Negative Effects of Financial Gearing

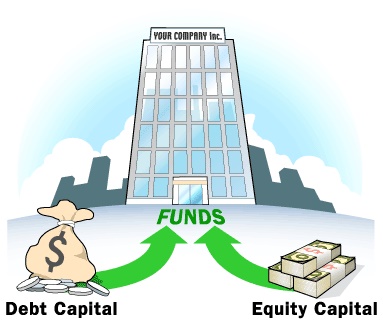

Capital structure is one of the paramount elements which a firm should consider when undertaking its short term and long term projects. Well, the balanced capital structure enables the company to achieve strike off the balance of growth‚ Continuous improvement and growth‚ risk mitigation thus ensuring production goes on uninterrupted. For this matter the paper analysis the factors to consider when setting the capital structure‚ advantages of proper debt-equity management and lastly the risks of having improperly balanced capital structure when financing various operations. Finally‚ evaluation of best financial management techniques which can help to ensure organizational goals are achieved without compromising its operations.

Enterprises should maintain the proper balance of the capital structure which entails attaining the reasonable level of equity-debt level. Furthermore‚ it is recommendable that there should be the efficient matching of liability to asset level, this implies that only long-term projects should be. Financed by the long-term liabilities and vice versa for short-term projects which should be funded by use of the short-term sources of the funds. Lack of this aspect will compromise the value of the firm which can lead to financial distress in its advance levels‚ as debt capital is very much expensive source of fund (Ding, Wu, & Zhong, 2016‚p 328).

For instance use the short-term loans to build rentals with the anticipation they will raise some money which can be used to service the loan repayment can ditch the firm in financial problems especially when the building fails to get occupants. It should be noted that returns on some projects are probabilistic whereby there is no consistency of their returns as market forces of demand and supply are unpredictable. Thus market assessment and evaluation should be carried out to prevent such advance results which can jeopardize the firm’s operations.

Factor to Consider When Setting Appropriate Capital Structure

In recent past, there has been the development of various theories to expound on factors which should be considered when determining proper level debt-equity ratio to be maintained by the company (Öztekin, 2015 ‚p 302). Most of the theories suggest that before choosing the capital structure to use firms should consider various factors which include the following;-

Cost-benefit‚ the companies should come up with the capital structure which yields the highest return with the least risk involved. For instance, if the shareholders capital is capable of financing the operations of the firm or they have sponsors. Dong, Yanmin, Kaul, Charles ‚Yui, and Tsang, (2016‚p 200) noted that having these organization helps in achieving proper control and management of capital structure The management should opt to maintain the high level of equity to debt ratio in its capital component. Furthermore‚ depending on the risk propensity and attitude of the management one can opt to go for debt capital due to tax shield benefit.

Financial flexibility‚ this involves ease at which the enterprise can interchange debt to equity without possible cases of financial distress. For instance, promptly the airline industry is capable of making significant returns‚ while at bad times it can consider raising working capital through debt capital.

Management style may be classified as either aggressive or conservative. Aggressive managers have the appetite for risk‚ hence taking the risk for them is not a big deal (Zawadzka, Szafraniec-Siluta, & Ardan, 2015‚p 358). For conservative managers, they are risk averse, so they will tend to avoid debts.

The growth phase of the firm -The companies in growth stage tend to finance their operations through debt capital while well-established firms prefer equity capital more than debt capital.

Market condition‚ if the company is raising funds to finance new plant having high market volatility. In such situation, there are high chances of the company to land in financial distress whereby the returns accrued from the plant are not sufficient to service the loans.

Illustration

Assuming that a company has borrowed £5,000,000 to be repaid for eight years at an interest rate of 12% pa to invest in both shares and real estate. The repayment will be systematically be amortized as follows:-

|

Year |

Opening Balance | Annual repayment | Interest | Principal |

Closing balance |

| 1 | 5,000,000 | 1,006,514 | 600,000 | 406,514 | 4,593,486 |

| 2 | 4,593,486 | 1,006,514 | 551,218 | 455,296 | 4,138,190 |

| 3 | 4,138,190 | 1,006,514 | 496,582 | 509,931 | 3,628,259 |

| 4 | 3,628,259 | 1,006,514 | 435,391 | 5,711,223 | 3,057,136 |

| 5 | 3,057,136 | 1,006,514 | 366,856 | 639,658 | 2,417,478 |

| 6 | 2,417,478 | 1,006,514 | 290,097 | 716,417 | 1,701,061 |

| 7 | 1,701,061 | 1,006,514 | 204,127 | 802,387 | 898,674 |

| 8 | 898,674 | 1,006,514 | 107,841 | 898,673 | – |

Amount to be repaid annually is 5,000,000=PMT (1-1/ (1+r)/r

£5,000,000=PMT (1-1/ (1+0.12)8)/0.12=£1006514.

Assuming after the company bought shares the value of returns on stocks deteriorated and stabilized at £50,000 at the interest rate of 10%. The present value can be computed by use of present annuity formula as follows

Amount=50,000 (1-1 / (1+0.10)8)/0.10=266746

From above illustration the due to unforeseen market condition during loan acquisition. The firm will be unable to meet the debt obligation as even cumulative returns for eight years cannot pay for the loan in the first year. As there is the deficit of 1,006,514-266,746=£749,768.

Advantages of Above Arrangement

Robust accessibility of capital‚ efficient utilization of the debt capital can help the firm achieve the significant level of growth especially when the management have ventured in the viable industry. For instance ‚ by venturing in real estate the company will be capable of recouping the money required to service the loan in a very short. After which it can invest back the capital accumulated. The net effect of this will be multiplier effect‚ which will help the firm achieve its goal for sustainable development.

Best for buyout and acquisition for strategic growth‚ due to the risky nature of the debt capital it is only effective when the firm has short term strategic needs which are geared towards achieving a particular short viable objective. For instance buying of shares in the profitable company.

Tax shield benefit- debt capital is tax deductible thus a high level of returns to shareholders.

Disadvantage of Above Arrangement

Costly‚ for instance in case the enterprise has secured the loan to invest the in the financially geared products such as high-yield bonds and leveraged loans. For this matter managers must monitor the interest effectively that it does not suppose the intended rate of return on investment (Homburg, 2014‚ p 414). For investors to be convinced to take such investment risk, they will need compensation regarding premium of which in case of the unfavorable market condition the firm may be unable to raise.

It is the risky source of finance‚ even though financial gearing is one of the effective methods of financing operations of the firm. Extreme levels increase the risk level of the company to land at the lead to financial distress which at the advanced level can lead the Company to be put into receivership. For this reason, managers must ensure proper maintenance of liabilities and assets trend off is maintained to prevent adverse results which can jeopardize the firm’s operations. Hence, leading to financial failure which signifies the failure of the enterprise.

The sophisticated analysis required before taking loans. Most financial institutions need proper business plan from borrowing individuals and companies. In such situation, the borrowing entity may be compelled to hire financial analyst consultant to do some market feasibility and come up with the business plan which is very expensive, and it does not guarantee the proposal will be accepted by the prospected lending institution.

Conclusion

Going by the above discussion, it is clear that although using debt capital to finance operations has advantages. Such as Powerful accessibility of capital due to tax shield benefit and is best for buyout and acquisition strategic growth. It has inherent risks and disadvantages which can lead to financial distress hence bankruptcy. Thus‚ management must ensure proper trend off of risk and returns of borrowed loans and anticipated projects to be financed by such debt.

References

Ding, X. (Wu, M., & Zhong, L. 2016. ‘The Effect of Access to Public Debt Market on Chinese Firms Leverage’. Chinese Economy, no 49(5), pp 327-342.

Dong, C., Yanmin, G., Kaul, M., Charles Ka Yui, L., & Tsang, D. 2016. ‘The Role of Sponsors and External Management on the Capital Structure of Asian-Pacific REITs’: The Case of Australia, Japan, and Singapore. International Real Estate Review, no 19(2), pp 197-221.

Homburg, S. 2014. ‘Overaccumulation, Public Debt and the Importance of Land. German Economic Review’, no 15(4), pp.411-435.

Öztekin, Ö. (2015). ‘Capital Structure Decisions around the World: Which Factors Are Reliably Important?’. Journal of Financial & Quantitative Analysis, no 50(3), pp 301-323.

Zawadzka, D, Szafraniec-Siluta, E, & Ardan, R 2015, ‘Factors influencing the use of the debt capital on firm, Research Papers of the Wroclaw University of Economics / Prace Naukowe Uniwersytetu Ekonomicznego we Wroclawiu, no. 412, pp. 356-366.

Other Relevant Blog Posts

Where Can I Find Finance Dissertations

Corporate Accounting Dissertations

Click Here To View Finance and Accounting Dissertations

If you enjoyed reading this post on negative effects of financial gearing and capital structure, I would be very grateful if you could help spread this knowledge by emailing this post to a friend, or sharing it on Twitter or Facebook. Thank you.