Basics of Investment

Financial Investment – To know how to invest, first it is necessary to understand the basics of investment. To learn an investment art is more like to study a new language. A fundamental thing any successful investor needs to do is to allow his earnings to run on for a long time. Before consideration of some advance theories and practical investment, there is a need to understand the fundamental concepts and terms of investment. Money Investing is a complex thing; moreover, people often feel themselves confused due to sufficient knowledge and poor experience in this field. In this article, we will try to make main basic investment theories clear. Moreover, people should thoroughly study the investment concepts before their attempt to understand the mechanism of investment.

Risk and Return

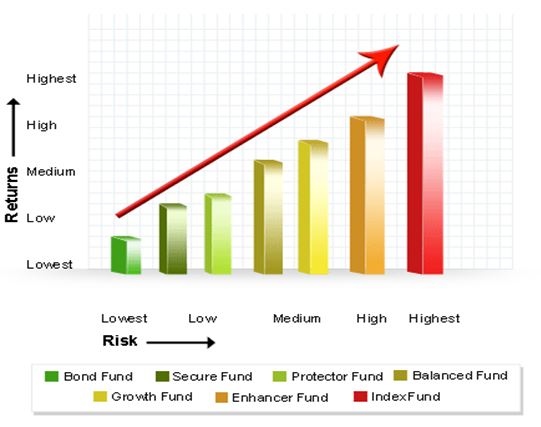

Risk and return are the most fundamental concepts of investment. Risk and return are directly proportional data. It means, taking a high risk, investors will receive a high return and the vice versa. There is an example for comparison. Some people use to dive in the water knowing nothing about its depth. Others prefer first to measure water depth, to calculate its indicators, and then to find out about diving safety. This example proves extremely high benefits for investors to predict a possible investing risk and to imagine its future effect.

In some books on the investing theme, they consider a risk as “a chance to the actual rate of Return on Investment can differ from expected”. In other books, the risk refers to “probability of negative outcome on your investment.” Thus, people use a risk concept to calculate the level of uncertainty. To take a low risk means to expect low return, and the vice versa.

The investors stay always in a search for a right solution that will help them to achieve the best high return with the best low risk. This is an ideal situation, hard-to-finding in the current uncertain economic environment. As discussed, high risks lead investors to high returns, whereas low risk normally leads them to low returns. The rate of return on investment mainly depends on the level of risk associated with investment. It is easy graphically to explain the relation between risk and return as the figure below illustrates.

Often people misunderstand the risk concept because of assuming that the high-risk level leads the high-return rate in any case. A high risk actually means only a possibility to provide an investor a high return, but there are no guaranties. Analogically, low-risk taking does not always lead to low return-earnings, because it is just a possibility to get low returns. Another concept necessary to understand is a risk-free rate. The risk-free rate is the rate of return on investment, achieved by investors through taking no risk.

As an example, it could be a rate of return on United States Government Bond. If the U.S. Government provided an 8% return on its bond investment, the risk-free rate would be 8%. Afterwards, the question arises: “Does investor aim to earn more than 8%?” The more he aims to benefit from the investment, the higher risk involved. Taking into account an acceptable scope of investing risk, the investor can accept a reasonable decision about his interest in the investment process. Benefits from investments can extremely vary investor to investor. There are a number of factors, affecting investors’ decisions, for example, an objective, personal situation, income level, etc.

Financial Investment Diversification

Diversification is one of vital investment basics. It is important to understand this concept to get to know why investors diversify their portfolio. Most investors cannot resist the short-term economic fluctuations, increasing as well as decreasing earnings from investments. To avoid a negative effect from economy uncertainty, investors need to diversify their investments. Diversification means managing and minimizing the risk by investing money in different sectors. As a complex concept, diversification needs its explanation through the example below.

There are two companies in a coastal area. One company sells sunscreen creams, and the other one sells umbrellas. As you can find out, the economic situation both of them depends on a season. If there were a rainy season, the umbrella company would operate with higher financial result. It is because of increase in demand for umbrellas. However, in sunny weather, the umbrella company most likely would have nothing to earn. In this situation, we have to invest a part of your investment in both the companies so that we are able to survive in both seasons.”

Diversifying investments Investors should abide by two main rules described below.

- It is necessary to invest money in different sectors allocating savings to stocks, cash, bonds, and in real estate. To avoid industry related risks, it is better to invest in different industrial sectors.

- It is necessary to invest money in companies with a variable risk. Before that, investor should choose an entity with different risk levels; moreover, blue chip shares should be not always preferred.

Diversification helps to achieve the long-term goals and makes us able to stand in short-term fluctuations. Diversifying their investment portfolios investors only minimizes the risk; however, there is no guarantee of high earnings. There is always a certain amount of risk involved no matter how much investor diversifies his investment.

Often investors wonder how many items they should use to achieve an optimum level of diversification. Experts suggest that 20 different stocks added in the portfolio are the most reasonable decision to avoid all individual risks attached with investment. Diversification means to buy the shares of the companies, variable in a size and type of industry.

Dollar Cost Averaging

The most difficult task while understanding the investment basics is picking the tops and bottoms of the stock market. Every investor aims to buy the stock at the lowest level and sell at record high level. Dollar cost averaging is a concept of buying shares for a particular amount regardless of their price. If an investor wants to buy the stocks of XYZ Company for $500 every week, we will buy the shares regardless of their price. If the price is higher, it is rather reasonable to buy fewer shares, and vice versa. The cost of the shares will be average out in the end. This technique helps to reduce the level of risk involved by purchasing shares at different prices.

Asset Allocation

Asset allocation is primarily decision about where to invest money. People, which want to invest their savings for a longer term, should invest in stocks. However, if people wish to invest for a short or medium term they should put their money in securities of different sectors and industries. Asset allocation is a technique that provides a balance in your investment and helps to diversify investments in a safe way. In asset management, it is actually necessary to divide the investment between cash, bonds, real estate, and stocks. Each of these investing directions provides its own level of risks and returns; therefore, the behavior of each sector is mainly different.

The asset allocation concept has a relation to an age of a person. Investing their money, the older people prefer to take lower risk. It is because of their savings, which in retirement generally come from the only source of income. To preserve their assets, it is safer for retirees to invest money in more conservative manner.

Another important aspect of asset allocation is to choose proper portfolio items for investment. The question arises: “How much money should we put on stocks and other securities such as bonds, securities?” Older and retired persons need more to invest in the items in which less risk is involved such as bonds and securities.

Random Walk Theory and Financial Investment

In 1973, Burton Malkiel first developed Random Walk Theory. The book titled “A Random Walk Down Wall Street” is now considered a classic investment theory. This theory states that the previous performance of any company in the stock market cannot be used to predict with precision its future performance. In 1953, this theory was first examined by Maurice Kendall stated that the fluctuations of stock prices were independent of each other.

Random Walk Theory says that the stock market always takes a random walk. People are able precisely to predict almost nothing about stock changes in the future. The chances of going the stock prices both upward and downward are equal. The followers of this theory assume a possibility to achieve high returns due to the correct calculations. Burton Malkiel stated that all types of analysis worked out to predict volatility of stock prices in the future make investors just waste their time. Malkiel supposed that only the long-term shareholding allows achieving high returns on your investment.

There are many followers of the Random Walk Theory. The others consider Investment a complex science, and they cannot invest their money based on a book written 40 years back. Today, investment basics changed as compare to 1973; moreover, nowadays people have a great access to the market news and ways to exchange views.

Hypothesis of Efficient Market

In 1960s, Eugene Fama first developed the idea of Efficient Market Hypothesis This theory states that it is not possible to beat the market as prices reflect all information. Disputed theory creates many controversies. Followers of this theory suggest futility of all types of technical and fundamental analysis.

In Efficient Market Hypothesis, investor can buy and sell shares anytime he wants. The return on investment mainly depends on a chance rather than investor’s skills. According this theory, if the stock market is efficient, the prices always go up. That is why it is useless to look for low-price shares.

Technical analysts always resist this theory due to their assumption that there is no logic in that old theory of financial investment. There are many arguments against the Efficient Market Hypothesis. As an instance, people invest their money because of the expectations, based on analysis of the company’s past performance and logical assumption about future prices.

Optimal Portfolio

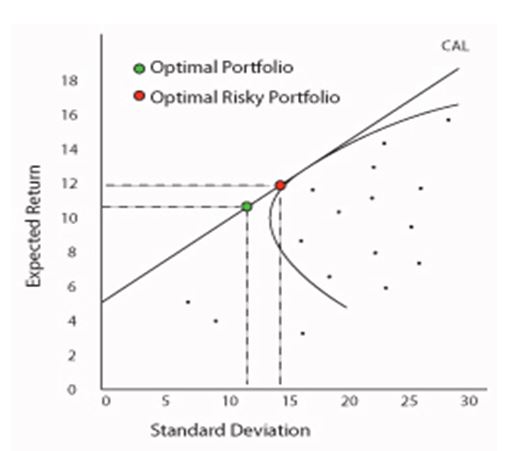

The Optimal Portfolio concept is based on Modern Portfolio Theory. Harry Markowitz first introduced this concept. He stated that different portfolios provide different levels of risks as well as return. The investors should accept a right decision about how much high risk they can manage. Then, on a base of that decision, they diversify their portfolios. The figure below explains what the optimal portfolio means.

If we look at the figure, we can see the optimal portfolio is always in the middle of the curve. Going up the straight line, portfolio reaches higher risk involved. Investors also have to think how volatile portfolio he should choose. Certainly, volatile financial investment is the one that provides investors with high returns; however, at the same time, risk involved is also higher.

Capital Asset Pricing Model

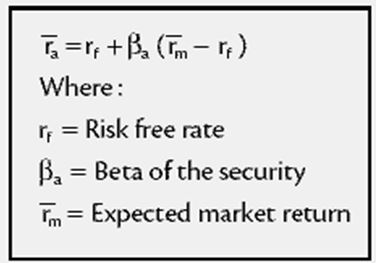

In 1952, Harry Markowitz developed Capital Asset Pricing Model, known also as a model for risky securities pricing. Some others have overhauled this concept during 60s. The model reflects the relation between risk and return. Its main idea manifests that expected return on security is equal to a sum of the security’s risk-free rate and a risk premium. If the result is lower than the required return, then it is not reasonable to invest in that option. The formula below describes Capital Asset Pricing Model.

Expected market Return = Risk Free rate +

+ Beta × (Market Return – Risk Free Rate)

Note: Market Return – Risk Free Rate = Equity market premium

In formula above, the result largely depends on the Beta value of the security. Stock’s beta measures the sensitivity of a stock relative to the overall market or an index. The trend is that the higher Beta’s value the higher expected market return. The sensitivity of stock usually is compared to the S&P 500 Index. However, this is just a theory, and there is no guarantee that this theory gives us 100% results in a practice case.

This article is aimed to help people to understand the basic concepts of investment and give readers some ideas about how the investment theories work.