The 2007-2008 Financial Crisis

2007-2008 Financial Crisis – According to Saylor Academy (2012), a financial crisis happens when many financial markets function inefficiently or stop functioning completely; when one or few of the financial markets stop functioning the crisis that result is nonsystematic Saylor Academy (2012). The 2007 financial crisis started with subprime mortgages and in 2008 it turned severe systematic after major financial institutions failed.

The 2007-2008 Financial Crisis was a combination of many things, including: Monetary policy easing, banks taking excessive risks, consumers borrowing more than they could afford, the eventual US Housing Market Crash, stocks and poor risk pricing, the federal budget deficit, excessive leveraging by banks, predator lending, poor underwriting practices and the Federal Budget Deficit. This paper explores how the 2007-2008 Financial Crisis financial happened, what markets were impacted and how it was dealt with.

Monetary policy easing – Deregulating policies that were placed in placed to repeat historic failures is like playing Jenga, eventually everything will fall. According to (Market Oracle Ltd, 2009), the first block of deregulation happened in 1980 with the Depository Institutions and Monetary Control Act of 1980 – this was the first thing the banking system was being let a bit loose after the regulations that were put into place after the Great Depression.

The act accomplished the following: required less reserved from the banks, it created a committee to get rid of federal interest rate caps, increased insurance of Federal deposits, allowed banks to get credit advances from the Federal Reserve Discount Window and finally, it overstepped over state laws that restricted lenders by putting a ceiling on the interest rates they could charge from mortgage loans.

The second piece of monetary easing happened when the government and their great wisdom or greed decided to pick apart key pieces of the Banking Act of 1933 (Glass-Steagall Act of 1933). The act was in place to prevent banks from gambling with people’s savings, it separated commercial banks from investment banks – this was very important because investment banks could not take huge risks with people’s money.

Gramm-Leach-Bliley Financial Services Modernization Act was the drop that spilled the cup or the final straw that broke the camel’s back. This law, removed the last protective barrier that Glass-Steagall Act provided and allowed banks to do whatever they wanted; for example, Travelers investment bank was able to buy Citibank…Remember the law wanted to keep investment banks from using people savings? Well, this last act allowed investment banks to play with other people’s money (Market Oracle Ltd, 2009). Monetary policy easing removed all roadblocks that annoyed banks, but kept people’s savings intact and save; additionally, it gave birth to Subprime lending which later would be a major player in the Housing Market crash.

Banks taking excessive risks: According to (The Economist, 2013) Senator Phil Gramm once was quoted as saying “I look at subprime lending and I see the American Dream in action”. Due to the economy doing so well and low inflation, banks and investors were willing to take more risks in order to get a piece of the action. Banks were being irresponsible with mortgage lending and lower standards with subprime lending, borrowers who should not have gotten loans were able to get into houses they could not afford.

In order for banks to lessen or mitigate the risks, they played the numbers games, they gathered a many high-risk loan and put them together in groups (pooling), depending on the probability of defaults – in theory, this would decrease the risk because what were the probabilities that all borrowers in that pool could default on their loans? (The Economist, 2013)

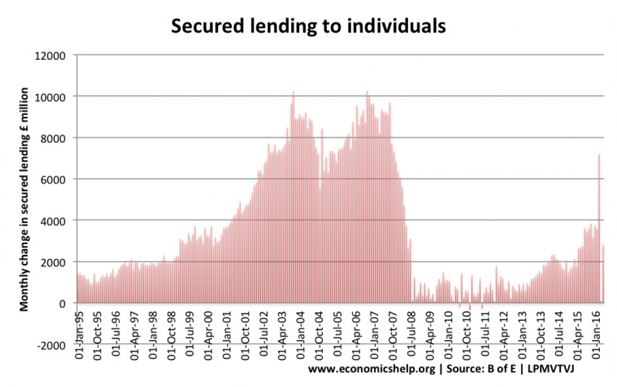

Consumers borrowing more than they could afford – This comes back to subprime mortgages and just the timing of what was happening with the economy and the housing market. According to (John V. Duca, 2013) – traditionally, borrowers have to have good credit, good income and good debt to income ration in order to be the proud owners of a house with a white picket fence – those borrowers who did to meet the requirements above, would historically not qualify for any loans to buy a house. The ability of more people qualifying for mortgages they could not afford, lead to an increase in the housing market because the economy was experiencing more first-time home buyers.

The increase in demand created an increase in housing prices and it required more money to be borrowed by the people who were already stretched thin on the amount of money they were borrowing (John V. Duca, 2013). Up to this point, banks and consumers were lending and borrowing money banking on best case scenario and not planning for the worst. Added to the situation was the fact that the government had mandated Fannie Mae and Freddie Mac to increase home ownership, so both Fannie Mae and Freddie Mac had purchased lots of subprime mortgages (John V. Duca, 2013).

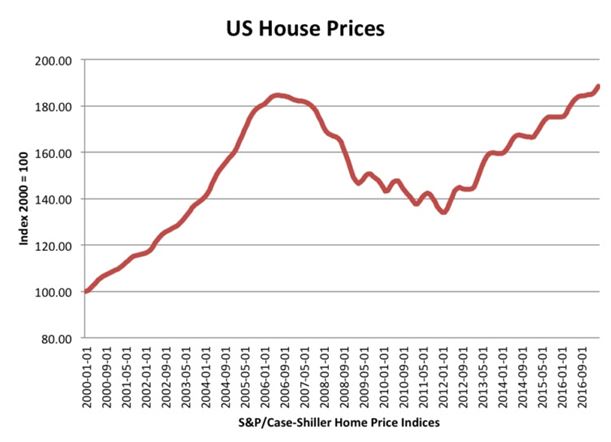

US Housing Market Crash – In the famous quote from Isaac Newton “What goes up must come down”. Once housing market reached its plateau, mortgage financing and home selling became less attractive and that is when they began to drop in price, lenders and investors started losing money. The first casualty of subprime mortgages happened in April 2007, New Century Financial Corps filed for bankruptcy – after that, all the pooling that was done by experts to mitigate default risk was downgraded to high risk and many small subprime lenders went out of business. Lenders stopped issuing loans, specially the high interest rate ones (subprime) – this resulted in less people getting loans after that and as a result, less houses being purchased by consumers.

Low demand for houses led to a drop-in price, the famous law of supply and demand had kicked in. Prices dropped so much that borrowers who were trying to sell them could not send them at the price they owed in their loans. Remember that government told Fannie Mae and Freddie Mac to increase home ownership? Well, as a result, Fannie Mae and Freddie Mac suffer major losses an all subprime mortgages they had purchased and insured (John V. Duca, 2013). The housing market was flooded by banks selling their foreclosed/repossessed homes, people trying to sell their houses because they get foreclosed, people doing short-sales and in addition the market was getting the normal number of houses being sold the usual sellers (new construction, people moving, etc.).

Stocks and poor risk pricing – Prior to the economic crisis, investors were unable to get the exact value of risk they would be bearing when taking up stocks or financial assets from the traders. Risk pricing or the cost of risk is implied in the rate of interest charged and the investors, with poor risk profile of certain assets in the market, would not know the value of the risk assumed when buying stocks or the value of risk exchanged when selling stocks (Amadeo, 2010; Williams, 2010). The market participants were thus inaccurate in their risk analysis due to the complex financial system and innovations among other factors such as ignorance and deceit from the traders themselves.

JP Morgan is quoted as selling and quoting the risk price of CDOs at a price way lower than the market price due to lacking accuracy or information as is contrasted to stable prices in a perfect market, where market information is publicly available, as per the Basel accords. In a similar risk pricing error and crisis, the AIG had to be taken over by the American government, settling about 180 billion US dollars from the tax payers’ money because AIG had taken premium guarantees to pay several CDS obligations to many lenders of small and global parties, whose risk profile was then uncertain to the lender and insurer and plunged the institution into near bankruptcy (Amadeo, 2010).

There was then no clear model of ascertaining the level of risk assumed by a guarantor or a borrower given the dynamic and complex financial innovations of the time and the slowly growing financial academia, practice and experience within a span of two years, that is, between 2007 and 2008 (Jickling, 2009).

The Role of The Federal Reserve in the 2007-2008 Financial Crisis

The Federal Reserve and liquidity – The Federal Reserve is the lender of last result to banks and thus, is the only last savior in a financial crisis. However, the reserve faced inadequate cash to lend to banks with the rapid mortgage and loan processing witnessed alongside booming borrowing and house financing by banks and financial institutions. Commercial banks couldn’t afford adequate liquidity to finance their obligations and the large sizes of mortgages they were buying.

In the same time, the price of commodities and especially minerals such as oil and copper were growing at an unsustainable rate, with most of the minerals being imported from outside. The rise would give the impression to traders that it was an opportunity to invest in the appreciating metals and thus, there was a general cash outflow from the US in exchange for metals and gems, which saw increased trading lead to a decline in the prices thereof and a general loss of cash from the American economy to oil producing and mining countries such as the middle east nations. The cash inflow into the US was less than the cash outflow and commercial banks would earn less than they were paying as cost of leveraging. This Federal Reserve with less inject into the economy to facilitate liquidity among the commercial banks (Jickling, 2009).

Excessive leveraging by banks – Before the 2007-2008 financial crisis struck the market, banks and other institutions in the mortgage and finance sector had used massive leveraging, that is, using credits and other derivatives to acquire assets. Leveraging shifts the risk of lending to the leveraging institution, thus removes the risk adverseness of a financial institution. They trade with appetite for risky investments which they perceive are most productive. The state of affairs with the highly leveraged financial institutions, therefore, led to risky deals which ultimately led to high rates of defaulting. Also, a major contributor to the 2007-2008 financial crisis.

The high level of leveraging, also, exposed the banks to massive risk impact should a financial downturn result and when it did with the bursting housing prices balloon, the financial institutions came crumbling down, leading to a global and all-sector financial crisis with little identity as to which institutions were in bankruptcy (Amadeo, 2010). This was as a result of a complex system of financial derivatives and contracts that were difficult to determine given the limited financial information then available (Jickling, 2009).

Predator lending – Another factor that contributed greatly and grossly to the financial crisis of the time was the deceitful predatory lending by financial institutions. The institutions would entice borrowers or mortgage buyers with appealing interest rates and have them commit to the mortgages even when such a commitment had hidden charges or adjustments (The Economist, 2010). A common practice involved the use of very low interest rates to hook up people after financing. Upon the completion of the mortgage, the client would realize later that the mortgage was an adjustable one with rates rising gradually to almost double the value they borrowed.

Many would end up unable to pay back the commitments and have their mortgages seized or have to deal with a negative amortization mortgage (McLean & Nocera, 2010). In one case, the California attorney sued Countrywide Financial for fraudulently enticing borrowers in to a bait-and-switch conman mortgage with expensive mortgage payments (The Economist, 2010). With the falling housing prices, the home owners with outstanding mortgages were demotivated to pay their dues against the devalued prices of their mortgages, leading to massive defaulting and a financial crisis in the industry (Jickling, 2009).

Poor underwriting practices – Another factor that led to the ultimate onset and peaking of the financial crisis was the poor underwriting practices by intermediaries, banks and even insurers. Regulations require that a loaning process should follow the loaning institutions documentation guidelines and the underwriting process ought to be understood in depth to avoid unforeseen difficulties or illegalities. However, the pre-crisis period was characterized by rapid underwriting processes with little or no attention to the lender’s procedures and rules of engagements.

Loans and mortgages would be processed with little or no official documentation completed as per the issuers rules of engagement, which would lead to borrowers being subjected to terms they didn’t sign for or they were unaware of, high defaulting rate by loan holders and selling of loans without full disclosure as to the terms attached to such loans (Greenberg & Hansen, 2009; Amadeo, 2010). At the end, the victims would be realized as unable to honor their commitment due to the inflated loans, some of which would never be recovered.

In this saga, about 1600 mortgages bought by the mortgage firm Citi from mortgage dealers were found to be defective and unenforceable while the mortgages had been passed on from the dealers to the banker. The poor and fraudulent underwriting process therefore contributed immensely to the financial crisis in which banks couldn’t provide financing as they had too many commitments to honor, alongside the housing crisis (Jickling, 2009).

2007-2008 Financial Crisis, in conclusion, this paper asserts the academic and scholarly authority that the largest and longest financial crisis witnessed post the great depression era was as a result of structural factors such as the easing on monetary policies, excess risk assumed by banks, excessive borrowing of cheap but risky loans by consumers, the fall of the US Housing Market, poor risk profile on stocks, the federal budget deficit, over leveraging by banks, predatory lending, poor underwriting and the Federal Budget Deficit. These factors made many banks and institutions to collapse.

References

Amadeo, K. (2010). “2008 Financial Crisis: The Causes and Costs of the Worst Financial Crisis Ever Since the Great Depression.” The Balance.

Greenberg, R., & Hansen, C. (2009). “If you had a pulse, we gave you a loan.” NBC news.

Jickling, M. (2009). Causes of the 2007-2008 Financial Crisis.

McLean, B., & Nocera, J. (2010). All the devils are here: unmasking the men who bankrupted the world. Penguin UK.

The Economist (2010). “Predatory lending: let’s not pretend we don’t understand how it worked.”

Williams, M.T (2010). Uncontrolled risk: the lessons of Lehman Brothers and how systemic risk can still bring down the world financial system. McGraw-Hill.

Relevant Posts

Behavioral Finance Financial Decision Making

Finance Dissertation Topics

Did you find any useful knowledge relating to the 2007-2008 Financial Crisis in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.