Accounting Information System

Executive Summary

This report pertains to the selection of an Accounting Information System for an organization having 50 employees and annual revenues of $10 million. A number of accounting information systems has been discussed in the report, but most of them are suitable for a large sized organization with high geographical expansion and huge number of employees. It is evaluated whether a business is small or large, but it always requires the implementation of an appropriate accounting information system to enhance its productivity and reduce its operating expenses.

As the company is operating in an apparel industry, therefore, the PolyPM ERP software has been recommended for the better operations of the company because it contains a number of industry specific characteristics. This will help the company in effectively designing its strategies and products, which will increase its revenues in the long run.

Introduction

The paper provides an in-depth understanding of the potential challenges that ABC manufacturing will face due to its high dependence upon manual accounting and other management practices. It is important to notice that even in such a technologically advanced era, where almost all the manual and analogue tasks have been transformed to a digital one, ABC manufacturing is still operating manual systems for managing their accounts and other operational management tasks.

The paper is aimed to provide an appropriate suggestion for the selection of a suitable accounting information system that would not only help them in managing their accounts and financial transactions, but will also assist the management in effectively managing other operations of the business.

Company Overview

ABC manufacturing is a small sized family-owned business having its operations in the Melbourne city. The business has 50 employees working at different tasks and locations in the city. It has been established about 20 years ago as a small sized business and their main product line was winter clothes and the main target customers were a number of cloth shops in the city.

It has reported revenue of $10 million during the last year, which is a handsome profit for this size of business. The company has recently expanded its business and launched some new product lines, but due to ineffective cost management of the company, it was unable to offer these products to the customers at competitive prices and faced a downturn in the market in terms of revenues and market share.

One of the major reasons behind its high operating cost is the company’s manual operational and managerial practices because it has to hire a number of personnel for managing different tasks of the company, which can be otherwise cost effectively and efficiently performed by establishing an automatic or computer-based infrastructure for the management of all the major tasks of the company. With the help of such systems, the company would become capable of performing and monitoring multiple tasks simultaneously even in remote areas of the country.

Business Requirements

The current concern of ABC manufacturing is related to the uncontrollable operating cost of the company, which is causing huge losses to the company’s reputation and earnings as well. The major reason behind such a high operating cost is its manual business practices because manual operations don’t only require higher number of employees, but also requires a large office area and other related expenses to accommodate these high numbers of employees.

Therefore, the company needs to employ such an expert information system that will not only address the accounting related requirements of the company, but will also help the management of the company in reducing their operational expenses to increase its efficiency and performance. It will also help the company in transforming its manual sales management and revenues recognition methodologies to a digital one, which will enhance the accuracy and efficiency of the sales function of the organization and increase the overall productivity of the organization (Dickhaut & Lere, 1983).

For the success of a business, it is necessary to have such a competent team of the management, which can make timely and accurate future forecasts regarding the company’s future performance and earnings, such forecasts are usually based upon the company’s past performance and the adjustment of its operations towards the changes of the internal and external economic factors.

It is reported that the company has been planning to expand its business to other markets of the city and even outside the city, therefore, it is necessary for the management to make a competitive feasibility report regarding the company’s expansion of its operations. The feasibility report should be based upon certain realistic estimates and calculations because the company has to take their decision on the basis of that report.

Communication plays a vital role in the development and success of any sort of business because it keeps the employees updated about different departments and functions of the organization. Therefore, it is necessary to integrate an effective communication system into the current organization structure, which will help the company in effectively executing certain activities like job rotation and job enlargement. Inventory management is one of the important processes of an organization that can have a great influence over the future performance of a company.

In order to meet the increasing market demand and retain its customers in the long run, the company has to maintain an effective inventory management system. Which will not only help it in maintaining an effective purchasing function, but also help it in reducing the cost by employing a just in time inventory system. Although, the company has a limited number of employees, but in relation to its size that the management of these employees also becomes a very tough task, therefore, the company needs to have a competent payroll system.

So that it can become capable of keeping the payroll record and disbursement of salaries to the individual bank accounts of all the employees on certain fixed time, i.e., on the 1st day of a starting month or on the last day of an ending month. For a customer centric organization, it is very necessary to meet the changing trends and demands of the market because it would not be capable to stay in competition without addressing the needs and demands of the customers.

Therefore, the management of the company should be capable of evaluating the changing trends of the market and it should be able to timely respond to these changes. This will help the company in capturing the potential customers on a timely basis and give a competitive edge to the rest of the industry.

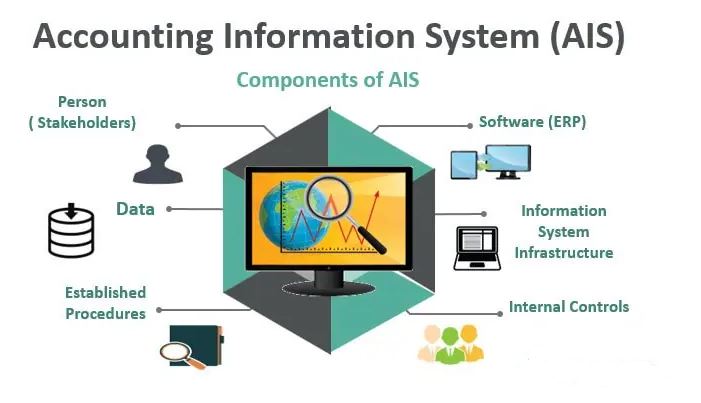

System Requirements

AIS should be designed in such a manner that it can cover all the business functions of ABC manufacturing, i.e., from managing the accounting transaction system for supporting the top executives of the company in financial planning and decision-making processes. The system should connect all the three major operational departments of the company, i.e., sales, purchasing and production, so that the transactions can be summarized for the internal decision making of the middle line managers.

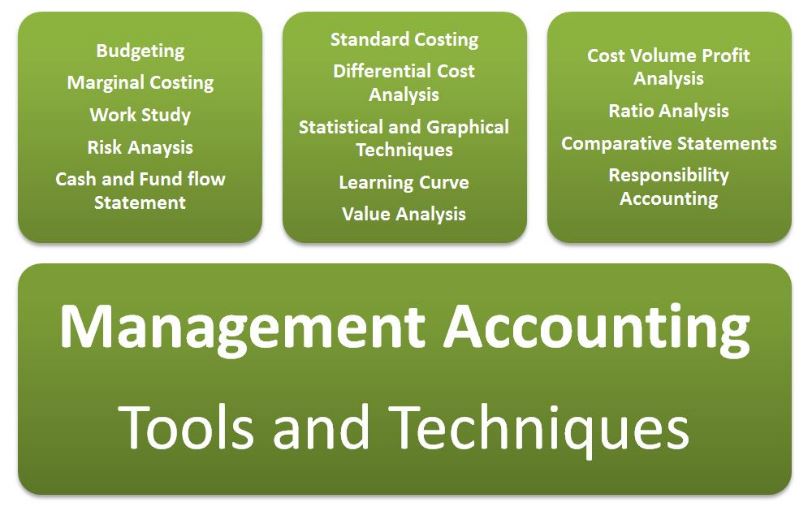

The AIS should also be equipped with a sophisticated cost accounting system, which will help the management in tracking the total cost associated with the production of a product. This will help the company in proper allocation of its resources and also help it in exploring different opportunities to lower down the production cost. It should also have certain qualities of an expert management system, which means that the system should be capable of organizing data in a logical manner and then forming decision on the basis of this information (Dickhaut & Lere, 1983).

The AIS should be updated according to the applicable financial reporting framework of the entity and should also comply with all the legal requirements of the country where the entity is having operations. It should be capable of exercising strong internal controls over different functions of the organization and connect different departments of the organization with each other through a cloud computing mechanism. It should contain tools like customer relationship management, supply chain management and capable of using advanced accounting techniques, i.e., activity-based costing (ABC system). This will help the company in performing improved managerial reporting by employing a number of analytical techniques.

Software Selection

There are a number of companies that are offering different software packages to the business community. Some of them sell the software as an end product to the buyer, while the other enter into a service agreement with the companies and offer them different packages, while retaining the ultimate control and ownership of the software with themselves (Fulmer & Gerard, 2015). Intacct is one of the most efficient and productive software that can be employed in a small or midsized business. It is a SaaS (Software-as-a-service) product, which means that it can be accessed at any time by visiting the website of the company through a browser.

It offers a number of products according to the requirement of the entity and support applications for the management of core accounting, project accounting, revenue management, purchasing, order and billing, multi-currency management, financial reporting and also help in the decision-making process (Wu & Cao, 2009). Another software known as Sage ERP is a collection of different products that are designed to meet the requirements of a highly diverse industry, i.e., Sage ERP Accpac, MAS and X3. These products cover a wide range of services and provide a competitive environment for a manufacturing concern. Sage ERP offers functionality for inventory control, supply chain management, manufacturing and distribution, material resource planning and human resource management.

PolyPM provides a complete ERP and PLM solution for small and mid-sized manufacturing and distribution concerns. The software is specifically developed for a company operating in the apparel manufacturing industry. It offers a wide range of industry specific services and possess certain unique characteristic like it can be customized according to the requirements and size of the business. The developer of this software is easily accessible and ready to help the users at any time on their doorsteps. It can be implemented in an organization having annual revenues not exceeding $300 million.

The company is currently operating in a single city with 50 employees and $10 million annual revenues; therefore, a medium sized ERP software is suitable for the company, which would only be able to manage the key operational and management functions of the company. Implementing a medium ERP solution will require lower capital investment as compared to implementing a high-end solution.

It is evaluated that the company is currently operating manual systems and it would require a significant number of resources to train the employees of the company to run a totally computerized system. Therefore, initially the implementation of a medium level ERP will help the company in arranging a suitable training environment for its employees, where they can learn how to carry out computerized based operations. This will reduce the expenses of the company by eliminating the cost required for the training of the employees (Mojzis & Coufal, 1970)

Another reason behind the implementation of a medium level ERP is its user-friendly interface, which will reduce the risk of error and execute different functions of the organization effectively even during the trial period. Unlike the high-end complicated ERP solutions, the medium level ERP system will not require the company to transfer all of its departments to the computerized system simultaneously rather it will provide an opportunity to initially implement the ERP over some of its departments and if the response is favorable, then the company should extend this system over the rest of the organization as well. This will help the company in evaluating the performance of the proposed ERP system and also help it in fixing the weaknesses of the proposed system (Kamiński, 2010).

Accounting Information System Vendor Selection

The Sage ERP and PolyPM ERP solutions are the most suitable options for the company and the company has to make a choice out of these two solutions because the ERP solution offered by the Intacct is not suitable for a business like that of ABC manufacturing. Sage ERP solution is developed by the Sage Company, which is a $2.24 billion business and headquarter of the company is located in England. The company is also operating in other regions of the world under the same brand name (Jutras, 2003). It offers a number of ERP solutions and users have to make their choices according to the specific requirements of their business.

The company also develops software on the demands of the customers and sells it to the buyer as an end product. The Sage ERP X3 is the most suitable product for ABC manufacturing because it is a very cost effective and easy to use product. Users can integrate this software into different processes of their business through a single common system that can be accessed through a single user interface. The software will help the management in timely decision making by dealing different issues of the customers and business in real time scenarios.

It is also capable of addressing the changing business environment and demands of the customers due to the growth of the company enabling the users to improve the productivity of their operations. This software can translate multiple languages for the users and can be used at different locations simultaneously. However, the implementation of this software would require the company to invest heavily at the start, but it will benefit the company in the long run.

PolyPm software is an ERP solution developed by the Polygon Software Company, which has a long history of developing industry specific software for the apparel industry. The company had developed its first software about 30 years ago, known as the PloyNest. However, with the development of technology, most of the businesses have started to transform their operations on the ERP solutions and therefore, the company had also developed a unique ERP solution that is also having the PLM/PDM in addition to the ERP, which are integrated into a single application. The software allows its users to integrate all the functions of the organization from product development to distribution processes.

It helps the management in building an understanding about the specific market requirements and changing trends of the market, so that they can adjust their products accordingly (Chen et al., 2011). Unlike the Sage ERP X3, it can be customized according to the specific requirements of a user’s business and can be installed directly into the client server and run over the SQL database of the Microsoft. This option will reduce the cost of implementation of new ERP software. By incorporating all the steps involved in product development, companies can get a better understanding of the overall lifecycle of a product, from the development of an appropriate and attractive design to the execution of production and distribution activities.

Some of the functions that are incorporated into the software and related to the specific requirements of the apparel business include fabric inspection, size ranges, Cut planning and CMT production. The software also contains some standard production functions to enhance the quality of the products like PSV, order tracking and BOM. It also connects different departments of the company with one another so that they can effectively communicate and share their individual experiences (Bell et al., 2010).

Accounting Information System Recommendation and Conclusion

I would recommend the PolyPM software to the ABC manufacturing company because the company is operating in the apparel industry and this software has been developed according to the specific requirements of the apparel industry. The software contains all the functions and specifications that can easily meet the requirements of ABC manufacturing. It will help the management of the company in managing their operations and product development activities and just like other management expert system, it will also provide suggestions to the management regarding incorporating different sort of changes in its products.

Due to its simple to use interface and low system requirements, it will not require the company to invest heavily in its installation or implementation in the organization (Fulmer & Gerard, 2015). The proposed ERP system will also help the company in managing its inventory, because inventory management is the most important function of an organization and a slight miss management of this function can cause huge losses to the organization, i.e., goodwill, customers and corporate reputation.

The proposed ERP solution will also make a real time connection between different departments of the company and especially between the production, inventory and sales department, this will help them in effectively communicating with each other, which will not only enhance the quality of the product but will also reduce the material wastage (Daneva, 2004).

A strong communication between different departments of the company will allow its management to implement a just in time inventory management system, which will further reduce its operating cost and the company will become capable of offering its products at competitive prices, based on the successful deployment of an accounting information system ERP.

On the basis of the discussion made in this paper, it has been concluded that Accounting Information System can enhance the productivity and performance of an organization and open a number of new opportunities in terms of new business ventures and growth strategies. The selection of an appropriate Accounting Information System should always be based upon a critical evaluation of the organization’s needs and operations (Hamilton, 2003).

Although, the implementation of such software requires a high initial investment, but in front of the long-term benefits associated with the establishment of such software, these elements are negligible. However, it is observed that a competent software is the one that can incorporate all the legal, ethical and accounting standards and implement them in the operations of the organization.

References

Bell, R., Dentale, S., Buchner, A. & Mayr, S., 2010. ERP correlates of the irrelevant sound effect. Psychophysiology.

Chen, K., Razi, M. & Rienzo, T., 2011. Intrinsic Factors for Continued ERP Learning: A Precursor to Interdisciplinary ERP Curriculum Design. Decision Sciences Journal of Innovative Education, 9(2), pp.149-46.

Daneva, M., 2004. ERP requirements engineering practice: lessons learned. IEEE Softw., 21(2), pp.26-33.

Dickhaut, J.W. & Lere, J.C., 1983. Comparison of Accounting Systems and Heuristics in Selecting Economic Optima. Journal of Accounting Research, 21(2), p.495.

Fulmer, B.P. & Gerard, G.J., 2015. Selecting an Enterprise Resource Planning System: An Active Learning Simulation. Journal of Emerging Technologies in Accounting, 4(12), pp.150-76.

Hamilton, S., 2003. Maximizing your ERP system. 1st ed. New York: McGraw-Hill.

Jutras, C.M., 2003. ERP optimization. 1st ed. Boca Raton, Fla.: St. Lucie Press.

Kamiński, A., 2010. Computer Integrated Enterprise in the MRP/ERP Software Implementation. Foundations of Management, 2(2).

Mojzis, M. & Coufal, J., 1970. ERP Experimentation Guide Software. Front. 2nd. INCF. Congr. of. Neuro..

Wu, H. & Cao, L., 2009. Community Collaboration for ERP Implementation. IEEE Softw., 26(6), pp.48-55.

Relevant Accounting Information System Posts

Accounting Dissertation Topics

Management Accounting Systems Dissertation

Did you find any useful knowledge relating to the selection of an accounting information system in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.