. Conversely, if the balance of payment is in deficit position in the host country, they may welcome new money flow to their country. Thus, the balance of payment position in host and home country affect the decision of business start up. The MNC should also asses the foreign exchange rate position in home and host country.

The weaker currency in home country means the multinational company have to pay more to start their business in another country. Conversely, if the exchange rate is weaker in host country, the Multinational Corporation can start their business cheaply in the host country. Balance of payments also influence the interest rate because of high bank reserve, the MNC also have to consider the interest rate in the host country. The higher the interest rate means the higher business cost for MNC in the host country.

Changes in Balance of Payment and Management Actions

What is change in balance of payment?

Balance of Payments should be equal in all time. However, in reality, it does not happen. The balance of payment is continuously fluctuating all time. This is called disequilibrium of balance of payment. According to TR Jain, disequilibrium payment is a situation when the balance of payment fluctuates from zero (2008). Another author Cherunilam argues that a country’s balance of payment is disequilibrium when there is surplus or benefit (2010). There are three types of changes in balance of payment favourable, unfavourable and balance. Favourable balance of payment means surplus balance of payment. Unfavourable balance of payment means deficit balance of payment. Balance in BOP means equal incoming fund and outgoing funds.

Causes of Changes in Balance of Payments

There are various causes of change in balance of payment. From them, Raj Kumar, author of international economics pointed out three main reasons such as economic, political and natural (2008). He said that if a country is in developing position it must be in deficit balance of payment. The reasons behind economic cause are huge economic development in infrastructure, inflation or deflation, cyclical fluctuation and changes in foreign exchange rates. Again, the reasons behind political cause in balance of payment are political instability and international relations. The natural consequences such as earthquakes, hurricane and others are the reason for natural cause in balance of payment.

Result of Changes in Balance of Payment

The changes in balance of payment may affect positively or negatively to the economy. Here are some Results of changes in Balance of payment:

- Positive effects of Changes in BOP increase the creditability of a country. Conversely, Negative changes in BOP lower the international creditability.

- Positive changes decrease the foreign dependency in terms of financial help. Conversely, Deficit changes in BOP increase the foreign economic dependency.

- Surplus changes increase the foreign exchange reserve. Conversely, Negative changes in BOP deplete the foreign exchange reserve.

- Reserve of gold is increase in the case of surplus balance of payment. Conversely, the reserve of gold decreases and goes away in negative BOP situation.

- Negative balance of payment hampers the economic development. Conversely, positive balance of payment improves the economic condition.

- Surplus balance of payment increases the global market leadership for the home multinational company. Conversely, Deficit balance of payment hampers to get global market leadership position.

Opportunities for MNCs Revealed by Changes in Balance of Payments

The changes in balance of payment position affects positively and negatively for a country’s economy. As the MNCs are one of the important parts of economy, it also gets affected due to changes in balance of payment. Here are some opportunities for MNCs revealed by the changes in balance of Payments.

Business Growth: A multinational company can get business growth advantages in both home and host country. If the home country has surplus balance of payment, the authority approves MNC to start their business internationally. It means they do not mind in capital outflow from the nation as they have surplus funds to invest. On the other hand, a MNC can expand their business to a host country if they have negative balance of payment. They must try to grab money from the other national to increase their business infrastructure. For this reason, MNC is the best way to get finance.

Low start-up cost: A multinational company can start their operation cheaply in host country due to changes in balance of payment. If the host country has deficit balance of payment, they must encourage funds flow from MNC with low regulations and cost. Again, if the home country has high balance of payment, they allow MNC to start its business with lower fees.

Tax benefits: An MNC can also get tax benefits both home and host country due to fluctuation of balance of payment. The home country encourages FDI when it has surplus balance of payment. For this reason, the tax tends to be lower than deficit BOP to encourage foreign direct investment. Again, in the host country the MNC gets lower tax benefit due to deficit balance of payment (Robert, Dunn and Mutti, 2009). The MNC can also get the lower tax benefit, when the country tries to increase their export and reduce import.

Exchange rate benefits: The fluctuation of exchange rate is highly related to balance of payment. This exchange rate or balance of payment affects the operation cost positively or negatively to a multinational corporation. The MNC pay less if the home country has higher balance of payment or strong exchange rate. Here, they get exchange rate benefits due to weak currency in host country. This strong exchange rate also reduces the resources costs in the host country. Moreover, the MNC can get bill paying benefits due to change in balance of payment system.

Low cost of operation: A multinational corporation can experience low cost of operation due changes in balance of payment in both home and host country. It can get factors of production such as land, labour, machinery and others tools at low prices where the balance of payment is lower. Because, lower balance of payment indicates high rate of unemployment in the host country.

Higher Sales: A multinational corporation can increase their sales due to impact the balance of payment in the host countries. When a country experience lower balance of payment, it tries to increase the export and reduce import to get higher balance of payment. To do this, the country should ensure high production unit. The domestic producer may unable to cope up this policy. Therefore, the MNC get the opportunity to sales more during the recovery situation in balance of payment.

Higher Profit: A multinational corporation can make higher profit due to changes in balance of payment. As we discuss earlier MNC can sale higher volume in the host country in the recovery situation. By this, it can make higher profit because higher sales means higher profit (Deresky, 2009). On the other hand, the MNC can make higher profit if the currency of host country is devaluated. For example, European MNC operates its business in US. If the US dollar is weaker than Euro, the European countries will get higher value of money when they convert the money into their own currency.

Measures to exploit opportunities revolved by changes in Balance of Payments

As a MNC operates internationally, it must cope up with the changes on balance of payment in both home and host country. The manager of MNC should be careful to grab every opportunity provided by the BOP. The management measures have been given below:

Seek for growth: A manager of Multinational Corporation should always seek for business growth in home, host or any other country. To seek the business growth opportunity the MNC have to assess the balance of payment position. If the balance of payment is favourable, the manager should grab the opportunity for growth.

Alert all time: The manager should be alert all time to grab the best opportunity for business. As there are various obstacles for a multinational business, the manager have to overcome the obstacle by grabbing the best available opportunity.

Acquire new technology: New technology is very important for a business to get the competitive advantages. A company can implement a new technology to track the balance of payment related data to know the future trend of exchange rate, business cost and tax rate.

Hire business analyst: The manager can hire a business analyst to analyze the balance of payment data and recommend the best opportunity. The analyst also may responsible for making quick and instant decision regarding balance of payment trend.

Implementing short and long-term strategy: The manager can implement a short and long-term strategy for grabbing the opportunity of balance of payment. The short-term strategy may be for less than one year and the long-term strategy may be for above the one year. In addition, this strategy should include the yearly business strategy.

Conclusion

Due to high impact of globalization, every country must engage business internationally through Multinational Corporation. The multinational corporation contribute in the economy of related party’s as well whole world. This report describes that there is a strong relevance of balance of payment to Multinational Corporation. They are related to each other’s in terms of direct impact, regulatory relation, assets measurement, foreign exchange, business policy and decision-making.

This report also describes that the changes in balance of payment creates some opportunities for MNC such as business growth, low start up cost, exchange rate, higher sales and higher profit benefit. Moreover, this report suggests that a manager of a company should take some important measures such as implementing new technology, higher business professional and hiring business analyst to grab the best available opportunity revealed by changes in the balance of payments.

References

Akrani, G. 2010. Disequilibrium in the Balance of Payment – Meaning , Causes.

BusinessDictionary.com. n.d.. What is unfavorable balance of payments? definition and meaning.

Cherunilam, F. 2010. International business. New Delhi: PHI Learning Private Limited.

Dabrowski, M. 2006. Rethinking balance-of-payments constraints in a globalized world. [e-book] Available through: Munich Personal RePEc Archive

Daniels, J., Radebaugh, L. and Sulivan, D. 2011. International business. Boston: Pearson.

Deresky, H. 2011. International Management. Boston, Mass.: Pearson.

Eicher, T., Mutti, J., Turnovsky, M. and Dunn, R. 2009. International economics. London: Routledge.

Essay.uk.com. n.d.. Negative and positive impact of globalisation

Hale, G. 2013. Federal Reserve Bank San Francisco | Research, Economic Research, Europe, Balance of Payments, European Periphery

Investopedia.com. 2013. What Is The Balance Of Payments?

Investopedia.com. 2013. How The Federal Reserve Manages Money Supply

Jain, T. 2008. Macroeconomics and Elementary Statistics. V K Publications.

Kokko, A. 2006. The Home Country Effects of FDI in Developed Economies. [e-book] Stockholm School of Economics

Kumar, R. 2008. International economics. New Delhi: Excel Books.

Landefeld, J., Moulton, B. and Whichard, O. 2008. The Impact of Multi-National Companies on Balance of Payments and National Accounts

Mcbride, C. 2007. How to Calculate the Balance of Payments | eHow

Palgrave-journals.com. 2004. United Kingdom Balance of Payments: The Pink Book – Further information on UK balance of payments

Shoo, D. 2005. Economic Effects of Multinational Corporations | eHow

Sloman, J. 1998. Essentials of economics. London: Prentice Hall Europe.

Stein, L. 1984. Trade & structural change. London: Croom Helm.

The Economic Times. 2011. MNCs lower tax burden by swopping domicile – The Economic Times.

The Sydney Morning Herald. 2013. Multinationals cry foul at tax changes

Van De Kuil, A. 2008. Strategies of Multinational corporations in the emerging markets China and India. Mu¨nchen: GRIN Verlag GmbH.

Vinals, J. 2004. “European Central Bank Statistics and Their Use for Monetary and Economic Policy Making”, paper presented at Second ECB Conference on Statistics, European Central Bank, 22 and 23 April 2004. Germany: European Central Bank.

Wang, P. 2005. The economics of foreign exchange and global finance. New York, NY: Springer.

Wilamoski, P. and Tinkler, S. 1999. The trade balance effects of U.S. foreign direct investment in Mexico. Atlantic Economic Journal, 27 (1), pp. 24-37

meritnation.com. n.d.. What are the advantages & disadvantages of MNCs?