Impact of Government Involvement in International Trade

International trade can be described as the exchange of services and goods between countries, which gives rise to a world economy where prices are affected by global occurrences (Ajami & Goddard, 2013). As indicated by (Wild & Wild, 2013, p. 123), international trade has the benefit of offering people in different countries a more expansive selection of goods and services at competitive prices.

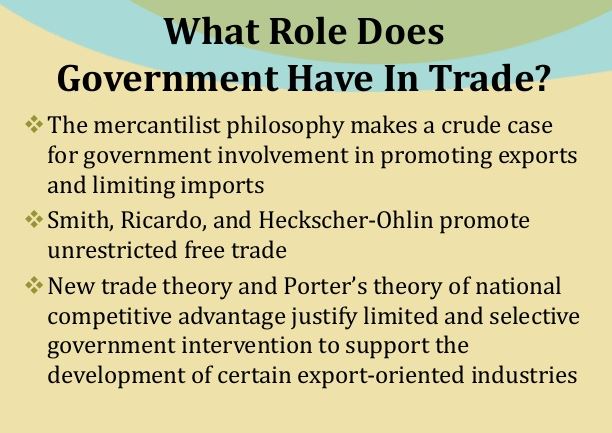

Given that the idea of international trade has dominated business scholarship for some time, differing opinions exist on whether the international trade should adopt a free trade approach or opt for a protectionist approach. Free trade, in this regard, implies the application of a laissez-faire style of commerce, without market restrictions. The central concept in the international free trade is that demand and supply factors, applied on a global level, ensure efficient production, requiring nothing to be done to either promote or protect business growth. In contrast, the philosophy of protectionism insists on the importance regulating trade to ensure proper functioning of markets. Proponents of protectionism hold that certain market inefficiencies can impede the benefits of international trade, thereby requiring the application of mechanisms to guide the market accordingly. This paper explores the primary motives of government interventions and critically analyzes the consequences of the methods of intervention.

Government intervention in international trade has had a significant impact on trade patterns. Unfair government intervention practices thus have had lasting negative lasing impacts on global economics. This paper looks at the global political economy, reasons for governments to intervene in international trade, consequences of government involvement and ways to prompt the global economy despite the political influence.

The Motives for Government Trade Intervention

Though free trade implies the pattern of exports and imports without any barriers, most governments impose controls on trade for cultural, economic and political reasons. While political motivations include protection of jobs, preservation of national security, response to apparently unfair trade practices of other nations and the quest for influence over other countries, the economic motives include the protection of infant industries and pursuance of strategic trade policy.

Political Motivation: One category of reasons offered for government intervention is political. Most of the political motivations for government interventions are connected to the need for the government to remain popular among its citizens. As indicated by Ajami and Goddard (2013), the political motivations may have little or nothing to do with the economic performance of the country (p. 21).

One such political motive is to protect jobs and, therefore, prevent an increase in unemployment levels. The idea informs the motive for restricting trade to protect jobs that international trade lowers the number of jobs available locally for the citizens of a country (Wild & Wild, 2013, p. 132). Though this may be true for certain industries, studies have established that trade does not necessarily reduce jobs, since business offers consumers a chance to purchase products at competitive prices, which, subsequently enables them to buy more goods and services. Given that most of the products are locally produced, the enhanced purchasing power of the consumer is likely to stimulate the creation of jobs internationally and locally. Moreover, the protection of certain jobs may not be entirely beneficial, and has been shown to lower economic efficiency. According to Silva, Afonso and Africano (2010), an economy can function at maximum efficiency only when its labor force is mobile, and people are willing to alternate jobs need arises (p. 369). Governments must acknowledge that the nature of the economy and, consequently, jobs are constantly metamorphosing, meaning that even their labor force must be flexible and ready to change.

Another political reason often offered for government restriction of trade is national security interests. According to Ajami and Goddard (2013), the argument of national security is often a legitimate argument, especially when it concerns the production of weapons and printing of domestic currency (p. 34). Consequently, industries that are pivotal to national security are offered protection by governments for both imports and exports.

Governments can, for instance, place restrictions on imports to guarantee domestic supply which preserves national security. It is important to note that national security as it is used here is not exclusive to issues of war and armed security. Rather, the concept of national security implies those goods and services that are critical for the wellbeing of the citizens of the country, including currency, agricultural products, oil, and weaponry. For instance, many countries actively protect their agricultural sectors since countries that depend on agricultural imports to feed their citizens risk starvation in the event of war. Governments also place restrictions on the export of defense-related goods, especially if such exports pose threats to international security.

The government can also restrict trade in response to apparent unfair trade practices by other nations. In situations where there is a feeling that their governments give certain industries an unfair advantage through subsidies or reduced restrictions, unilateral reduction in restrictions can be applied. For instance, Fertö and Hubbard (2003) show that, compared to industrialized countries, developing countries have significantly relaxed environmental laws, reducing the costs of operation (p. 245). Governments are often inclined to introduce trade restrictions especially in the face of restrictions by other countries.

States can also use trade restrictions to gain influence over other nations, especially the economically less developed. For instance, the China Uses trade interventions to increase its influence in Africa. The idea here is for an economically stronger country to use its position to influence less developed countries, which ultimately offer a market for its products.

Economic Motives: Besides the political reasons for governments’ intervention in trade, arguments are often fronted on the economic foundations for intervention. Some of the arguments from the economic perspective include the protection of infant industries and pursuance of strategic trade policy. The case for the protection of infant industries is often made so that young industries are protected by the government until they become self-sustaining (Silva, Afonso & Africano, 2010, p. 369).

However, it is not only infant industries that seek protection. According to Melitz (2003), some mature industries insist that they are protected to enable them to adapt to new business environments and conditions (p.1696). Nevertheless, the idea of protecting companies seems to go against the spirit of healthy competition that allows only the most successful businesses to be sustained. This presents problems to the government seeking to intervene on trade based on the argument of the infant industry. The first challenge would concern how to pick winners and reject losers. The idea also leaves room for people within the echelons of power to use that power to initiate protection for their companies. Besides, protection has the potential of encouraging complacency by domestic companies towards innovation and can limit company competitiveness.

Regarding the pursuance of strategic trade policy, government intervention can enable a company to enjoy the first-mover advantages and the subsequent economies of scale. The concept of first-mover advantage can be described as a type of competitive advantage that accompany attains by being the first entrant into an industry or a market (Fertö & Hubbard, 2003, p. 251). The understanding here is that, by being the first competitor in a new market, the firm can gain an advantage over its actual and future rivals. This idea applies whether a company is seeking to develop new demographic markets or sections of existent markets, or whether it is looking to introduce new products into its already existent market segments.

When a business is the first to enter a market, it can form a defensible ground, allowing it to capture the large sections of the market share quickly without being concerns about rivals competing for the same market. Also, by the time the competitors arrive, the first-mover is likely to have advantages in the competition because its products will have gained familiarity, besides other factors like brand loyalty established distribution systems. For instance, being a first-mover in soda production, Coca-Cola was able to develop its brand and build a reputable force in the beverage industry. The biggest problem with the strategic trade policy is that government support is often subject to political manipulation, and certain interest groups can usurp gains with no benefit to the consumer.

Cultural Motives: Cultures are created and modified through interactions. Consequently, the exposure of citizens of a country to other people and products from other nations can gradually alter the culture of a country. In this line of thought, the undesirable cultural influence caused by interaction with certain products can cause the government to block imports. The United State, for instance, is often perceived as a threat to national cultures due to its influential entertainment, consumer goods, and media.

Methods of Promoting Trade

Other than specialization and increased business potential, international trade has been linked to greater efficiency and greater opportunity for foreign direct investment. As described by Wang et al. (2012), foreign direct investment implies the amount of money invested by individuals and corporations in business as well as in research and development (p. 627). By attracting foreign direct investment, economies can grow in their level of competitiveness and production efficiency. For the receiving government, foreign direct investment is a way through which expertise and foreign exchange can enter the country, further stimulating economic growth. Given the importance of international trade to governments as well as consumers, various states adopt steps such as subsidies, export financing, foreign trade zones, and individual government agencies to encourage international trade.

Subsidies: For our purposes, a grant can be defined as financial assistance to domestic companies in the form of low-interest loans, cash payments, product price supports, or tax breaks. The primary intention of applying subsidies is to increase the advantage of the local companies and compete favorably with international firms. According to the World Trade Report (2006), export subsidies generate incentives for producers to supply products for export rather than for domestic use within a country (p. 56). This can be a drawback since the withdrawal of supply from the local market can lead to increases in the local price of the products. Simultaneously, due to increase in supply to the world market world prices of the product is likely to fall. If the re-importation of products from the world market into the domestic market is prevented, the result is a wedge between the world price and the local price. All the same, the impact of export subsidies on the domestic country is contrary, with local consumers having to pay higher for a product that they are prevented from sourcing from the world market as a lower price.

Export Financing: In export financing governments promote exports by assisting companies to finance their trade activities through loans as well as loan guarantees. Since funding is crucial, especially for entrants into the export business, the philosophy informing export financing is that by offering loans that would have otherwise been accessible of loans at reduced rates, the government can encourage export business, and enhance the competitive edge of the company. In the United States, for instance, export financing is offered by Export-Import Bank.

Foreign Trade Zones: A foreign trade zone is an area where goods can be landed, handled, reconfigured or manufactured, and even re-exported without going through customs authorities. The goods only become subject to the prevailing customs duties when they are moved to consumers in the country within which the zone is located. Organized in areas with various geographical advantages for international trade such as Singapore, Stockholm, Hong Kong, and Gdańsk, the primary purpose of the foreign trade zone is to eliminate seaport, border, and airport barriers to trade, often associated with complex customs regulations and high tariffs. Lowering customs facilitates international trade since customs duties elevate the cost of production as well as the time it takes for the products to reach the market. In the United States, for instance, the lowered customs duties are balanced by the created jobs.

Special Government Agencies: As a way of encouraging international trade, various governments create agencies charged with the promotion of exports. The agencies organize trips for business persons and trade officials to visit other nations and institute trade offices in other countries. These organizations, such as the Japan External Trade Organization not only promote exports but also occasionally encourage imports.

Trade Unions: Trade unions today play a critical part in moulding the lives of workers, though their influence has considerably diminished over the recent past. The union is often mandated to negotiate conditions and contracts with employers on behalf of the employee. Though the roles of trade unions are numerous, some being more prominent than others, the trade unions core functions can be summarized as social, militant, regulative, and fraternal. In this regards, the militant function implies the struggle that is likely to occur as the union tries to get employers to increase worker remuneration or to address the grievances presented by employees. The main issue addressed here is whether the perceptible incompatibility between industrial relations and employees can be resolved. Resolution of the conflict between trade unions and employers is only possible given the assumption that both parties share the objectives of employee development, fairness, and equity.

Unions need to acknowledge that collective bargaining may require some redesigning to include a lesser component increasing pay than in the past, and should push for involvement in skill-based and flexible elements of pay. Industrial relations remain the principal way of maintaining industrial order and should focus on approaches to avoiding and resolving disputes and conflicts.

Methods of Restricting Trade

Most governments restrict international trade to protect domestic companies from external competition, mostly from multinationals. One such method of restriction is through tariffs. Tariffs are taxes levied on imported products as they enter or leave the country. Tariffs can be categorized as import, transit and export. Import duties are further subcategorized into ad valorem, specific, and compound. An ad valorem tax is levied as a percentage of the cost of the imported good while specific tariff is levied according to each unit (by weight or number). On the other hand, the compound tax is levied as a percentage of the stated price of the imported product, and partly as a specific fee for each unit. According to Wild and Wild (2013), besides protecting local producers and employees from foreign competition, tariffs perform the function of raising revenue for the government (p. 232). Though domestic producers gain from import duties as they are shielded from foreign competition, this protection comes at a cost to the consumer. The consumers often have to pay more for some imported goods. Also, though the producers benefit from the lowered foreign competition, the lack of competitiveness may lead to laxity and reduced overall efficiency.

Quotas and Voluntary Export Restraints (VER): Quotas and Voluntary Export Restraints (VER) are restrictions directed towards the quantity of certain goods that can be imported into a country (Wild & Wild, 2013, p. 143). The quota limitation is usually imposed by allotting import licenses to a group of firms or individuals. The reason for issuance of allowances is to protect domestic producers by limiting the entry of certain goods into the country. This limitation enables local producers to maintain a considerable market share in to offer decent prices for their products within the country. Like in tariffs, the gain by producers comes at a cost to consumers, who have to contend with high prices caused by impeded competition. A VER, on the other hand, is a unique type of quota imposed by the exporting country upon the request of the government of the importing country. If the domestic producers do not limit production, consumers gain because of lowered prices from the increased supply. Other measures that can be applied by governments to restrict trade include embargoes, content requirements, administrative delays and even currency controls. Ultimately, the reasoning behind restrictions is to protect local companies from foreign competition and to ensure that the economic interests of the country are not ignored during the international trade.

Conclusion

Despite the theoretical benefits associated with international trade, governments are not always eager to openly welcome free trade at the expense of domestic businesses. This paper examined the reasons behind the government interventions to protect some of their local industries and the methods they use to offer such protection. Though it is evident from the analysis that many of the strategies like tariffs, the quota system, and subsidies appear to support domestic producers, this support often comes at a cost to the consumer, who often has to pay more for goods. Measures must be put in place to ensure that even in protecting the domestic companies, healthy competition that is important for production efficiency and reasonable pricing of products is not compromised.

References

Chaney, T. (2008). Distorted gravity: the intensive and extensive margins of international trade. American Economic Review, 98(4), 1707-21

Girma, S., Görg, H., & Wagner, J. (2009). Subsidies and exports in Germany, evidence from enterprise panel data. Applied Economics Quarterly, 55 (3), 175-195

Martincus, C. & Carballo, J., (2008). Is export promotion effective in developing countries? Firm-level evidence on the intensive and the extensive margins of exports. Journal of International Economics, 76, 89-106

Wang, C., Hong, J., Kafouros, M., & Wright, M. (2012). Exploring the role of government involvement in outward FDI from emerging economies. Journal of International Business Studies, 43(2012), 655-676

Wild, J., & Wild, K. (2013). International business: The challenges of globalization. Upper Saddle River, NJ: Pearson Education, Limited

World Trade Report. (2006). Exploring the links between subsidies, trade and the WTO. World Trade Organization

Other Relevant Blog Posts

European Union Regional Economics

International Relations Theory

Did you find any useful knowledge relating to government involvement in international trade in this post? What are the key facts that grabbed your attention? Let us know in the comments. Thank you.

This is a great post. I have been looking for standardization versus adaption material for some time and this post has it all. The references used will prove very useful to me when I write my own marketing dissertation. Let me take this opportunity to thank you for the effort you have put into this post. It is first class and up to date. Thanks, Gregory.

Thanks for reading and commenting on the post Gregory. More international trade related posts to be added shortly. Follow our blog to get updates.