Theories of Finance

Finance and Time Value of Money

Definition of Time Value of Money

The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. It means the value of an amount of money is different in different time periods. The value of a sum of money received today is less many than its value received after some time. Conversely, the sum of money received in future is less valuable than it is today. The time value of money is the central concept of finance.

For example, USD 100 of today’s money invested for one year and earning 5% interest will be worth of USD 105 after one year. Therefore, USD 100 paid now or USD 105 paid exactly one year from now both have the same value to the recipient.

Importance of Time value of money

Time value of money is considered as the fundamental concept in financial management. It can be used to compare investment alternatives and to solve problems involving loans, mortgage, leases, savings and annuities.

Financial planning

How much fund is needed? It’s needed for what’s time? What’s the sources and to this source how much money is needed is detailed description is called financial planning.

Source Identification

After financial planning the most important work of finance is to identify sources from where that fund will be collected. It’s may be a person or organization that will be decided using time value of money.

Raising Fund

Another most important task of finance is to collect funds from identified sources. The question of how much money will be invested in a particular project that will be decided through TVM.

Repayment of loan

The process of repayment of a loan is evaluated through the process of TVM.

Definition of Present Value

Present value is the current worth of a future sum of money or stream of cash flows given a specified rate of return i.e. present value is the current value of a future amount. The amount is to be invested today at a given interest rate over a specified period to equal the future amount.

The present value formula has four variables. The formula is –

PV=FV/ (1+i) n

Definition of Future Value

Future value is the value of an asset or cash at a specified date in the future that is equivalent in value to a specified sum today. It measures the nominal future sum of money that a given sum of money is worth at a specified time in the future assuming a certain interest rate or more generally rate of return. It is the present value multiplied by the accumulation function.

Following is the future value formula-

FV=PV (1+r) t

Definition of Annuity

An annuity, in finance is a terminating streams of fixed payments i.e. a collection of payment to be periodically received over a specified period of time. The valuation of such a stream of payment s entails concepts such as the time value of money, interest rate and future value. For example- annuities are regular deposits to a savings account, monthly home mortgage payments and monthly insurance payments.

Annuity can be classified by the frequency of payment date. The payments may be made weekly, monthly, quarterly, yearly etc.

Finance Amortization

Amortization is the process of decreasing or accounting for an amount over a period. In the concept of finance amortization is the process by which loan principle decreases over the life of a loan. An amortization table shows this ratio of principle and interest and demonstrates how a loan’s principle amount decreases over time. Amortization is generally known as depreciation of intangible assets of a firm.

Amortization Schedule

It is a table detailing its periodic payment on an amortizing loan as generated by an amortization calculator. This amortization schedule is based on the following assumptions;

First, it should be known that rounding errors occur and depending how the lender accumulates this error, the blended payment may vary slightly some months to keep this error are adjusted for at the end of each year or at the final loan payment. There are a few crucial points worth noting when mortgaging a home with an amortized loan.

Second, understanding the first statement, the repetitive refinancing of an amortized mortgage loan even with decreasing interest rates and decreasing principle balance, can cause the borrower to pay over 500% of the value of the original loan amount.

Third, the payment on an amortized mortgage loan remains same for the entire loan term, regardless of principle balance owed but only for a fixed rate, fully amortizing loan.

Methods of Amortization

There are different methods in which to arrive at an amortization schedules. These are;

- Straight line

- Declining Balance

- Annuity

- Bullet

- Balloon

- Increasing Balance (Negative Amortization)

Capital Budgeting

Capital budgeting is the process of evaluating and selecting long term investments that are consistent with the goals of the shareholder’s profit maximization.

PBP

Payback period is defined as the number of years required to recover a project cost. The regular pay back method ignores cash flow beyond payback period and it does not consider the time value of money. The payback provides an indication on a project’s risk and liquidity, because it shows how long the invested capital is at risk.

NPV

The net present value method discounts all cash flows at the project’s cost of capital and then sums those cash flows:

Acceptance rule- Accept if NPV>0

Reject if NPV<0

Project may be accepted if NPV=0

Merits

- Considers all cash flow

- True measure of profitability.

- Based on the concept of Time value of money.

- Satisfies the value audibility principle.

- Consistent with the wealth maximization principle.

Demerits

- Requires estimates of all cash flows.

- Requires computation of the opportunity cost of the capital that possesses practical difficulties.

- Sensitive to discount rates.

IRR

The discount rate that equates the present values of an investment, the cash inflows and outflows is its Internal Rate of Return.

Acceptance rule- Accept if IRR>k,

Reject if IRR<k,

Project may be accepted if IRR=0.

Merits

- Considers all cash flows.

- True measure of profitability.

- Based on the concept of time value of money.

- Generally consistent with profit maximization principle.

Demerits

- Requires estimates of cash flows.

- Does not satisfy the value audibility concept.

- At times, fails to indicate correct choice between mutually exclusive projects.

- At times, yields multiple rates.

- Relatively difficult to compute.

PI

The ratio between the present value of the net cash benefit to the net cash outlay is profitability index or benefit-cost ratio;

Acceptance rule- Accept if PI>1.0,

Reject if PI<1.0,

Project may be accepted if PI=1.0

Cost of Capital

Definition of cost of capital

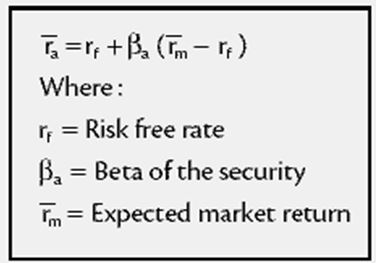

It is the rate that a firm must earn on its project investments to maintain its market value and attract funds.

The cost of each source or component is called specific cost of capital. When these specific costs are combined to arrive at overall cost of capital, it is referred to as the weighted cost of capital.

Assumptions

A basic assumption of traditional cost of capital analysis is that the firm’s business and financial risks are unaffected by the acceptance and financing of projects.

Business risks

It is the risk to the firm of being unable to cover fixed operating costs.

Financial risks

It is the risk to the firm of being unable to cover required financial obligations such as interest and preference dividends.

Explicit Costs

Explicit cost of capital is the “rate of return of the cash flows of the financing opportunity”.

Implicit Cost

Implicit cost of capital of funds raised and invested by the firm may, therefore, be defined as the rate of return associated with the best investment opportunity for the form and its shareholders that would be foregone.

Cost of debts

Cost of debt is the after tax cost of long-term funds through borrowing.

Cost of preference stocks

It is the annual preference stock dividend divided by the net proceeds from the sale of preference stocks. Or it can be said as the dividend expected by the preference stockholder.

Finance and Working Capital Cycle

Definition of Working Capital

Working Capital refers to that part of the firm’s capital, which is required for financing short-term or current assets such a cash marketable securities, debtors and inventories. Funds thus, invested in current assets keep revolving fast and are constantly converted into cash and this cash flow out again in exchange for other current assets. Working Capital is also known as revolving or circulating capital or short-term capital.

Why finance working capital cycle is calculated

Working capital is a common measure of a company’s liquidity, efficiency, and overall health. Because it includes cash, inventory, accounts receivable, accounts payable, the portion of debt due within one year, and other short-term accounts, a company’s working capital reflects the results of a host of company activities, including inventory management, debt management, revenue collection, and payments to suppliers.

Positive working capital generally indicates that a company is able to pay off its short-term liabilities almost immediately. Negative working capital generally indicates a company is unable to do so. This is why analysts are sensitive to decreases in working capital; they suggest a company is becoming over leveraged, is struggling to maintain or grow sales, is paying bills too quickly, or is collecting receivables too slowly. Increases in working capital, on the other hand, suggest the opposite. There are several ways to evaluate a company’s working capital further, including calculating the inventory-turnover ratio, the receivables ratio, days payable, the current ratio, and the quick ratio.

One of the most significant uses of working capital is inventory. The longer inventory sits on the shelf or in the warehouse, the longer the company’s working capital is tied up.

When not managed carefully, businesses can grow themselves out of cash by needing more working capital to fulfill expansion plans than they can generate in their current state. This usually occurs when a company has used cash to pay for everything, rather than seeking financing that would smooth out the payments and make cash available for other uses. As a result, working capital shortages cause many businesses to fail even though they may actually turn a profit. The most efficient companies invest wisely to avoid these situations.

Analysts commonly point out that the level and timing of a company’s cash flows are what really determine whether a company is able to pay its liabilities when due. The working-capital formula assumes that a company really would liquidate its current assets to pay current liabilities, which is not always realistic considering some cash is always needed to meet payroll obligations and maintain operations. Further, the working-capital formula assumes that accounts receivable are readily available for collection, which may not be the case for many companies.

It is also important to understand that the timing of asset purchases, payment and collection policies, the likelihood that a company will write off some past-due receivables and even capital-raising efforts can generate different working capital needs for similar companies. Equally important is that working capital needs vary from industry to industry, especially considering how different industries depend on expensive equipment, use different revenue accounting methods, and approach other industry-specific matters.

Finding ways to smooth out cash payments in order to keep working capital stable is particularly difficult for manufacturers and other companies that require a lot of up-front costs. For these reasons, comparison of working capital is generally most meaningful among companies within the same industry, and the definition of a “high” or “low” ratio should be made within this context.