Unemployment, Inflation and Production

Normally, unemployment takes place when an individual who is actively searching for is actually unable to secure work. With this, any country globally uses the unemployment concept to determine the health of its economy. In essence, the unemployment rate is the most used measure of unemployment which is basically the actual number of unemployed individuals divided by people within the labor force. Thus, in any country, there happen to be unemployment even though the economy is at full employment because of frictional and structural unemployment (Hakim, 2015).

First and foremost, frictional unemployment takes place when people keep transitioning from their old works to new ones during a certain period. This kind of unemployment is actually considered a voluntary one since workers decide to remain unemployed in an economy instead of taking up the first job opportunity offered. Hence, this kind of unemployment is normally present because a significant number of people consistently keep on searching for new employment opportunities (Dullien & et al., 2018). Equally, structural unemployment take place when market conditions, as well as business cycles, keep on changing due to oversupply of employment opportunities and individuals are fundamentally willing to work, however they are not qualified for these employment opportunities; hence, it is absolutely impossible for unemployment to be zero in any economy (Johnson, 2017).

Lastly, individual, societal, and country costs are primal costs associated with unemployment. In essence, unemployed people are actually subjected to massive loss regarding income earnings, hence, reducing their living standards. With this, the societal is compelled to spend more in order to provide the needs of unemployed population and unemployment benefits paid by the government keep on increasing whilst the government is unable to collect enough income tax as before; hence, increasing government borrowing or reduce its other expenditures which reduce economic growth (Hakim, 2015).

Unemployment and Consumer Price Index

Produced by the Bureaus of Labor Statistics, the Consumer Price Index (CPI) is used to measure the inflation rate in America. Normally, the CPI is determined by taking price changes of every item in the predetermined product basket and then averaging them. In essence, the CPI adjusts payments to inflation in order to effectively assess the price changes associated with the cost of living. However, CPI’s accuracy has been questioned to a number of biases that actually make it to overstate the effectiveness of the inflation rate.

First and foremost, when the prices for products in the consumer basket substantially increases and consumers opt to substitute them with lower priced ones, there exist substitution biases. This is because the CPI cannot precisely predict the price increase effect on consumers’ budget given the fact that the CPI is based on a fixed-weight price index (Dullien & et al., 2018). Moreover, the CPI does not take into consideration new products when determining the index until they fundamentally become ordinary. Above all, sudden decline in product prices normally linked with new technology ones and advanced increase in life and usefulness of products are not whatsoever depicted in the index. Lastly, when consumers shift to new outlets, the CPI is unable to account for this given the fact that the product basket is predetermined. With this, the CPI is not able to precisely measure a change in the cost of living standard over time (Johnson, 2017).

Dependability of Government Tax Revenue and Spending on the Economy’s State

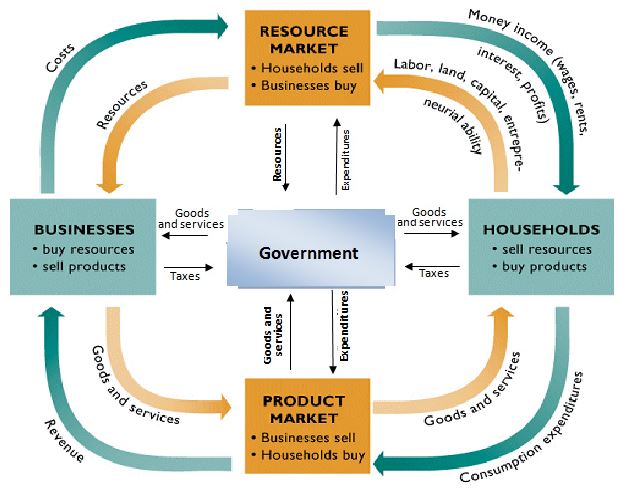

In any country, when the economy expands so does people’s income rises since more employment opportunities are created and people are employed. Even if the government cannot actually raise the taxation rate, it can still collect more taxes. This is because the tax revenue base keeps on becoming big as more and more people are able to secure employment and pay income taxes; hence, the government is able to increase its expenditure.

Contrary to this, when an economy is unable to create employment opportunities and citizens are unemployed, the tax revenue base is small since people have no income on which taxes can be levied from. Subsequently, the government is forced to reduce its expenditure whilst increasing borrowing in order to provide unemployment benefits. Thus, the nature and composition of an economy’s state influence government tax revenues, government expenditure and social welfare (Hakim, 2015).

Limitations of Gross Domestic Product as an Indicator of Living Standard and Unemployment

As the total monetary value of final output produce within a nation’s borders in a specified time period, the Gross Domestic Product (GDP) is normally calculated either quarterly or annually. In essence, the GDP incorporates all total output of the country by adding up all private and public consumptions, government expenditure, investment, and net export to measure the economy’s overall activity as an indicator of nation’s economic health and its living standard (Dullien & et al., 2018). With this, the GDP measure a nation’s output produced and retailed in legal markets whilst omitting productive activities such as prostitution and individual fixation of water leak which have no market transactions; hence, the GDP does not perfectly measure the living standard within a certain country.

Moreover, the GDP does not measure the environmental quality in determining the living standard of the nation. By an economy having significant GDP does not necessarily indicate that its people have a quality life when air, water, soil or even other natural resources are actually polluted. In essence, the GDP totally fails to measure the contribution of environmental sustainability to the country’s living standard. Equally, the GDP does not take into account how leisure time actually contributes to the country’s living standard. Although a country can have higher GDP if its economy is 12 or 24 hours one, this does not imply that people are better off given the fact that leisure time is vital in living standard (Johnson, 2017).

Therefore, the prevalent alternative to GDP as an indicator of living standard is the Human Development Index (HDI). Besides considering a country’s GDP, the HDI emphasis on people more specifically on their opportunities to achieve work and live satisfaction. In essence, in addition to the GDP, the HDI uses health and education statistics to measure the living standard within a certain country. By partially using purchasing power, which measures the actual cost of the same basket of output produced with a country’s border, the HDI can adjust the GDP to better measure living standard of a country (Dullien & et al., 2018).

References

Dullien, S., Goodwin, N., Harris, J. M., Nelson, J. A., Roach, B., & Torras, M. (2018). Macroeconomics in Context. Routledge.

Hakim, T. A. (2015). Introduction to Macroeconomics.

Johnson, H. G. (2017). Macroeconomics and monetary theory. Routledge.

Relevant Posts

If you enjoyed reading this post on unemployment, inflation and production. I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.