Revenue Recognition

A Summary of How Revenue is recognized within the Construction Industry under IAS 11

Title: Revenue Recognition: Construction contracts are designed to meet specifications for the negotiations on how assets are constructed or combined to meet their ultimate objectives (Buschhüter, Michael & Andreas 2011). Contract constructions may involve fixed prices where some are subjected to the cost escalation costs.

On the hand, a cost plus contract involves reimbursements or allowable and percentages of costs or the fixed rates present. The changes were made to meet the standards of Financial Accounting (IFRS 15 2014). Revenue is considered to be income earned from everyday activities as it goes by different names such as royalties, dividends, interest, fee or sales.

Revenues that are to be recognized would be from the selling goods, providing services royalties and interest. However, in this case, revenue is to be recognized from the construction of contracts. Construction contracts may be either fixed or cost plus contracts or a combination of the two (IAS 11 2011).

In this regard, a contractor needs to identify and determine what contract to use to know when to recognize revenue and costs as well. When the outcome can be properly estimated, the contract revenues and costs would be recognized as revenues and expenses respectively at the end of the contract period. A loss is also recognized as an expense by the accounting standards.

In fixed price contracts, construction contracts are estimated reliably once total contract revenues are reliable. The revenues are considered as benefits since the effects will be felt positively by any business. Stages of contract completion, as well as, the contract costs have been reliable to meet the standards. All contract costs are to be measured reliably to account for the actual contract costs that would be incurred when compared.

Similarly, for cost plus contract to be enforceable, the economic benefits of the contract have to be passed to the entity. The costs have to be also clearly and easily identified for measurements to be done reliably (IFRS 15 2014). The recognized revenue at the end of a contract is considered to be the percentage of completion. This whereby the contract revenues are matched with the contract costs and then reported in the books of account.

Afterward, the contract revenues and costs are recognized as revenues costs in the profit and loss account. The expected excess of costs over revenues is treated as expenses. If the outcomes are not measured reliably, the revenues will not be recognized and perhaps not even recoverable in the business. An entity will then disclose the revenues recognized during the accounting period as techniques of arriving at the revenues will be recognized as well.

A Description of the Process of Developing New Standards IFRS 15

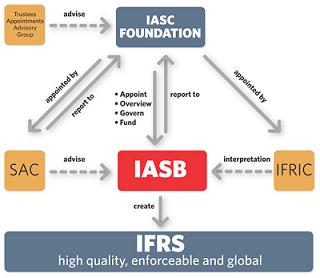

The International Financial Reporting Standard had to be formed by the Internal Accounting Standards Board; IASB to provide rules and procedures on how to account for revenues that are from customers. There were significant differences between IASB and the IFRS when it came to the definitions of revenue.

Even though they were almost similar, the different understanding of revenue resulted in different ways of treating revenue in financial accounting. The IASB thought they had not given enough revenue standards, policies and procedures on how revenue was treated (IAS 18 1993).

The IASB began working on the issues to try and formulate ways it could solve the issue from 2002.Their first review paper was released in 2008 as they further discussed it and gathered information from relevant sources. Afterward, a release on the exposure draft was done proposing the new accounting standards in 2010 and 2011. After a long process of deliberations and reviews that took several years, the IASB issued the final standard on 28th May 2014.

Changes made about the IAS 18 included recognizing and measuring financial tools revised in 2003 and the 2004 revision of insurance contracts. In 2007, the presentation of financial statements was reviewed through amendments in the different terms used. Their first issued review in 2008, involved investment costs in jointly controlled entities and subsidiaries as well as improvements on the IFRS. The same year also saw IFRIC agreements on issues relating to the constructions of the real estate.

The IFRIC 15 also dealt with issues of the non-monetary contributions by investors in entities that are jointly controlled as they evaluated all legalities in leasing or substance transactions. Barter trade and service concession agreements were also made as they issued customer loyalty programs in 2007 (IAS 18 1993). The IFRS 15 model follows procedures that begin with the; identification of the contracts as well as all individual parties involved.

Transaction prices are also determined as the prices are allocated to the different obligations in accounting. Revenues are finally recognized as the performance obligations are fulfilled. The amount of revenue to recognize and when acquiring costs are capitalized as assets are under the guidelines of the IFRS 15. Any of the expenses not capitalized as assets are considered to be expenses incurred. After all proper recognitions are reporting is done, financials are to be properly disclosed by the company.

Why the Process of Developing New Standards has proven to be difficult and Time-consuming

The new revenue recognition standards had left out key areas that bring in revenue and had not been recognized. New standards on how to recognize revenue had to be set for businesses to follow by the relevant bodies. The objective of the new set of rules and procedures is to explain how the different revenues would be treated.

Revenue recognition is recognized when it estimated to bring economic benefits that are measurable to the business in the future. Therefore, practical guidance is given on how the criteria will be met. The International Accounting Standards Board adopted previously issued the construction contracts and the new standards of recognizing revenue.

IAS 18 was put in place to replace the former methods of recognizing revenue while the IAS 11 replaced some accounting rules on the construction of contacts (Buschhüter, Michael & Andreas 2011). This is to help in knowing how to treat costs and revenues that are associated with the nature of activities undertaken.

Also, due to the then existing rules, changing to new standards had to take long processes of deliberations that were time-consuming. Steps had to be followed as described above as company’s found it hard to easily and quickly adapt to the new set of rules. The new set rules had to be then applied first to see if they would meet the specifications with no interference of other accounts that would result in imbalances in the financial statement and misappropriation and misallocation of resources.

Changing one side would have to result in changing of the other side to cancel out the effects. For instance, in ledger accounts, a debit entry has to be followed a credit entry and vice versa is also true.

What people do not know is that different firms have different accounting rules they follow. A majority however, follow the international standards while others follow the U.S. GAAP principles (Kieso, Jerry & Terry 2010). Unlike the U.S. GAAP, the International Financial Reporting Standards does not always give extensive regulation prompting the need of having some exercises in judgments in some instances. The U.S. GAAP accounting is based on standards while the IFRS focuses more on principles.

The accounting differences have made the financial comparison between different organizations difficult. For instance, actuarial gains and losses are treated differently. They are treated as off-balance sheet items by the IFRS standards unlike under the U.S GAAP.

The off-balances in the balance sheets would cause volatilities and fluctuations. Therefore, the IASB is trying as much as it can to harmonize the differences in the standards. This would also take time as the harmonization would require changes in almost every aspect of accounting (IASB 2006). Adaptation by firms would take time as well making it a difficult and a long, tedious process.

A Summary of how the New Standard IFRS 15 would Deal with a Construction Contract where Construction Happened Over One Accounting Period

The important principle of IFRS is that a company would have to recognize revenue for it to be related to the transfer of the commodities and services that were promised and what the company is expected to get. Services rendered depend on the agreement of the specific time it should cover. The period might exceed one accounting period as would be expected.

An accounting period is often considered to take one year. This, therefore, means that more than one accounting period takes more than one year. The work done at construction contracts usually take more than one accounting period. Therefore, rules have to be set that best suit the situation. One of the methods is to recognized revenues or profit at the end of the contract. This would be through following the IAS 18 – Revenue (IAS 18 1993).

Revenue Recognition and Profit

Recognizing profit at the end of the period does not show that profit was accrued. Under the IAS 11 all revenues and costs will be matched to the accounting period and documented at the end of each financial period (IAS 11 2011). Recognition of profit at the end of the contract would see the company reporting spikes or rises in profits that may not often be matched with the accruals. This is because the revenues would have accumulated to amounts exceeding what would have been recognized in one accounting period (Ursachi, Antonela, & Geanina 2014).

In this regard, revenues and costs are only recognized once estimations of the outcome are reliable. As stated earlier, properly estimated outcomes from contracts should be reliable for use and interpretation. An expected contract loss should be recognized immediately. The completion stage would be calculated on the basis of sales, costs, and physical proportions.

Revenue recognition done at the end of the construction contracts is known as the percentage of completion method. The reported revenue and costs would later be credited to the proportion of work that was completed (IAS 11 2011). The contract revenue is recognized as revenues while the contract costs as expenses in the profit and loss accounts. Similar to when accounting was done in one accounting period, expected amount that exceeds when contract costs are more than contract revenues are treated as expenses.

Where Can I Find Finance Dissertations?

Reference List

Buschhüter, M & Andreas S 2011, ‘IAS 11–Revenue Recognition & Construction Contracts’, Kommentar Internationale Rechnungslegung IFRS. Gabler, 374-391.

International Accounting Standards Board Revenue Recognition: (IASB) 2006, ‘International Financial Reporting Standards (IFRS’s): Including International Accounting Standards (IAS’s) and Interpretations’, International Accounting Standards Board.

International Accounting Standards Committee 2010, Revenue Recognition – ‘IAS 18’ Revenue, London: IASC 1993.

Kieso, E, Jerry W, & Terry W 2010, Intermediate accounting – Revenue Recognition: IFRS edition. Vol. 1. John Wiley & Sons.

Ursachi, Antonela, & Geanina M 2014, ‘IFRS 15–revenue from contracts with customers – Revenue Recognition,’ 2nd International Conference-2014.

View Finance Dissertation Collection Here

If you enjoyed reading this post on Revenue Recognition, I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.